- United Kingdom

- /

- Oil and Gas

- /

- LSE:CNE

Capricorn Energy PLC's (LON:CNE) 27% Price Boost Is Out Of Tune With Revenues

The Capricorn Energy PLC (LON:CNE) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 55%.

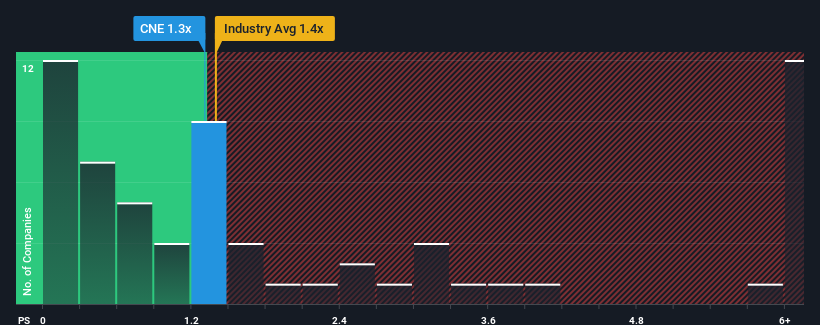

Although its price has surged higher, there still wouldn't be many who think Capricorn Energy's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United Kingdom's Oil and Gas industry is similar at about 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Capricorn Energy

What Does Capricorn Energy's P/S Mean For Shareholders?

Recent times have been more advantageous for Capricorn Energy as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Capricorn Energy.Is There Some Revenue Growth Forecasted For Capricorn Energy?

Capricorn Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.2%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to plummet, contracting by 14% per year during the coming three years according to the five analysts following the company. With the rest of the industry predicted to shrink by 0.7% per annum, it's a sub-optimal result.

In light of this, it's somewhat peculiar that Capricorn Energy's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Capricorn Energy's P/S

Capricorn Energy's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Capricorn Energy's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Capricorn Energy that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CNE

Capricorn Energy

An independent energy company, engages in the exploration, development, production, and sale of oil and gas worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives