- United Kingdom

- /

- Oil and Gas

- /

- AIM:SENX

Take Care Before Jumping Onto Serinus Energy plc (LON:SENX) Even Though It's 25% Cheaper

Serinus Energy plc (LON:SENX) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

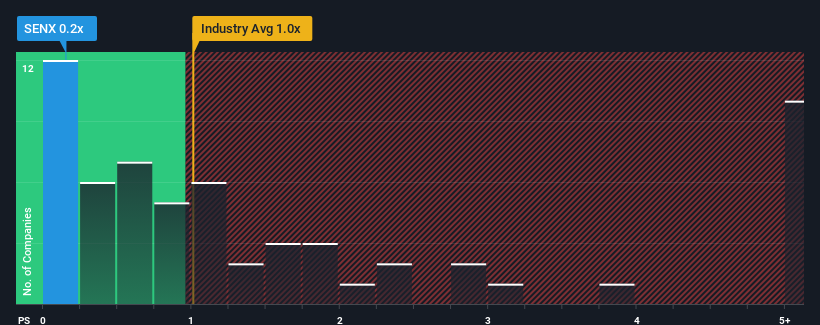

Since its price has dipped substantially, given about half the companies operating in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1x, you may consider Serinus Energy as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Serinus Energy

What Does Serinus Energy's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Serinus Energy has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Serinus Energy will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Serinus Energy would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 63%. The last three years don't look nice either as the company has shrunk revenue by 23% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 14% over the next year. That's shaping up to be materially higher than the 1.2% growth forecast for the broader industry.

In light of this, it's peculiar that Serinus Energy's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Serinus Energy's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Serinus Energy's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about this 1 warning sign we've spotted with Serinus Energy.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SENX

Serinus Energy

Engages in the exploration and development of oil and gas properties in Tunisia and Romania.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives