- United Kingdom

- /

- Energy Services

- /

- LSE:PFC

Petrofac's (LON:PFC) Shareholders Are Down 87% On Their Shares

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Petrofac Limited (LON:PFC) during the five years that saw its share price drop a whopping 87%. And we doubt long term believers are the only worried holders, since the stock price has declined 59% over the last twelve months. The falls have accelerated recently, with the share price down 15% in the last three months.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Petrofac

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Petrofac has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 7.4% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

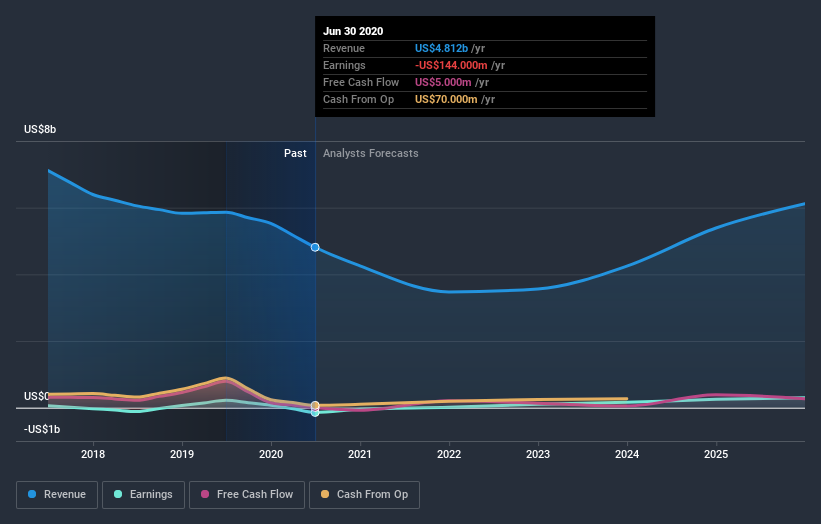

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Petrofac

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Petrofac's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Petrofac shareholders, and that cash payout explains why its total shareholder loss of 83%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Petrofac had a tough year, with a total loss of 59%, against a market gain of about 7.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Petrofac better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Petrofac you should be aware of, and 1 of them makes us a bit uncomfortable.

Petrofac is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Petrofac or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:PFC

Petrofac

Designs, builds, manages, maintains, and decommissions infrastructure for the energy industries in the United Kingdom, Algeria, Lithuania, Malaysia, the United States, Thailand, Oman, Australia, Bahrain, Kuwait, Iraq, Libya, India, the United Arab Emirates, the Netherlands, Ivory Coast, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives