- United Kingdom

- /

- Oil and Gas

- /

- AIM:UOG

Market Cool On United Oil & Gas Plc's (LON:UOG) Revenues Pushing Shares 39% Lower

To the annoyance of some shareholders, United Oil & Gas Plc (LON:UOG) shares are down a considerable 39% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

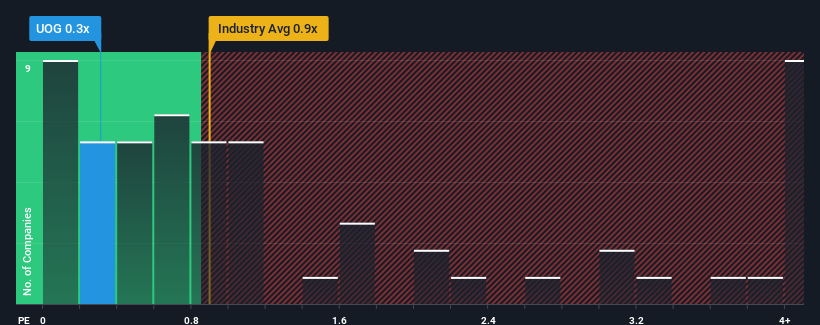

Since its price has dipped substantially, United Oil & Gas may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Oil and Gas industry in the United Kingdom have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for United Oil & Gas

How Has United Oil & Gas Performed Recently?

As an illustration, revenue has deteriorated at United Oil & Gas over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on United Oil & Gas will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for United Oil & Gas, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is United Oil & Gas' Revenue Growth Trending?

In order to justify its P/S ratio, United Oil & Gas would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

When compared to the industry's one-year growth forecast of 0.7%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that United Oil & Gas' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does United Oil & Gas' P/S Mean For Investors?

United Oil & Gas' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see United Oil & Gas currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 8 warning signs for United Oil & Gas (2 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on United Oil & Gas, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade United Oil & Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:UOG

United Oil & Gas

Engages in the exploration, development, and production of oil and gas in the United Kingdom, Egypt, Europe, and Latin America.

Excellent balance sheet moderate.