- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Top UK Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

The United Kingdom market has faced recent turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China. This environment underscores the importance of identifying robust growth companies with high insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.3% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Evoke (LSE:EVOK) | 20.5% | 104.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Here we highlight a subset of our preferred stocks from the screener.

Henry Boot (LSE:BOOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Henry Boot PLC is a UK-based company involved in property investment and development, land promotion, and construction activities, with a market cap of £310.01 million.

Operations: The company's revenue segments include property investment and development, land promotion, and construction activities within the United Kingdom.

Insider Ownership: 31.2%

Earnings Growth Forecast: 25.5% p.a.

Henry Boot, a growth company with high insider ownership, is forecast to grow earnings at 25.48% per year, significantly outpacing the UK market's 14%. Despite trading at 20.4% below its estimated fair value, recent financials show a decline in sales to £106.05 million and net income to £3.69 million for H1 2024. The company remains confident in its future prospects, evidenced by a 5% dividend increase and ongoing property developments like the £15 million I&L unit at Airport Business Park Southend.

- Click here to discover the nuances of Henry Boot with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Henry Boot's current price could be inflated.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.72 billion.

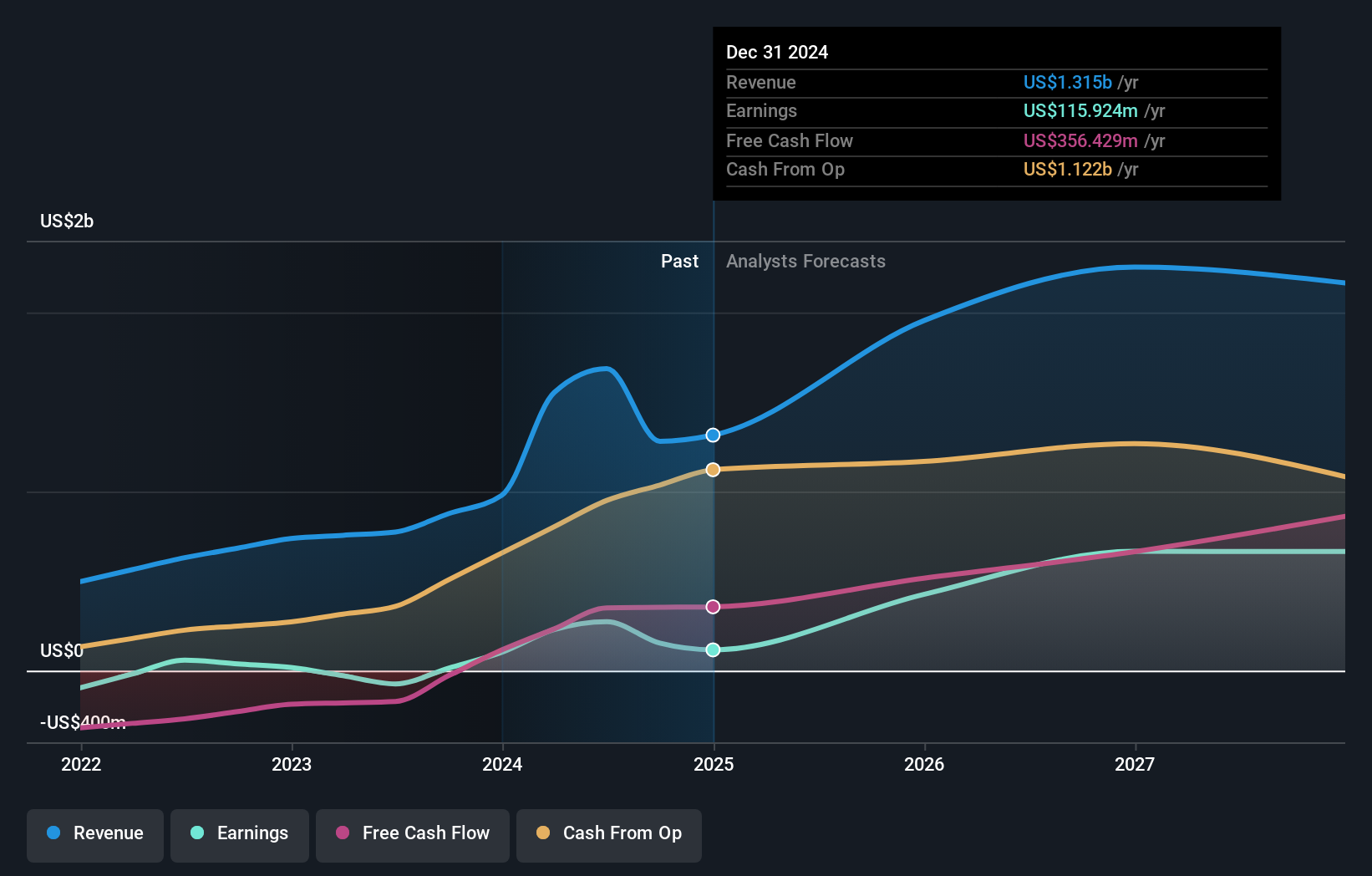

Operations: The company's revenue segment primarily consists of $1.69 billion from oil and gas exploration and production.

Insider Ownership: 10.6%

Earnings Growth Forecast: 27.4% p.a.

Energean, with significant insider ownership, reported strong H1 2024 results with sales of US$642.41 million and net income of US$88.54 million, reflecting a robust 38% year-on-year production increase. The company confirmed the successful start-up of the Cassiopea field in Italy and took Final Investment Decision for the Katlan project in Israel. Despite high debt levels and past shareholder dilution, Energean's earnings are forecast to grow at 27.4% per year, outpacing the UK market's growth rate.

- Unlock comprehensive insights into our analysis of Energean stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Energean shares in the market.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £939.40 million.

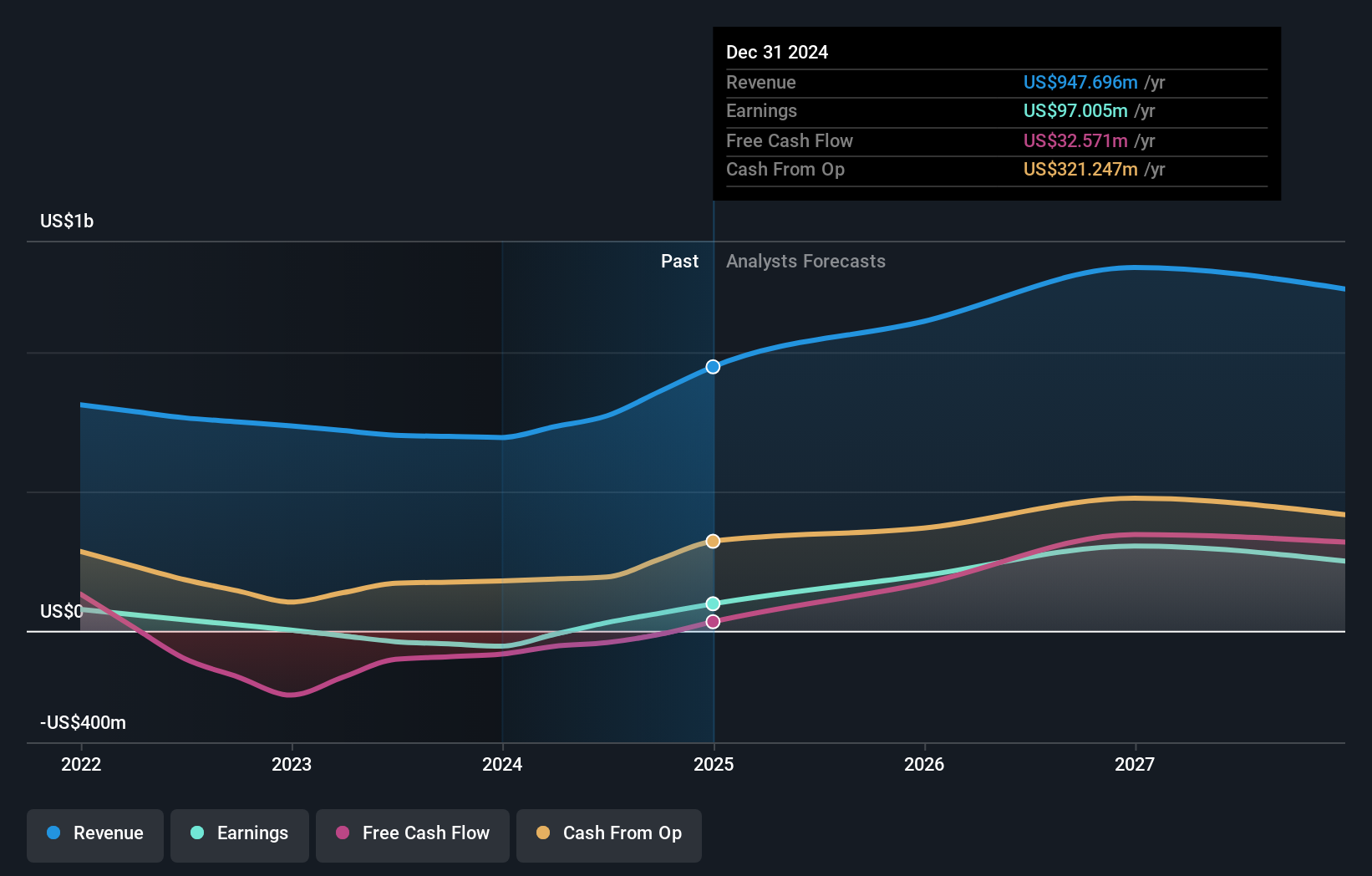

Operations: Hochschild Mining's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

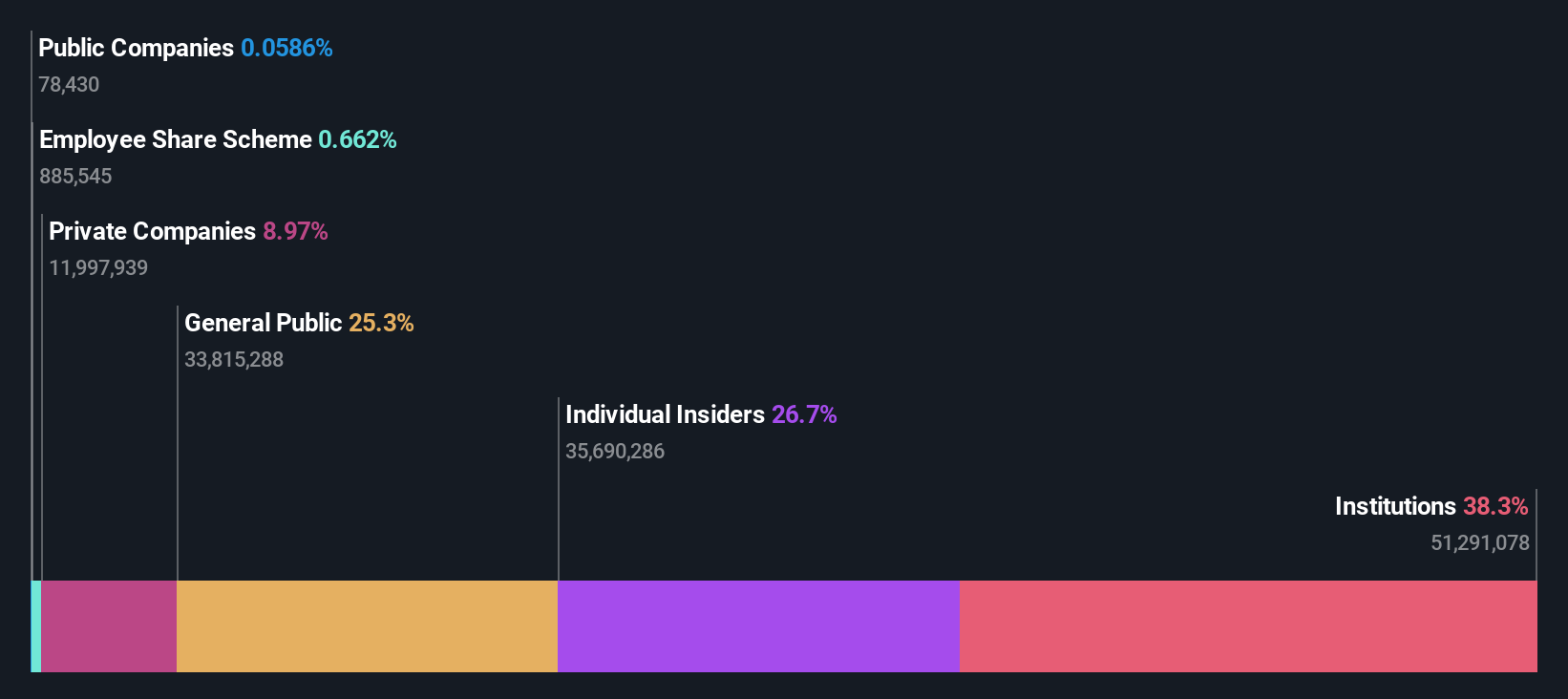

Insider Ownership: 38.4%

Earnings Growth Forecast: 43.8% p.a.

Hochschild Mining, with substantial insider ownership, reported H1 2024 sales of US$391.74 million and net income of US$39.52 million, reversing a prior year loss. Despite high debt levels and recent share price volatility, the company is trading at 58.6% below its estimated fair value. Earnings are forecast to grow significantly at 43.8% per year over the next three years, outpacing both revenue growth (5.9%) and the broader UK market's growth rates.

- Click here and access our complete growth analysis report to understand the dynamics of Hochschild Mining.

- The analysis detailed in our Hochschild Mining valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 67 Fast Growing UK Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.