- United Kingdom

- /

- Electrical

- /

- AIM:CKT

Checkit Leads The Charge In UK Penny Stocks

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, reflecting broader global economic concerns. Despite these hurdles, investors continue to explore opportunities in various market segments, including penny stocks. Although the term "penny stocks" may seem outdated, it still represents smaller or newer companies that can offer significant value and potential growth when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £419.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.985 | £296.88M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £147.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.28 | £412.58M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.80 | £67.91M | ★★★★★★ |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.88M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.39 | £214.38M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.17 | £154.81M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Checkit (AIM:CKT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Checkit plc, with a market cap of £15.39 million, offers intelligent operations management platforms designed for deskless workforces in the United Kingdom and the Americas.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to £13 million.

Market Cap: £15.39M

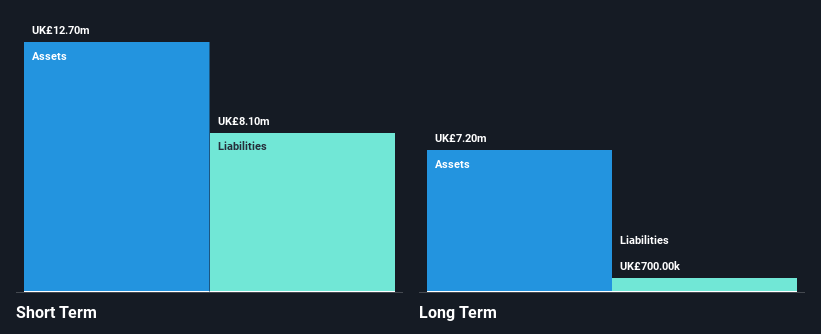

Checkit plc, with a market cap of £15.39 million, offers intelligent operations management platforms and generates revenue of £13 million from its Electronic Components & Parts segment. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow. Its short-term assets exceed both short-term (£8.6M) and long-term liabilities (£400K), providing financial stability despite being unprofitable with negative return on equity (-38.84%). Trading at 77.9% below estimated fair value, Checkit's revenue is forecasted to grow by 15.16% annually, though profitability isn't expected within the next three years.

- Dive into the specifics of Checkit here with our thorough balance sheet health report.

- Evaluate Checkit's prospects by accessing our earnings growth report.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £37.92 million, designs, manufactures, and markets semiconductor products for the communications industries across the United Kingdom, the Americas, Far East, and internationally.

Operations: The company's revenue is primarily generated from its semiconductor components segment for the communications industry, amounting to £24.85 million.

Market Cap: £37.92M

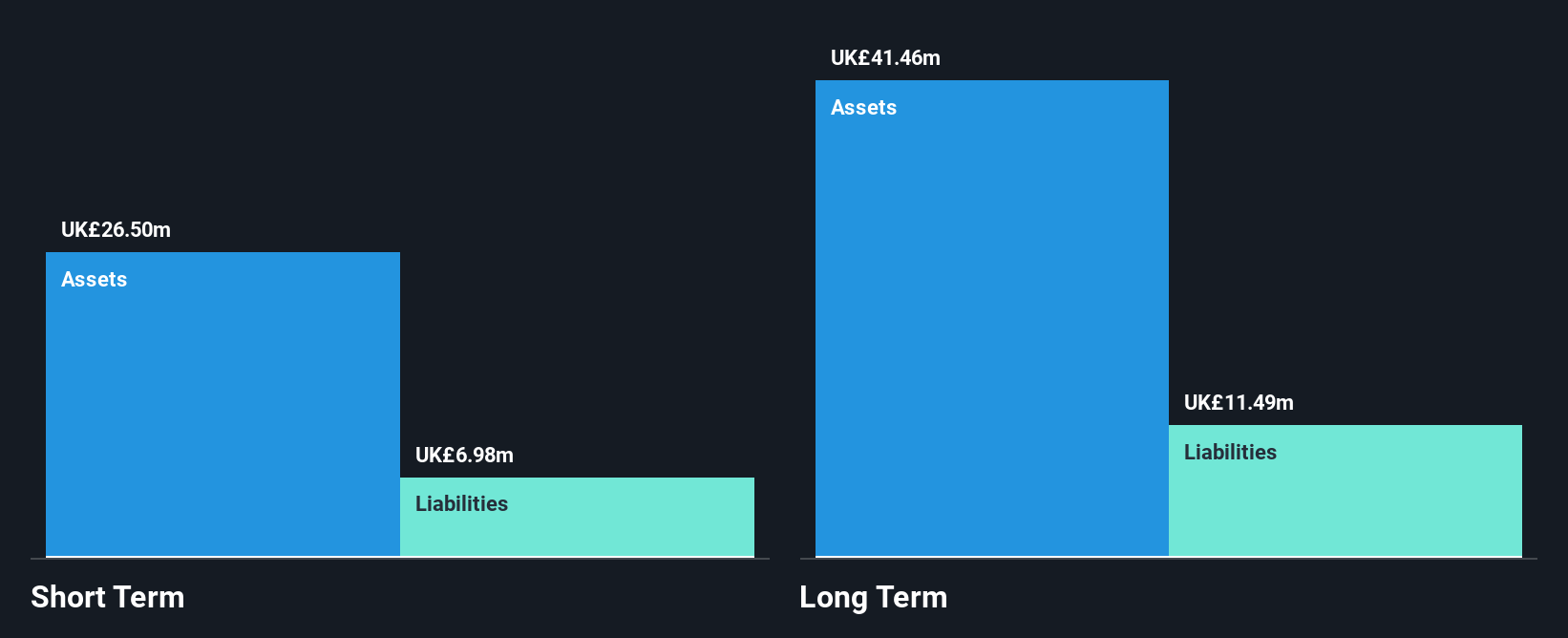

CML Microsystems, with a market cap of £37.92 million, operates in the semiconductor sector with revenues of £24.85 million from its communications components segment. Despite being debt-free and having short-term assets (£26.5M) that exceed both short-term (£7M) and long-term liabilities (£11.5M), the company faces challenges such as decreased profit margins (5.2% compared to last year's 20.8%) and negative earnings growth over the past year (-70.8%). While CML has not diluted shareholders recently, its return on equity remains low at 2.6%, indicating room for improvement in profitability metrics.

- Navigate through the intricacies of CML Microsystems with our comprehensive balance sheet health report here.

- Understand CML Microsystems' track record by examining our performance history report.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jersey Oil and Gas Plc is involved in the exploration, appraisal, development, and production of oil and gas properties in the UK's North Sea, with a market cap of £20.09 million.

Operations: Jersey Oil and Gas Plc has not reported any specific revenue segments.

Market Cap: £20.09M

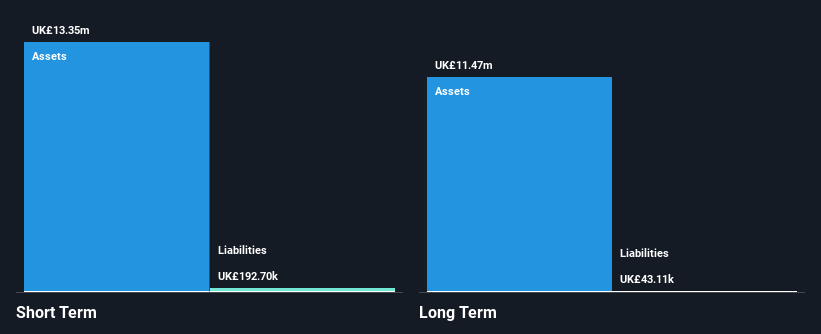

Jersey Oil and Gas Plc, with a market cap of £20.09 million, operates in the UK's North Sea oil and gas sector but remains pre-revenue, generating less than US$1 million. The company is currently unprofitable with losses increasing over the past five years at 20% annually. Despite this, it maintains a strong financial position with no debt and short-term assets of £13.3 million exceeding liabilities significantly. The management team has an average tenure of 3.3 years, indicating experience, while recent board changes include the retirement of Marcus Stanton as Non-Executive Director and Chairman of the Audit Committee.

- Take a closer look at Jersey Oil and Gas' potential here in our financial health report.

- Examine Jersey Oil and Gas' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Jump into our full catalog of 442 UK Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CKT

Checkit

Provides intelligent operations management platforms for deskless workforces in the United Kingdom and the Americas.

Excellent balance sheet slight.

Market Insights

Community Narratives