- United Kingdom

- /

- Banks

- /

- LSE:TBCG

Top UK Growth Stocks With Insider Ownership In December 2025

Reviewed by Simply Wall St

As the UK market grapples with challenges stemming from weak trade data from China, reflected in the FTSE 100's recent downturn, investors are keenly observing how global economic shifts impact local indices. In such a fluctuating environment, growth companies with high insider ownership can offer a unique appeal, as they often signal confidence from those who know the company best and are positioned to navigate through uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 14.3% | 74.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 88.2% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 23.8% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 19.5% | 102.9% |

Underneath we present a selection of stocks filtered out by our screen.

Metals Exploration (AIM:MTL)

Simply Wall St Growth Rating: ★★★★★★

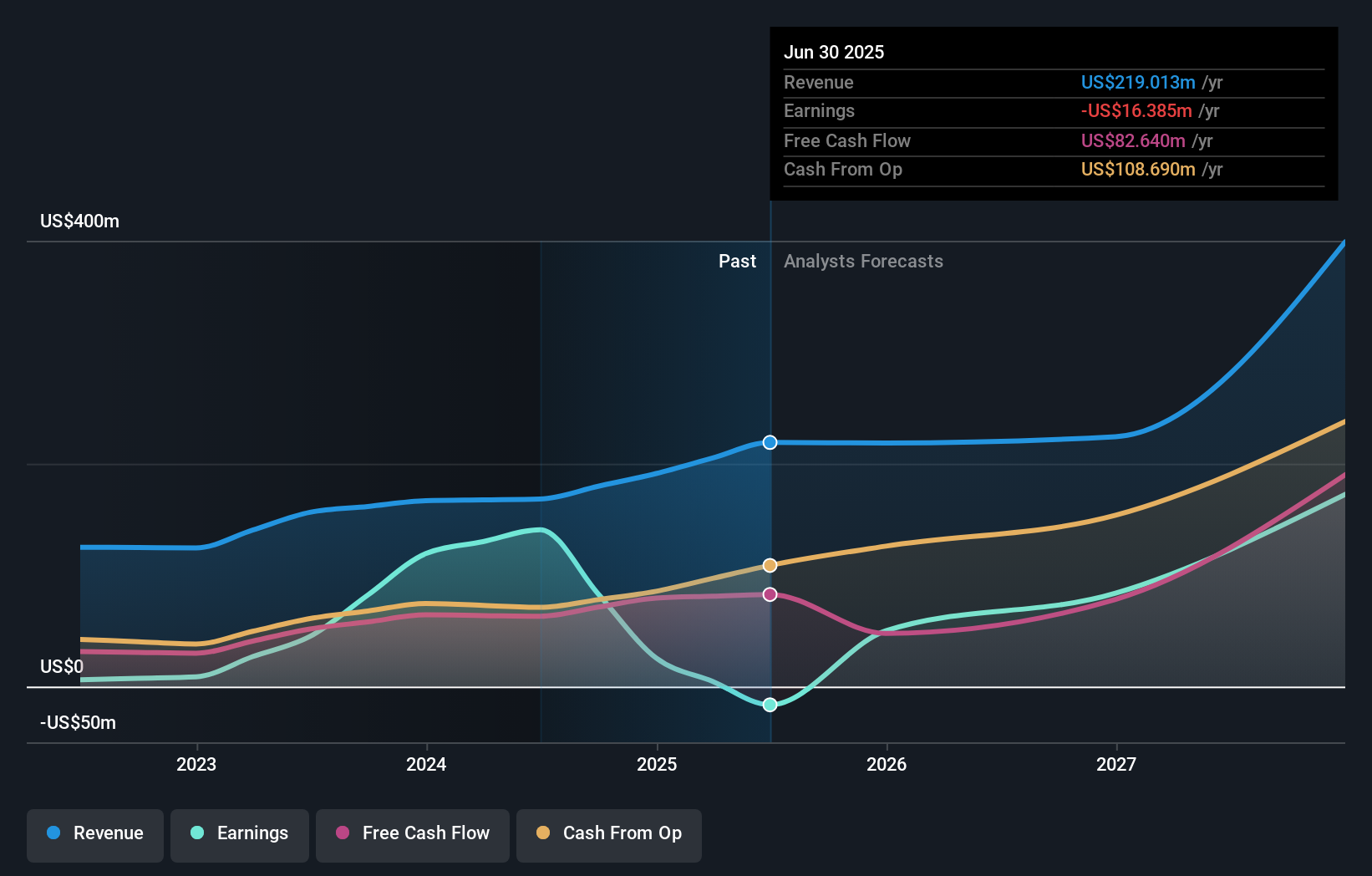

Overview: Metals Exploration plc is involved in identifying, acquiring, exploring, and developing mining and processing properties in the United Kingdom and the Philippines, with a market cap of £380.65 million.

Operations: The company's revenue is derived from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, amounting to $219.01 million.

Insider Ownership: 10.4%

Return On Equity Forecast: 30% (2028 estimate)

Metals Exploration, a UK-based company, is poised for significant growth with its forecasted revenue increase of 27.3% annually, outpacing the broader market. Despite recent operational disruptions due to natural events at its Runruno site, the company's La India project in Nicaragua shows promising expansion potential with newly identified mineralisation zones. Although trading at a substantial discount to estimated fair value and expected profitability within three years, past shareholder dilution and share price volatility warrant consideration.

- Get an in-depth perspective on Metals Exploration's performance by reading our analyst estimates report here.

- The analysis detailed in our Metals Exploration valuation report hints at an deflated share price compared to its estimated value.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★★☆

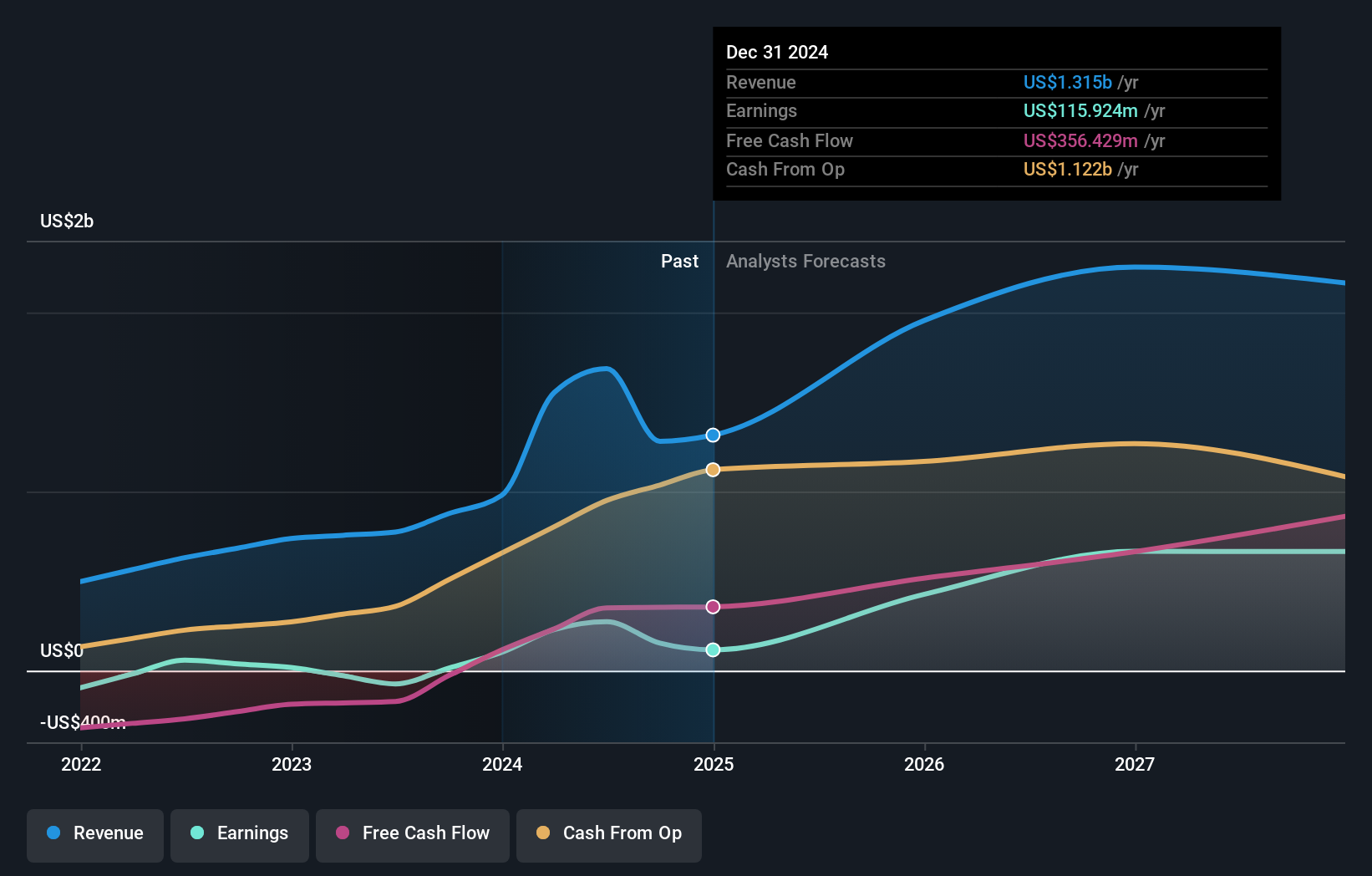

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market capitalization of £1.66 billion.

Operations: The company's revenue primarily stems from its oil and gas exploration and production segment, which generated $1.25 billion.

Insider Ownership: 19%

Return On Equity Forecast: 29% (2028 estimate)

Energean, a UK-based energy company, is positioned for growth with its earnings forecasted to expand significantly at 21.1% annually, surpassing the UK's market average. Despite production challenges in Israel impacting output, Energean maintains stable guidance and a high dividend yield of 10.01%, though not fully covered by earnings. The company trades well below its estimated fair value but faces financial pressure as interest payments are not adequately covered by current earnings.

- Take a closer look at Energean's potential here in our earnings growth report.

- Our valuation report unveils the possibility Energean's shares may be trading at a premium.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

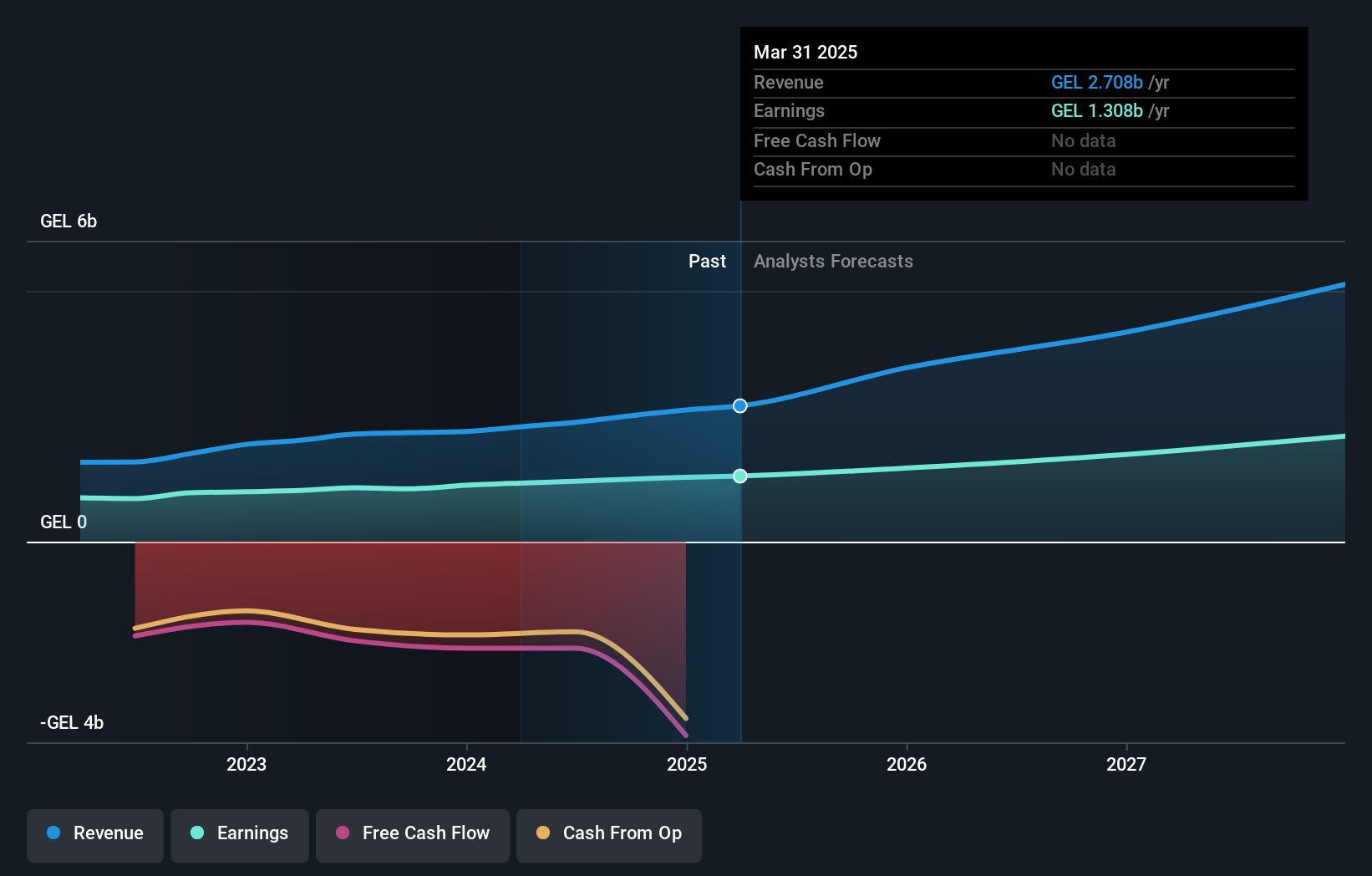

Overview: TBC Bank Group PLC, with a market cap of £2.24 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include Georgian Financial Services generating 2.40 billion GEL and Uzbekistan Operations contributing 442.25 million GEL.

Insider Ownership: 18%

Return On Equity Forecast: 24% (2028 estimate)

TBC Bank Group, with substantial insider ownership, demonstrates potential for growth in the UK market. The bank's revenue is forecast to increase by 20.8% annually, outpacing the UK average. Recent earnings reports show improved net interest income and net income figures year-over-year. Despite trading below its estimated fair value and having a high return on equity forecast, challenges include a high level of bad loans and slower earnings growth compared to the market.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical future growth report.

- Our valuation report here indicates TBC Bank Group may be undervalued.

Summing It All Up

- Reveal the 53 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026