- United Kingdom

- /

- Metals and Mining

- /

- AIM:CAML

Central Asia Metals And 2 Other Undiscovered Gems In The UK Market

Reviewed by Simply Wall St

The United Kingdom market has recently experienced turbulence, with the FTSE 100 index faltering due to weak trade data from China, highlighting broader concerns about global economic recovery. As investors navigate these uncertain waters, identifying undiscovered gems within the UK market can offer opportunities for those seeking stocks that show resilience and potential amidst challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Central Asia Metals (AIM:CAML)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Asia Metals plc, with a market cap of £248.57 million, operates as a base metals producer through its subsidiaries.

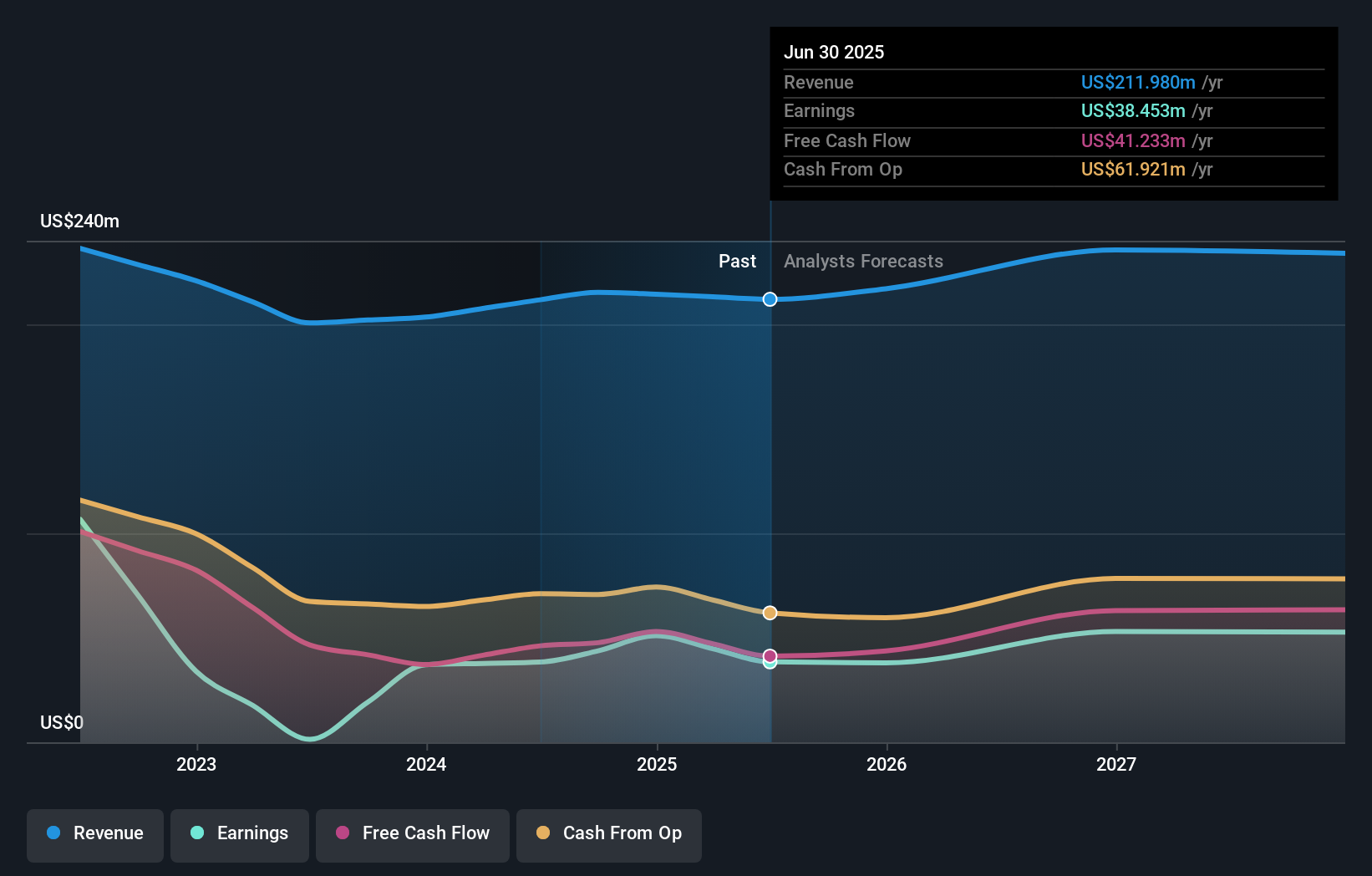

Operations: Central Asia Metals generates revenue primarily from its Sasa and Kounrad operations, with contributions of $94.89 million and $117.09 million, respectively.

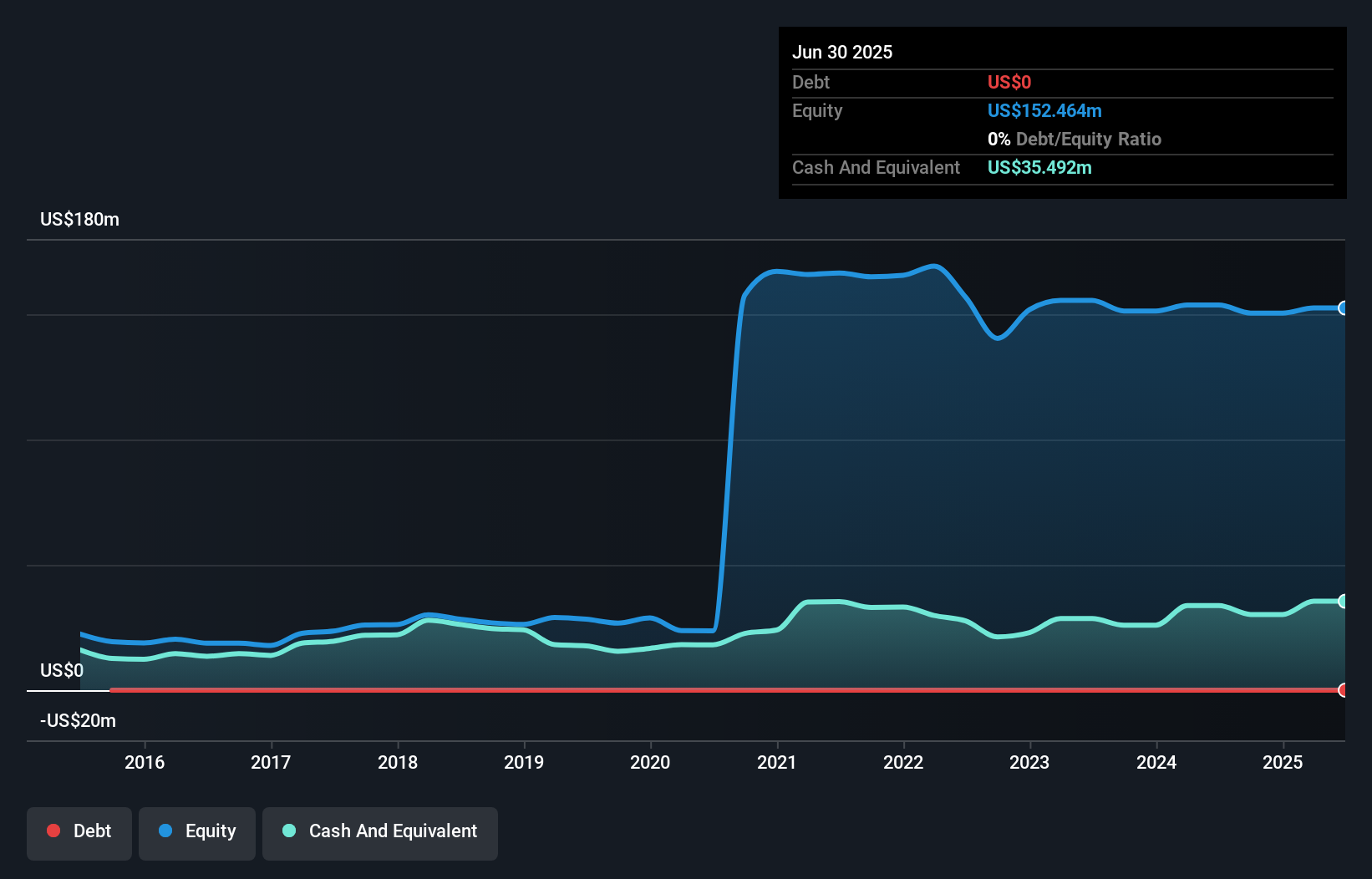

Central Asia Metals, a base metals producer, is working on enhancing ore recovery at its Sasa mine and expanding resource opportunities in Kazakhstan. The company trades at a significant discount to its estimated fair value and has reduced its debt to equity ratio from 28.1% to 1.8% over the past five years. Despite challenges like production declines and currency fluctuations, CAML's strategic focus includes solar power initiatives for cost efficiency and share repurchases authorized up to 18 million shares. Earnings are projected to grow annually by 5.64%, with current net income reported at $8.95 million for H1 2025 compared to $21.9 million last year.

Hargreaves Services (AIM:HSP)

Simply Wall St Value Rating: ★★★★★★

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and other international markets with a market cap of £249.91 million.

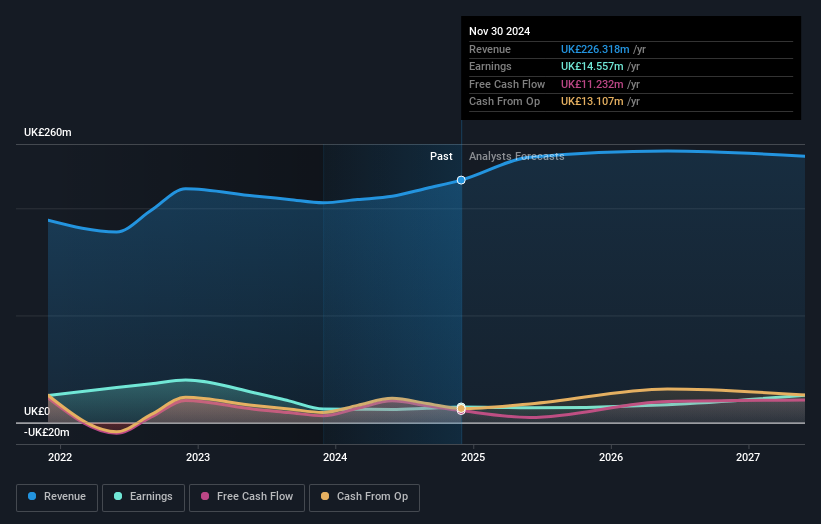

Operations: The company generates revenue primarily from its Services segment, which accounts for £247.69 million, while Hargreaves Land contributes £20.08 million.

With a debt-free status and high-quality earnings, Hargreaves Services is carving a niche in the UK infrastructure and environmental sectors. The company reported sales of £264.44 million for the year ending May 31, 2025, up from £211.15 million previously, with net income rising to £14.75 million from £12.28 million. Basic earnings per share increased to GBP 0.4481 from GBP 0.3778 last year, signaling robust financial health despite challenges like reliance on asset sales and market cycles. While analysts foresee modest revenue growth of 1.9% annually over three years, profit margins are expected to improve slightly by September 2028.

City of London Investment Group (LSE:CLIG)

Simply Wall St Value Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £193.76 million.

Operations: Revenue from asset management stands at $73.04 million.

City of London Investment Group, a notable player in the capital markets, has shown impressive financial health with earnings growth of 15% over the past year, surpassing the industry's 10.1%. The firm boasts a favorable price-to-earnings ratio of 13.4x compared to the UK market's 16.4x and remains debt-free, eliminating concerns about interest coverage. Recent earnings reports reveal net income rose to US$19.68 million from US$17.12 million last year, reflecting high-quality earnings and robust profitability that supports a consistent dividend payout of 33p for two consecutive years despite no increase this year.

Next Steps

- Reveal the 64 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CAML

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives