- United Kingdom

- /

- Oil and Gas

- /

- AIM:RKH

Rockhopper Exploration plc's (LON:RKH) high institutional ownership speaks for itself as stock continues to impress, up 9.3% over last week

Key Insights

- Significantly high institutional ownership implies Rockhopper Exploration's stock price is sensitive to their trading actions

- 55% of the business is held by the top 6 shareholders

- Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

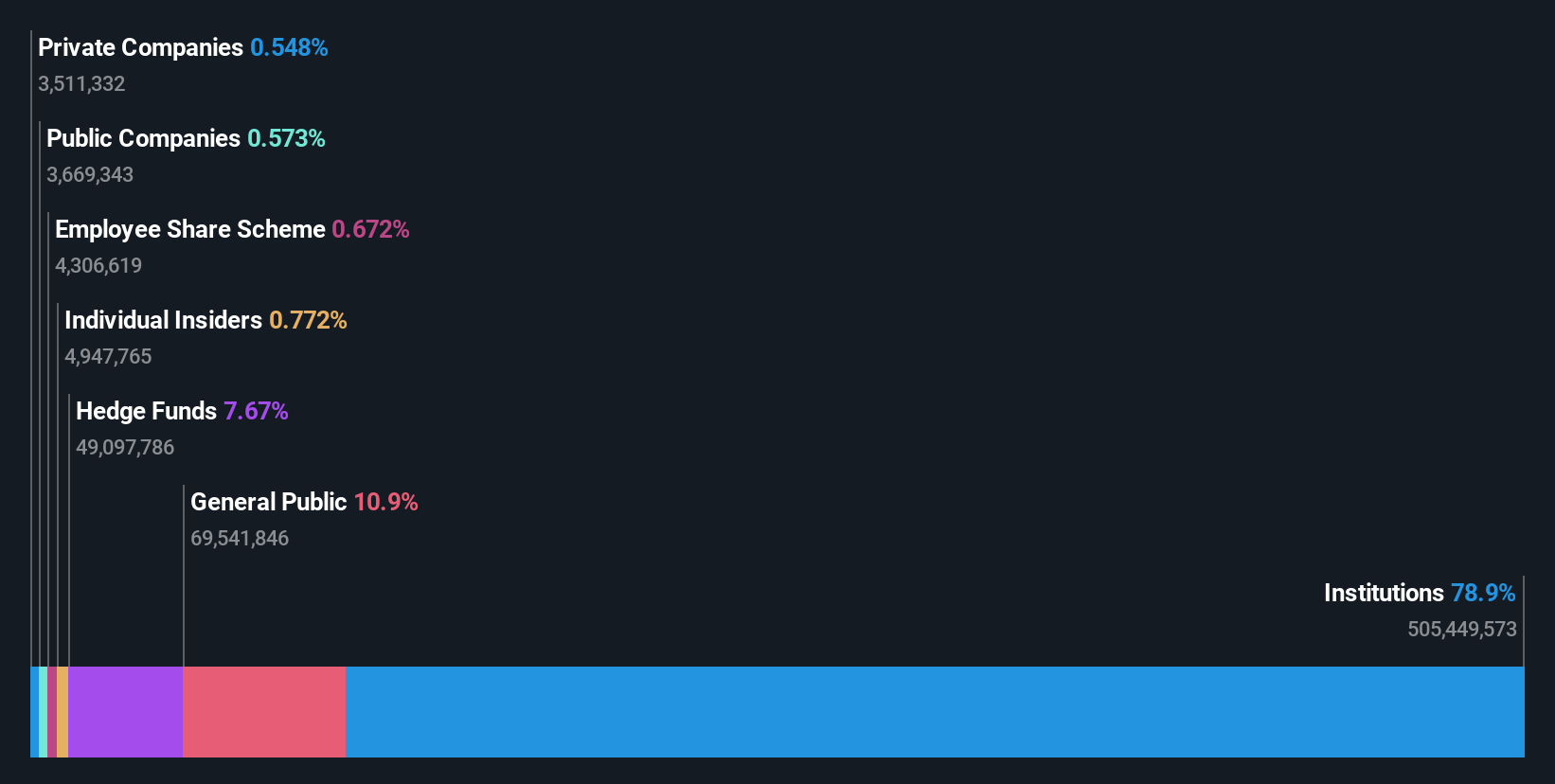

A look at the shareholders of Rockhopper Exploration plc (LON:RKH) can tell us which group is most powerful. The group holding the most number of shares in the company, around 79% to be precise, is institutions. Put another way, the group faces the maximum upside potential (or downside risk).

And as as result, institutional investors reaped the most rewards after the company's stock price gained 9.3% last week. One-year return to shareholders is currently 520% and last week’s gain was the icing on the cake.

Let's take a closer look to see what the different types of shareholders can tell us about Rockhopper Exploration.

View our latest analysis for Rockhopper Exploration

What Does The Institutional Ownership Tell Us About Rockhopper Exploration?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

We can see that Rockhopper Exploration does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Rockhopper Exploration's earnings history below. Of course, the future is what really matters.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. It would appear that 7.7% of Rockhopper Exploration shares are controlled by hedge funds. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. Our data shows that Aberdeen Group Plc is the largest shareholder with 17% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 13% and 7.7%, of the shares outstanding, respectively. Furthermore, CEO Samuel Moody is the owner of 0.7% of the company's shares.

We did some more digging and found that 6 of the top shareholders account for roughly 55% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Rockhopper Exploration

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own less than 1% of Rockhopper Exploration plc. It seems the board members have no more than UK£4.1m worth of shares in the UK£527m company. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 11% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Rockhopper Exploration better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Rockhopper Exploration you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RKH

Rockhopper Exploration

An oil and gas exploration and production company, engages in the exploration, appraisal, and development of oil and gas acreage primarily in the Falkland Islands.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion