Potential Hunting PLC (LON:HTG) shareholders may wish to note that the Independent Chairman of the Board, Stuart Brightman, recently bought UK£78k worth of stock, paying UK£3.88 for each share. However, it only increased shareholding by a small percentage, and it wasn't a huge purchase by absolute value, either.

The Last 12 Months Of Insider Transactions At Hunting

The CEO & Director, Arthur Johnson, made the biggest insider sale in the last 12 months. That single transaction was for UK£1.4m worth of shares at a price of UK£2.95 each. That means that even when the share price was below the current price of UK£3.72, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. We note that the biggest single sale was only 24% of Arthur Johnson's holding.

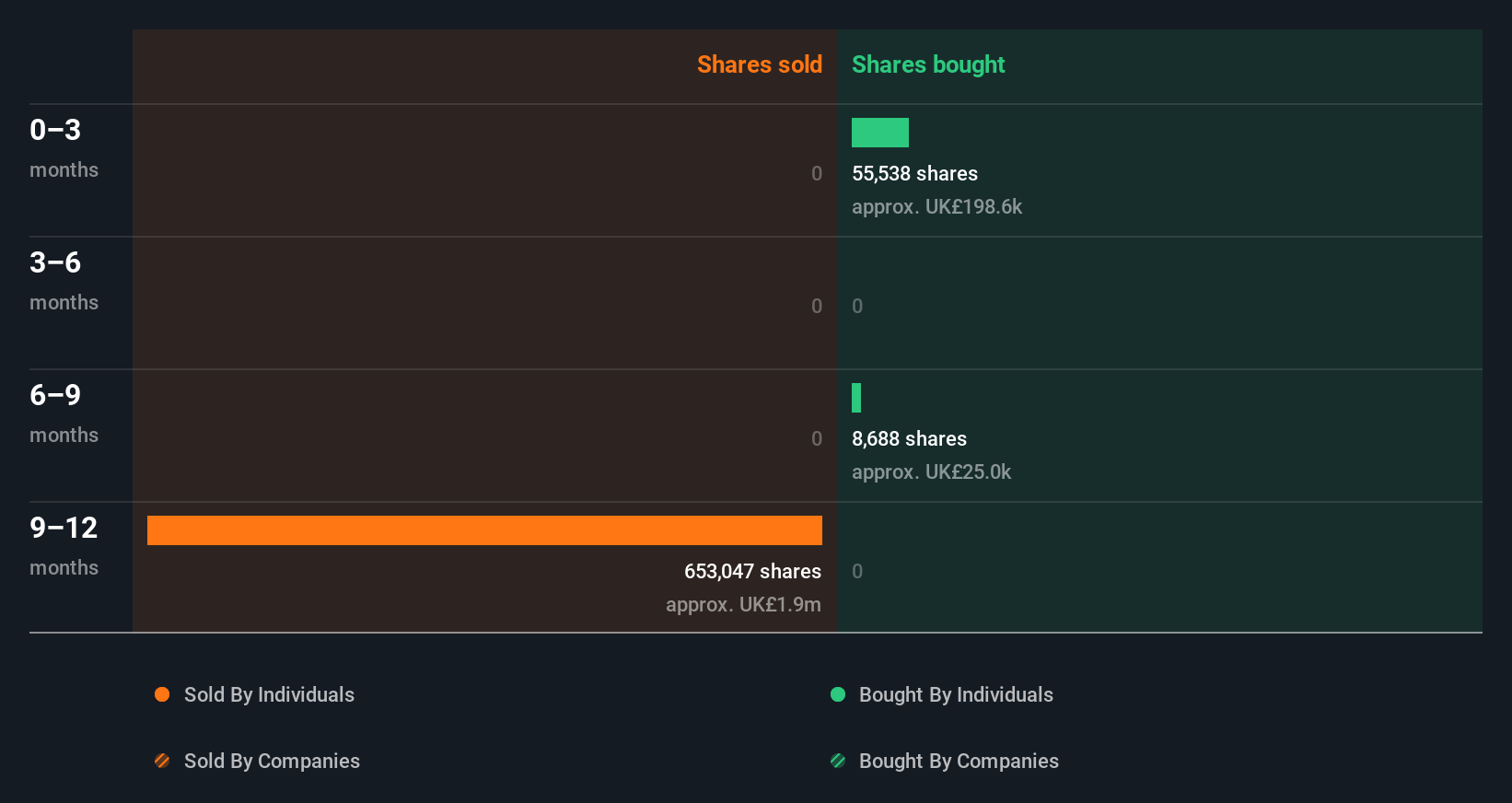

In the last twelve months insiders purchased 64.23k shares for UK£228k. But they sold 653.05k shares for UK£1.9m. All up, insiders sold more shares in Hunting than they bought, over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Hunting

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Does Hunting Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. It appears that Hunting insiders own 7.2% of the company, worth about UK£40m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About Hunting Insiders?

It is good to see recent purchasing. However, the longer term transactions are not so encouraging. The more recent transactions are a positive, but Hunting insiders haven't shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. So they seem pretty well aligned, overall. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 1 warning sign for Hunting and we suggest you have a look.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hunting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HTG

Hunting

Manufactures components, technology systems, and precision parts worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)