- United Kingdom

- /

- Biotech

- /

- AIM:AREC

3 UK Penny Stocks With Market Caps Under £30M To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, penny stocks present unique opportunities for investors seeking growth potential in smaller or newer companies. Although the term 'penny stock' may seem outdated, these stocks can offer significant returns when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.525 | £13.19M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.03 | £164M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.895 | £13.51M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.10 | £26.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6675 | $388.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.49 | £183.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.31M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.485 | £41.8M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Arecor Therapeutics (AIM:AREC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arecor Therapeutics plc is a clinical-stage biotechnology company in the United Kingdom that develops innovative medicines to address significant unmet patient needs, with a market cap of £29.83 million.

Operations: The company's revenue is derived entirely from its biotechnology segment, amounting to £5.06 million.

Market Cap: £29.83M

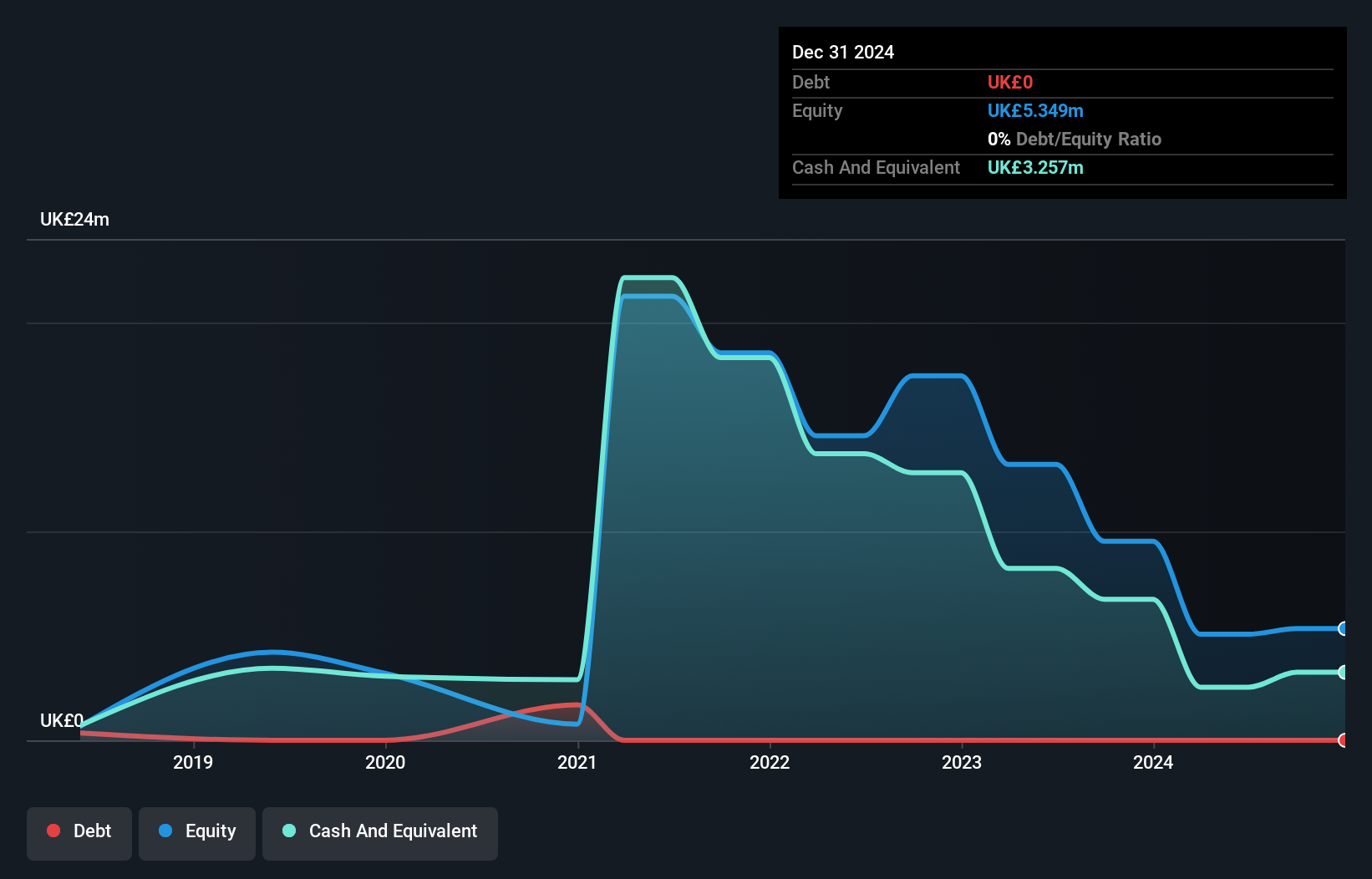

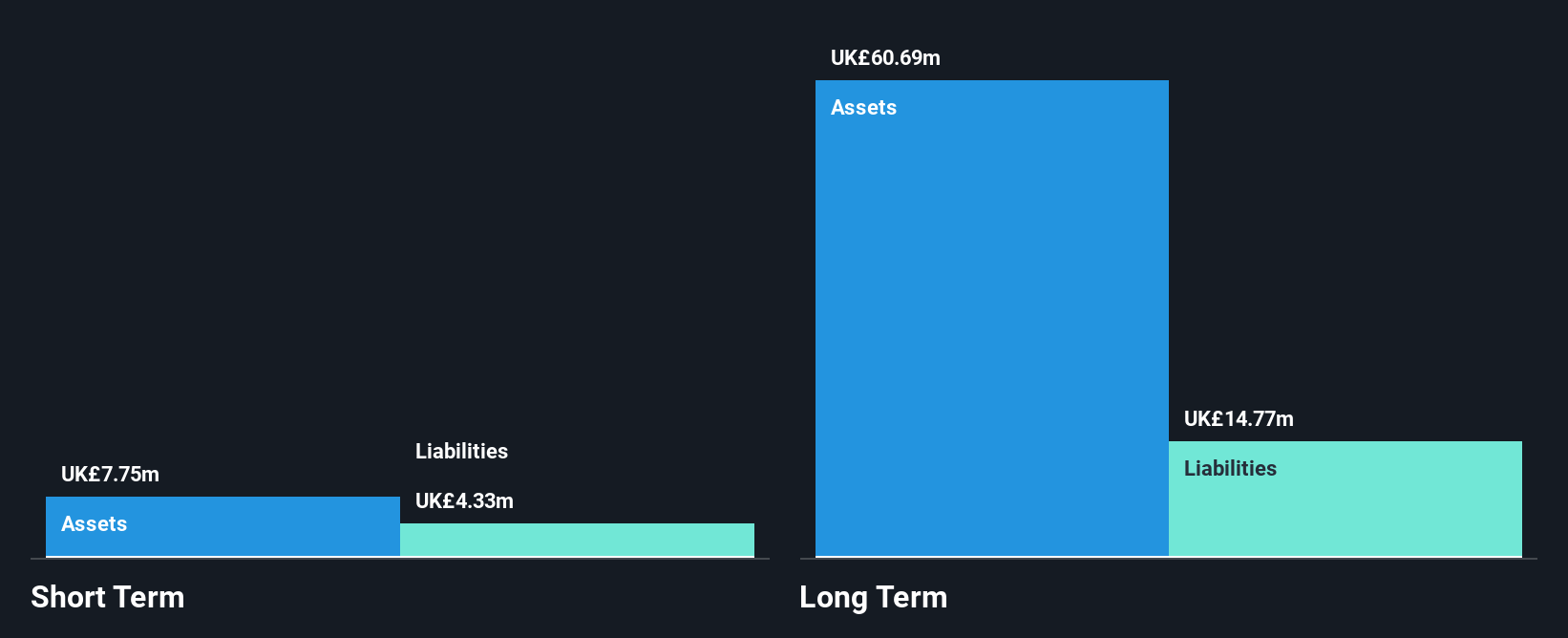

Arecor Therapeutics, a clinical-stage biotech firm, has strengthened its IP position with recent patents for AT278, an ultra-concentrated insulin aimed at enhancing automated insulin delivery systems. Despite being unprofitable and reporting a net loss of £2.51 million for H1 2025, the company maintains no debt and possesses short-term assets exceeding liabilities. Strategic partnerships, such as the co-development agreement with Sequel Med Tech and a royalty financing deal with Ligand Pharmaceuticals raising up to $11 million (£8.2 million), present growth potential. However, Arecor's cash runway remains limited to under one year without additional capital infusion or revenue increase.

- Get an in-depth perspective on Arecor Therapeutics' performance by reading our balance sheet health report here.

- Explore Arecor Therapeutics' analyst forecasts in our growth report.

First Property Group (AIM:FPO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Property Group plc is a real estate investment firm with a market cap of £26.98 million.

Operations: The company's revenue is derived from its Group Properties Division, generating £5.38 million, and its Fund Management Division, contributing £1.89 million.

Market Cap: £26.98M

First Property Group plc, a real estate investment firm with a market cap of £26.98 million, has shown financial stability by becoming profitable this year and maintaining high-quality earnings. Its interest payments are well-covered by EBIT, and short-term assets exceed short-term liabilities, although they fall short of covering long-term liabilities. The company's net debt to equity ratio is satisfactory at 12.4%, while its return on equity remains low at 5.1%. Recent earnings for the half-year ended September 30, 2025, reported sales of £3.65 million and net income of £1.17 million, indicating modest profitability improvement despite declining sales compared to the previous year.

- Unlock comprehensive insights into our analysis of First Property Group stock in this financial health report.

- Explore historical data to track First Property Group's performance over time in our past results report.

Tekmar Group (AIM:TGP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tekmar Group plc, with a market cap of £9.25 million, designs, manufactures, and supplies subsea stability and protection technology to offshore energy markets.

Operations: The company generates revenue from two main segments: Marine Civils, contributing £11.45 million, and Offshore Energy, accounting for £17.49 million.

Market Cap: £9.25M

Tekmar Group plc, with a market cap of £9.25 million, is navigating its unprofitable status by securing significant contracts in the offshore energy sector. Recent deals include a €8 million contract for a UK wind farm and another valued over EUR 3.5 million in the Middle East, reflecting growing client confidence. The company has sufficient cash runway for over three years despite losses increasing at 38.2% annually over five years. While Tekmar's stock trades below estimated fair value and has satisfactory debt levels, its new management team lacks experience, and share price volatility remains high compared to peers.

- Click to explore a detailed breakdown of our findings in Tekmar Group's financial health report.

- Gain insights into Tekmar Group's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click through to start exploring the rest of the 303 UK Penny Stocks now.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AREC

Arecor Therapeutics

A clinical stage biotechnology company, develops innovative medicines that address significant unmet patient needs in the United Kingdom.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026