- United Kingdom

- /

- Oil and Gas

- /

- AIM:JOG

June 2025's Best UK Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing a downturn, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market pressures, investors may find opportunities in penny stocks, which often represent smaller or newer companies with potential for growth. While the term "penny stocks" might seem outdated, these investments can still offer surprising value and financial resilience for those willing to explore beyond traditional blue-chip names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.758 | £63.83M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.70 | £278.42M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.46 | £178.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.81 | £428.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.24 | £408.79M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.45 | £184.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.842 | £1.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.974 | £155.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 398 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jersey Oil and Gas Plc focuses on the exploration, appraisal, development, and production of oil and gas properties in the UK's North Sea with a market cap of £42.79 million.

Operations: Jersey Oil and Gas Plc does not report any revenue segments.

Market Cap: £42.79M

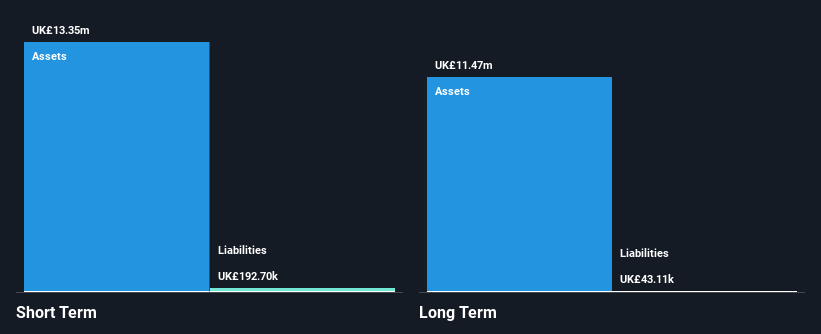

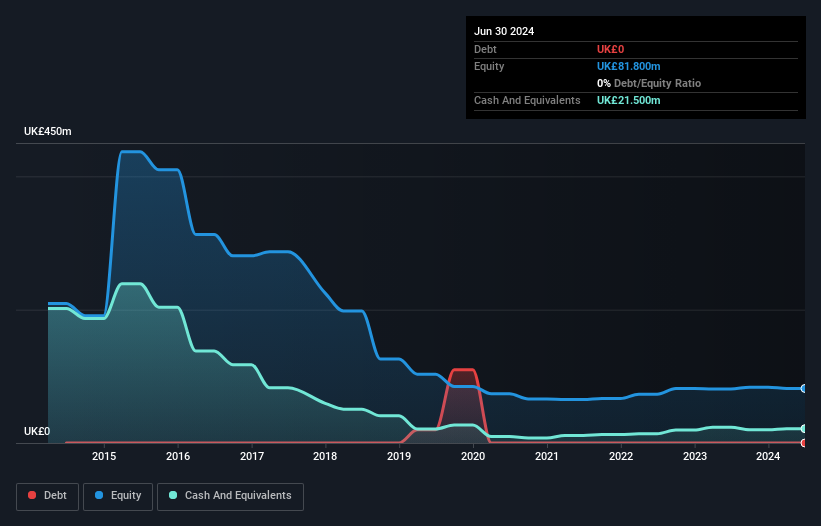

Jersey Oil and Gas Plc, with a market cap of £42.79 million, operates in the UK's North Sea and remains pre-revenue, generating less than US$1m. The company is unprofitable with losses increasing annually by 13.8% over the past five years but reported a reduced net loss of £3.54 million for 2024 compared to £5.6 million in 2023. Despite high share price volatility, JOG trades significantly below estimated fair value and has no debt, with short-term assets covering liabilities comfortably. Management and board are experienced, providing stability as they navigate towards potential future profitability without significant shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Jersey Oil and Gas stock in this financial health report.

- Evaluate Jersey Oil and Gas' prospects by accessing our earnings growth report.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc specializes in designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £277.51 million.

Operations: The company generates £41.8 million in revenue from its NIOX® segment, which focuses on medical devices for asthma-related applications.

Market Cap: £277.51M

NIOX Group Plc, with a market cap of £277.51 million, is a debt-free company focused on medical devices for asthma applications, generating £41.8 million in revenue. Despite recent profit margins declining to 8.1% from last year's 25.8%, the company maintains strong financial health with short-term assets exceeding liabilities and no significant shareholder dilution recently. However, its share price has been highly volatile, and insider selling was notable over the past quarter. Earnings are forecasted to grow significantly at 37.48% annually despite recent negative growth trends, positioning NIOX as an intriguing yet risky proposition in the penny stock arena.

- Click here and access our complete financial health analysis report to understand the dynamics of NIOX Group.

- Learn about NIOX Group's future growth trajectory here.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Capital Limited, with a market cap of £142.43 million, offers drilling, mining, mineral assaying, and surveying services through its subsidiaries.

Operations: Capital generates $348 million in revenue from its Business Services segment.

Market Cap: £142.43M

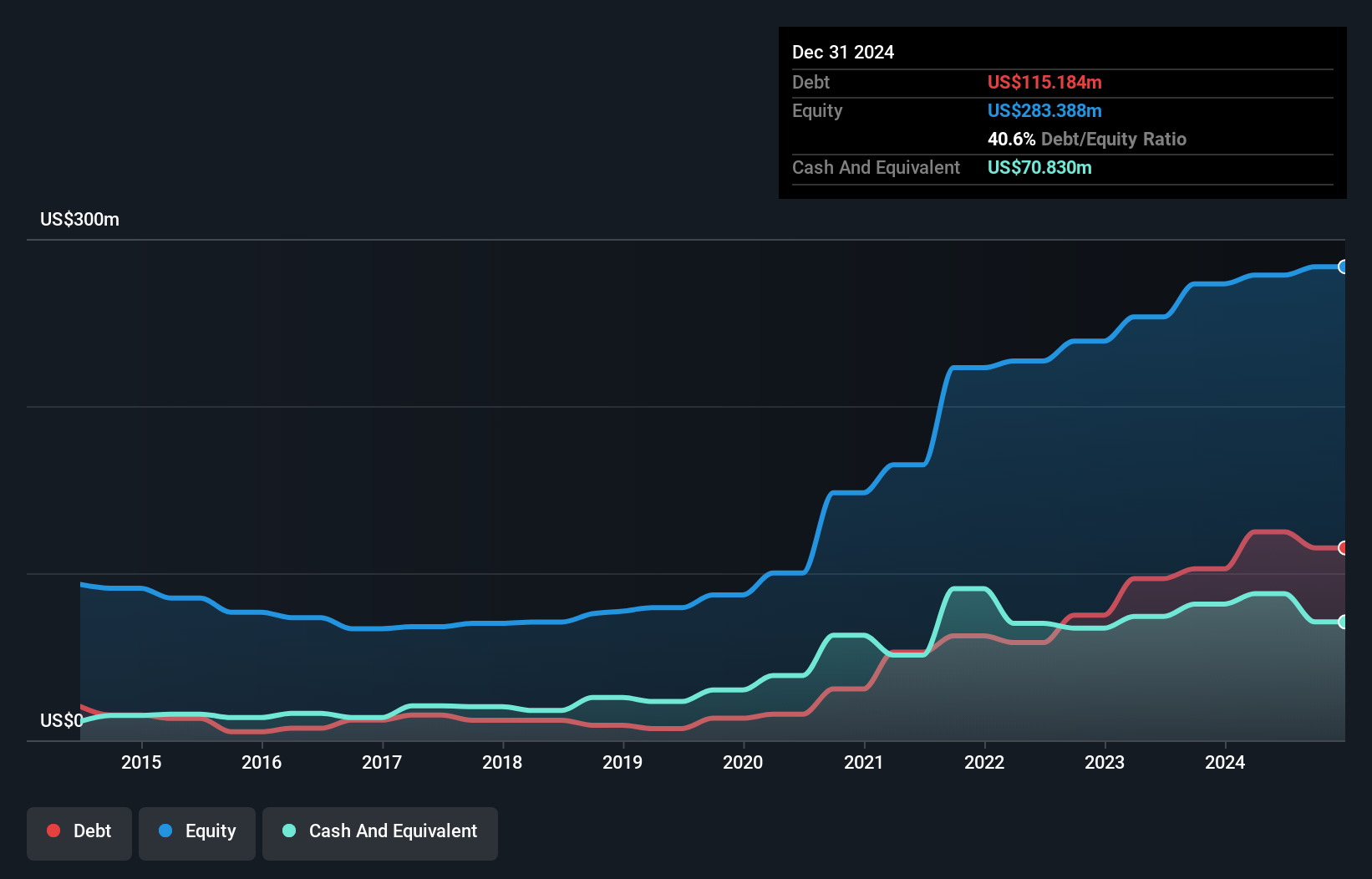

Capital Limited, with a market cap of £142.43 million, is navigating the penny stock landscape by leveraging its diverse service offerings in drilling and mining. The company recently secured a significant contract with Reko Diq Mining Pakistan Limited, expected to generate over US$60 million annually once fully operational. Despite a decline in net profit margins from 11.5% to 5% and reduced dividends, Capital's short-term assets comfortably cover liabilities, and it maintains satisfactory debt levels with operating cash flow covering debt well. However, negative earnings growth last year highlights challenges amidst strategic expansions like the Reko Diq project.

- Take a closer look at Capital's potential here in our financial health report.

- Assess Capital's future earnings estimates with our detailed growth reports.

Next Steps

- Discover the full array of 398 UK Penny Stocks right here.

- Curious About Other Options? Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JOG

Jersey Oil and Gas

Engages in the exploration, appraisal, development, and production of oil and gas properties in the North Sea of the United Kingdom.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives