- United Kingdom

- /

- Oil and Gas

- /

- LSE:ITH

Ithaca Energy plc (LON:ITH) Investors Are Less Pessimistic Than Expected

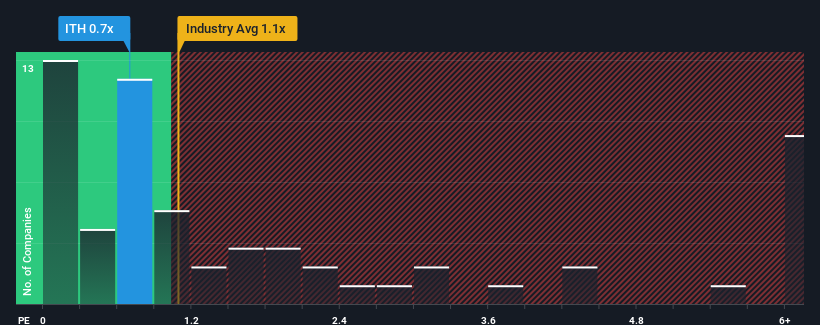

There wouldn't be many who think Ithaca Energy plc's (LON:ITH) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Oil and Gas industry in the United Kingdom is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Ithaca Energy

How Has Ithaca Energy Performed Recently?

With only a limited decrease in revenue compared to most other companies of late, Ithaca Energy has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Ithaca Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ithaca Energy's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Ithaca Energy's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 97% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 2.8% per annum during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to moderate by 0.1% per annum, which indicates the company should perform poorly indeed.

With this information, it's perhaps strange that Ithaca Energy is trading at a fairly similar P/S in comparison. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Ithaca Energy's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ithaca Energy you should know about.

If these risks are making you reconsider your opinion on Ithaca Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ITH

Ithaca Energy

Engages in the exploration, development, and production of oil and gas in the North Sea.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives