- United Kingdom

- /

- Oil and Gas

- /

- AIM:MEN

President Energy's (LON:PPC) Stock Price Has Reduced 84% In The Past Three Years

While not a mind-blowing move, it is good to see that the President Energy Plc (LON:PPC) share price has gained 29% in the last three months. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 84% in the last three years. Arguably, the recent bounce is to be expected after such a bad drop. Of course the real question is whether the business can sustain a turnaround.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for President Energy

Because President Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, President Energy saw its revenue grow by 27% per year, compound. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 22% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

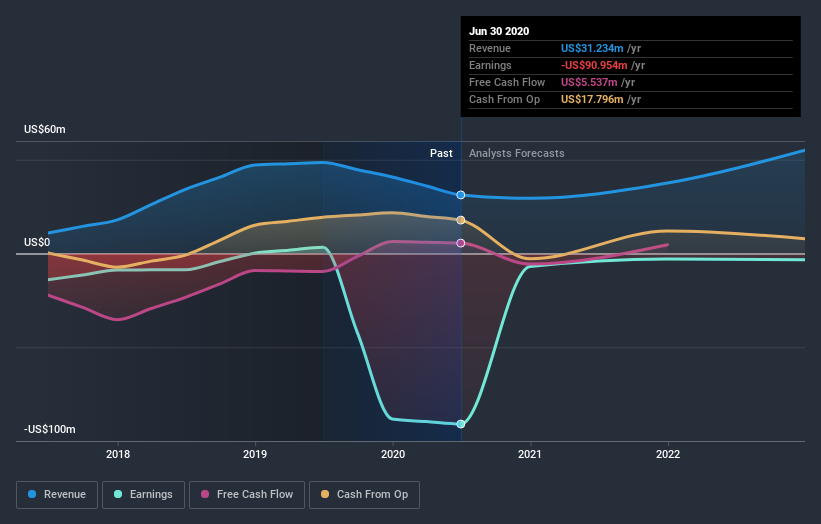

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at President Energy's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 2.5% in the twelve months, President Energy shareholders did even worse, losing 53%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand President Energy better, we need to consider many other factors. Take risks, for example - President Energy has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

We will like President Energy better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade President Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:MEN

Molecular Energies

Molecular Energies PLC, together with its subsidiaries, engages in the exploration, evaluation, development, and production of oil and gas properties primarily in South America.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives