- United Kingdom

- /

- Oil and Gas

- /

- LSE:BP.

BP (LSE:BP.) Valuation Check After Recent Share Price Gains and Improving Earnings Momentum

Reviewed by Simply Wall St

BP (LSE:BP.) has quietly pushed higher over the past month, with shares gaining about 4% as investors digest improving earnings momentum and firmer crude prices, setting up a fresh look at valuation today.

See our latest analysis for BP.

That move builds on a solid run, with BP delivering a roughly mid-teens year to date share price return and a strong double digit one year total shareholder return. This suggests momentum is quietly rebuilding as markets reassess cash generation and capital returns.

If you want to see how BP compares with peers on growth and capital discipline, it is a good time to explore aerospace and defense stocks as another pocket of the market where cash flows really matter.

With earnings ticking higher, crude supportive and the shares still trading below some estimates of intrinsic value, investors now face a crucial question: is BP undervalued, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 2.9% Undervalued

With BP closing at £4.64 against a narrative fair value of £4.78, the story leans slightly positive and hints at underappreciated cash generation.

Portfolio high-grading and disciplined capital allocation via active divestment of lower-quality or stranded assets and a focus on best-in-class project returns will streamline BP's asset base and support more stable, higher-margin earnings as carbon pricing and ESG pressures increase, consolidating the position of large incumbents.

Curious what long term revenue path, margin rebuild, and profit multiple are needed to back this stance? The projections behind that fair value may surprise you.

Result: Fair Value of £4.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent impairments in hydrogen and biofuels, along with lingering downstream pressures, could derail margin rebuild assumptions and challenge the underappreciated cash generation story.

Find out about the key risks to this BP narrative.

Another Lens on Value

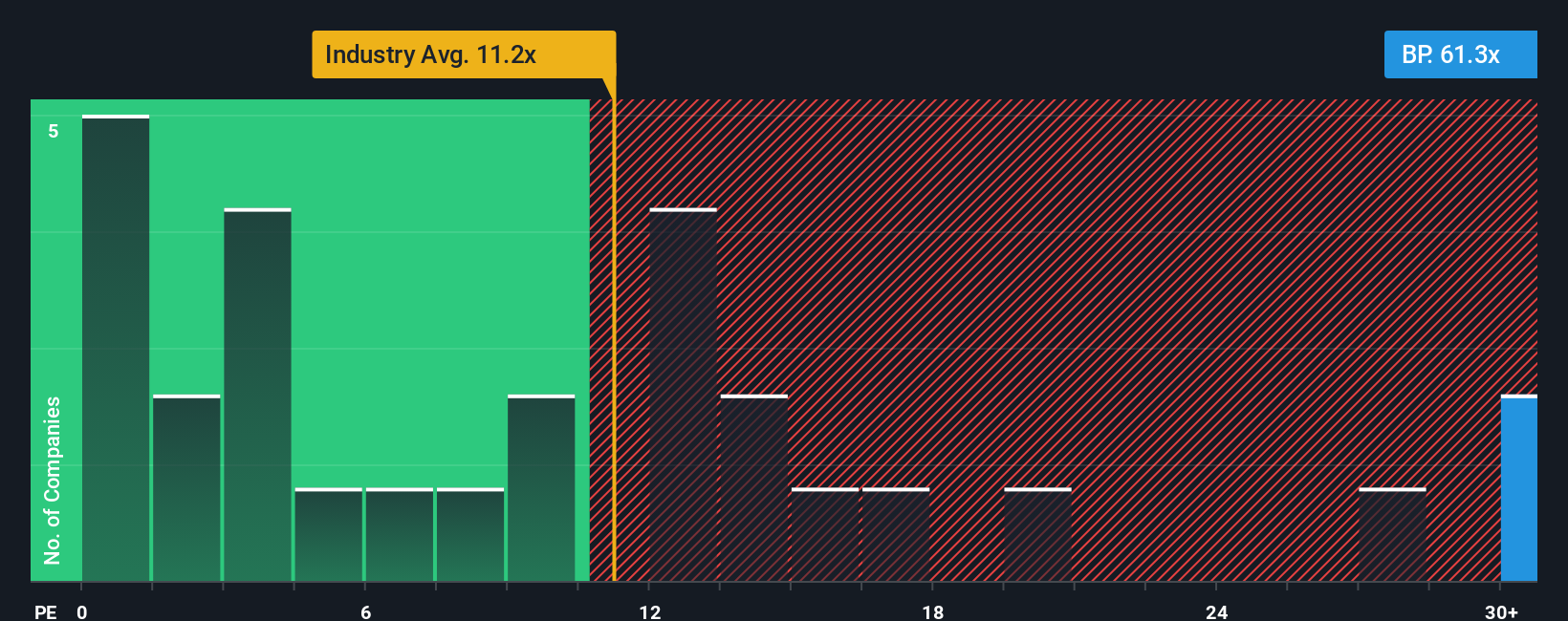

While our narrative fair value points to only a small 2.9% upside, BP's current price to earnings ratio of 62.5 times looks stretched against both its fair ratio of 21.1 times and the European oil and gas average of 11.6 times. This raises questions about downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BP Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall St Screener to uncover high conviction ideas before the crowd, while valuations and growth remain compelling.

- Capture early-stage growth potential by scanning these 3569 penny stocks with strong financials that already show stronger balance sheets and fundamentals than typical speculative names.

- Ride structural trends in automation and data by targeting these 25 AI penny stocks that may benefit from increasing demand for intelligent software and infrastructure.

- Seek reliable income streams by focusing on these 14 dividend stocks with yields > 3% that combine established payouts with sustainable business models and the potential for long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BP.

BP

An integrated energy company, engages in the oil and gas business worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026