- United Kingdom

- /

- Construction

- /

- LSE:KLR

3 Top UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China, which highlights the interconnectedness of global markets and their impact on UK equities. In such a fluctuating environment, dividend stocks can offer a sense of stability and income potential for investors seeking reliable returns amidst broader market uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.07% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.24% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.45% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.27% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.07% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.70% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.86% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.87% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.28% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.69% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

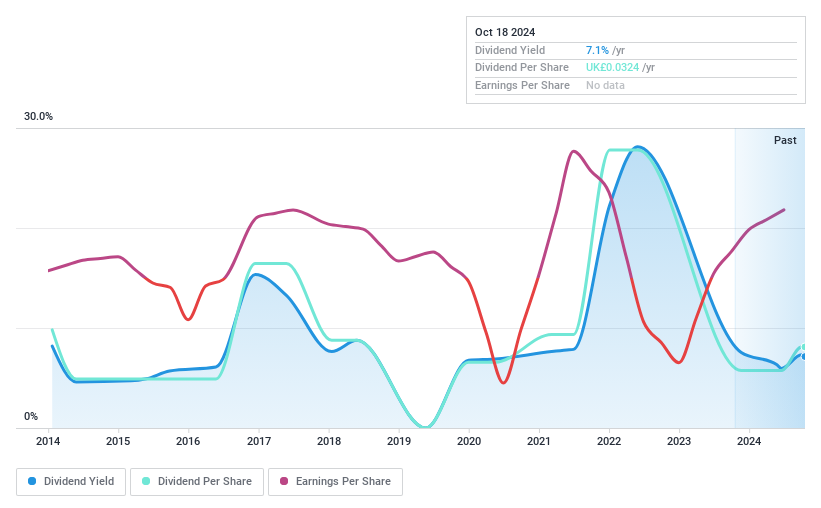

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £89.29 million.

Operations: Livermore Investments Group Limited generates revenue from its Equity and Debt Instruments Investment Activities, amounting to $23.75 million.

Dividend Yield: 6.2%

Livermore Investments Group offers a high dividend yield of 6.25%, placing it in the top 25% of UK dividend payers. Despite its attractive payout ratio of 25.3%, indicating dividends are well-covered by earnings and cash flows, the company's dividend history is unreliable, with volatility and declines over the past decade. Recent earnings growth to $9.67 million suggests potential stability, but historical inconsistency remains a concern for long-term investors.

- Click to explore a detailed breakdown of our findings in Livermore Investments Group's dividend report.

- Our comprehensive valuation report raises the possibility that Livermore Investments Group is priced higher than what may be justified by its financials.

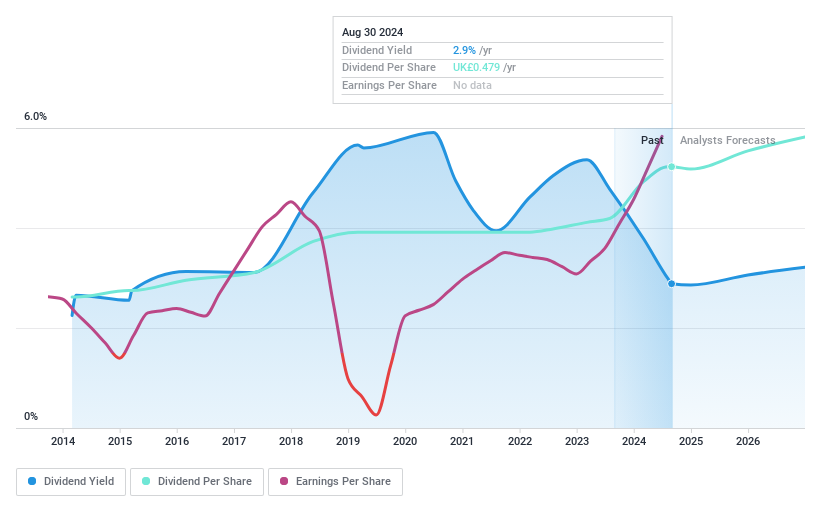

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a provider of specialist geotechnical services operating across North America, Europe, the Asia-Pacific, the Middle East, and Africa with a market cap of £1.07 billion.

Operations: Keller Group plc generates its revenue from specialist geotechnical services, amounting to £2.99 billion.

Dividend Yield: 3.2%

Keller Group's dividend is well-supported by earnings and cash flow, with payout ratios of 27.6% and 18.1%, respectively, ensuring sustainability. Although offering a reliable yield of 3.24%, it falls short compared to the top UK dividend payers. The company's dividends have been stable and growing over the past decade, reflecting consistent performance. Recent board changes include Carl-Peter Forster's appointment as Chair-designate, potentially influencing future strategic direction in sustainability initiatives.

- Click here and access our complete dividend analysis report to understand the dynamics of Keller Group.

- Our expertly prepared valuation report Keller Group implies its share price may be lower than expected.

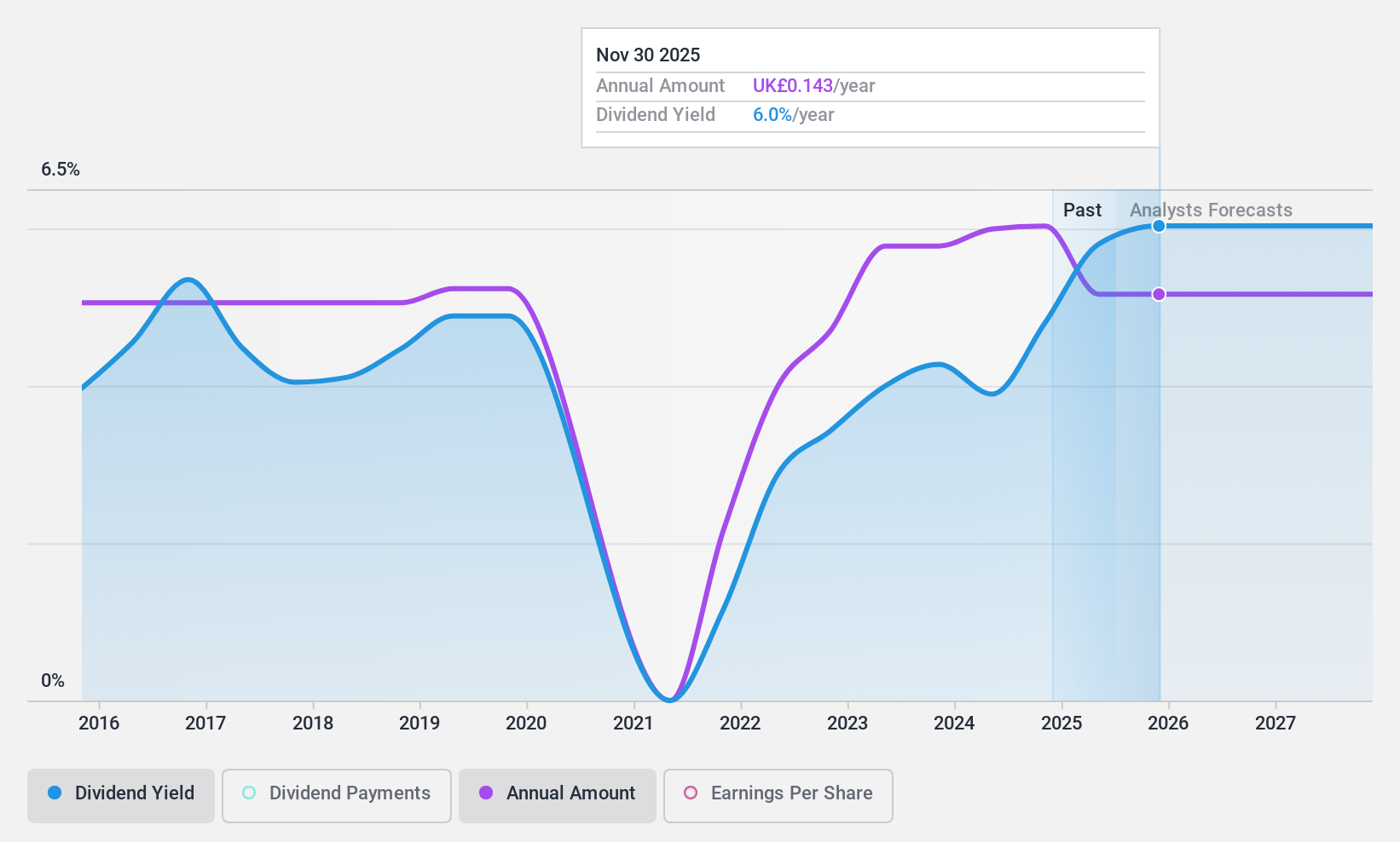

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SThree plc is a specialist recruitment company operating in the sciences, technology, engineering, and mathematics sectors across various countries including the UK, US, and several European nations with a market cap of £373.65 million.

Operations: SThree plc's revenue segments are comprised of the USA (£318.74 million), DACH (£490.18 million), Rest of Europe (£384.35 million), Middle East & Asia (£42.03 million), and Netherlands (including Spain) (£366.06 million).

Dividend Yield: 5.9%

SThree's dividend yield of 5.94% ranks in the top 25% among UK dividend payers, supported by a payout ratio of 39.2% and cash flow coverage at 42.4%. Despite this, the company's dividends have been volatile over the past decade, raising concerns about reliability. The recent £20 million share buyback program may positively impact shareholder value but comes amid forecasts of declining earnings over the next three years, highlighting potential challenges for sustained dividend growth.

- Take a closer look at SThree's potential here in our dividend report.

- The valuation report we've compiled suggests that SThree's current price could be quite moderate.

Taking Advantage

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 59 more companies for you to explore.Click here to unveil our expertly curated list of 62 Top UK Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keller Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KLR

Keller Group

Provides specialist geotechnical services in North America, Europe, the Asia-Pacific, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.