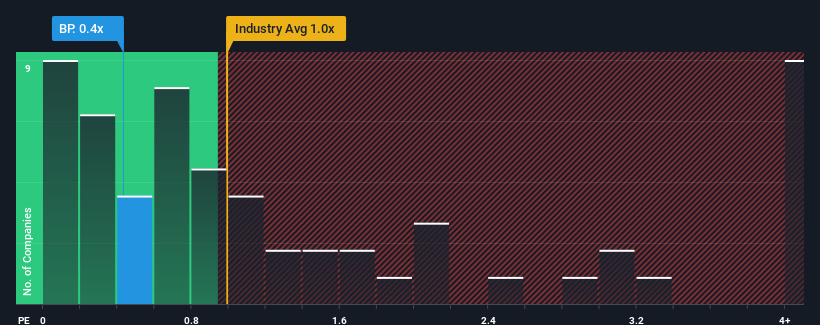

You may think that with a price-to-sales (or "P/S") ratio of 0.4x BP p.l.c. (LON:BP.) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in the United Kingdom have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for BP

How BP Has Been Performing

Recent times have been advantageous for BP as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BP.Is There Any Revenue Growth Forecasted For BP?

The only time you'd be truly comfortable seeing a P/S as low as BP's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 52% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to slump, contracting by 1.4% per year during the coming three years according to the analysts following the company. Meanwhile, the industry is forecast to moderate by 0.2% per year, which suggests the company won't escape the wider industry forces.

In light of this, the fact BP's P/S sits below the majority of other companies is unanticipated but certainly not shocking. We think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From BP's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that BP currently trades on a lower than expected P/S since its revenue forecast is matching the struggling industry but its P/S is struggling to keep up. Even though the company's revenue outlook is on par, we assume potential risks are what might be placing downward pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to resist further pain to its business from the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

Before you settle on your opinion, we've discovered 2 warning signs for BP (1 can't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BP.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives