- United Kingdom

- /

- Oil and Gas

- /

- AIM:SENX

Lacklustre Performance Is Driving Serinus Energy plc's (LON:SENX) 35% Price Drop

Unfortunately for some shareholders, the Serinus Energy plc (LON:SENX) share price has dived 35% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

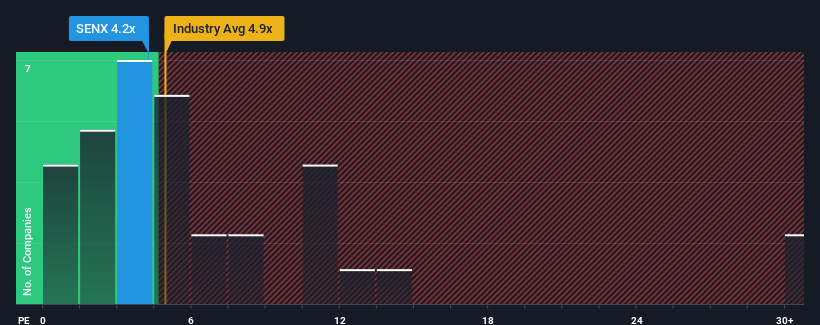

Following the heavy fall in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 14x, you may consider Serinus Energy as a highly attractive investment with its 4.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at Serinus Energy over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Serinus Energy

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Serinus Energy would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 80% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 6.5% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Serinus Energy is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, Serinus Energy's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Serinus Energy maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Serinus Energy (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Serinus Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SENX

Serinus Energy

Engages in the exploration and development of oil and gas properties in Tunisia and Romania.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives