- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

With A 27% Price Drop For Genel Energy plc (LON:GENL) You'll Still Get What You Pay For

Genel Energy plc (LON:GENL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 8.5% in the last year.

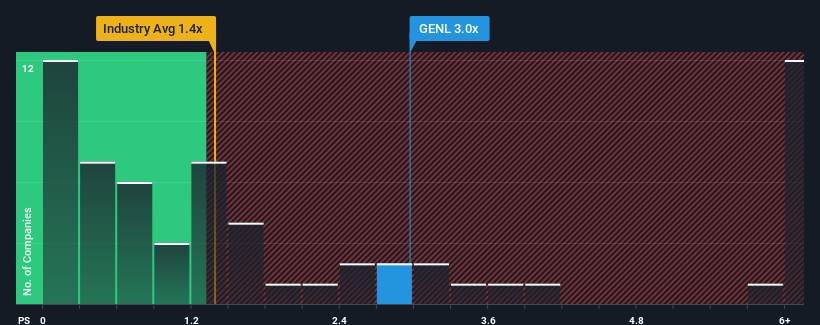

Even after such a large drop in price, given close to half the companies operating in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider Genel Energy as a stock to potentially avoid with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Genel Energy

What Does Genel Energy's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Genel Energy has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Genel Energy will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Genel Energy?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Genel Energy's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 64%. As a result, revenue from three years ago have also fallen 67% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 24% each year during the coming three years according to the six analysts following the company. That would be an excellent outcome when the industry is expected to decline by 0.7% per year.

With this information, we can see why Genel Energy is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Key Takeaway

Genel Energy's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we anticipated, our review of Genel Energy's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

You should always think about risks. Case in point, we've spotted 1 warning sign for Genel Energy you should be aware of.

If you're unsure about the strength of Genel Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives