- United Kingdom

- /

- Oil and Gas

- /

- AIM:WEN

Wentworth Resources (LON:WEN) Is Increasing Its Dividend To UK£0.012

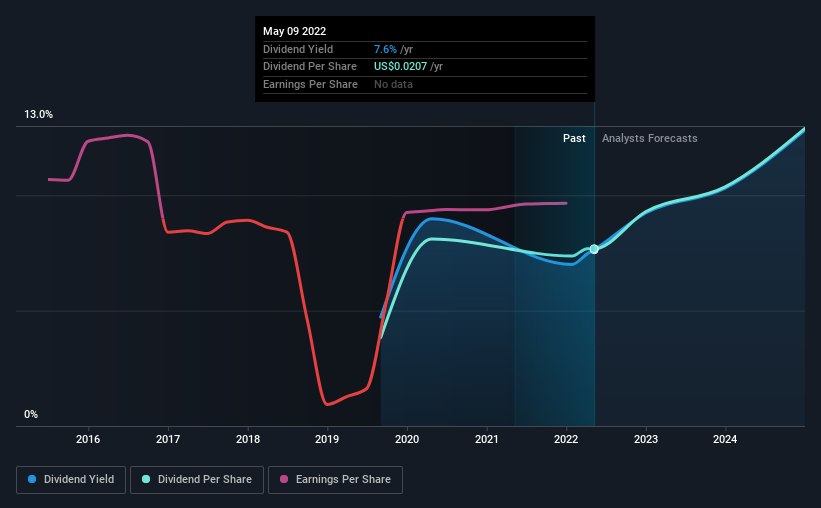

Wentworth Resources plc (LON:WEN) will increase its dividend on the 29th of July to UK£0.012, which is 16% higher than last year. This will take the annual payment from 7.6% to 7.6% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for Wentworth Resources

Wentworth Resources' Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last dividend was quite easily covered by Wentworth Resources' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

EPS is set to fall by 8.2% over the next 12 months. Assuming the dividend continues along recent trends, we believe the payout ratio could be 62%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Wentworth Resources Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from US$0.01 in 2019 to the most recent annual payment of US$0.021. This works out to be a compound annual growth rate (CAGR) of approximately 26% a year over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Wentworth Resources has grown earnings per share at 24% per year over the past five years. Wentworth Resources is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

Wentworth Resources Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Wentworth Resources that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Wentworth Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WEN

Wentworth Resources

Wentworth Resources plc engages in the exploration, development, and production of natural gas and other hydrocarbons.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion