- United Kingdom

- /

- Banks

- /

- LSE:LLOY

3 Top UK Dividend Stocks With Yields Up To 5.6%

Reviewed by Simply Wall St

In the current landscape, the UK market has been grappling with challenges as evidenced by recent declines in the FTSE 100 and FTSE 250 indices, largely influenced by weak trade data from China. This environment underscores the importance of identifying robust dividend stocks that can offer stability and income potential even amid global economic uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.56% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.01% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.87% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.98% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.73% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.84% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.79% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.08% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.35% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

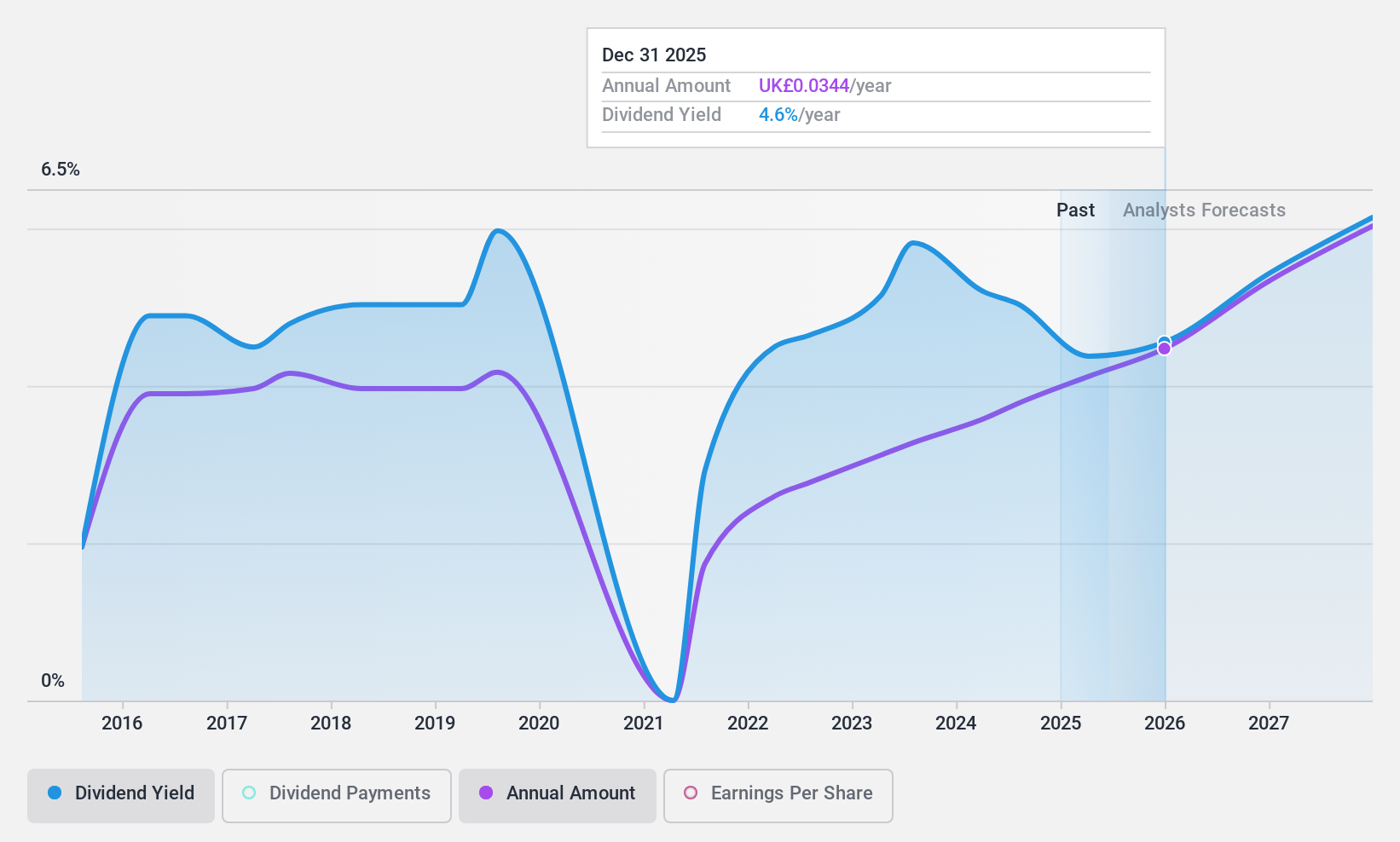

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc manufactures and sells building products, systems, and solutions across various regions including the United Kingdom, Europe, North America, the Middle East, and the Far East with a market cap of £119.58 million.

Operations: The Alumasc Group's revenue is primarily derived from its Water Management segment (£55.87 million), Building Envelope segment (£39.16 million), and Housebuilding Products segment (£15.24 million).

Dividend Yield: 3.2%

Alumasc Group's dividend payments have grown over the past decade, supported by a low payout ratio of 40.7% and a cash payout ratio of 34.6%, indicating strong coverage by earnings and cash flows. However, dividends have been volatile with instances of significant annual drops, making them unreliable. Recent earnings growth is promising, with net income rising to £4.9 million for the half year ended December 2024, but the dividend yield remains below top-tier UK payers at 3.25%.

- Unlock comprehensive insights into our analysis of Alumasc Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Alumasc Group is trading behind its estimated value.

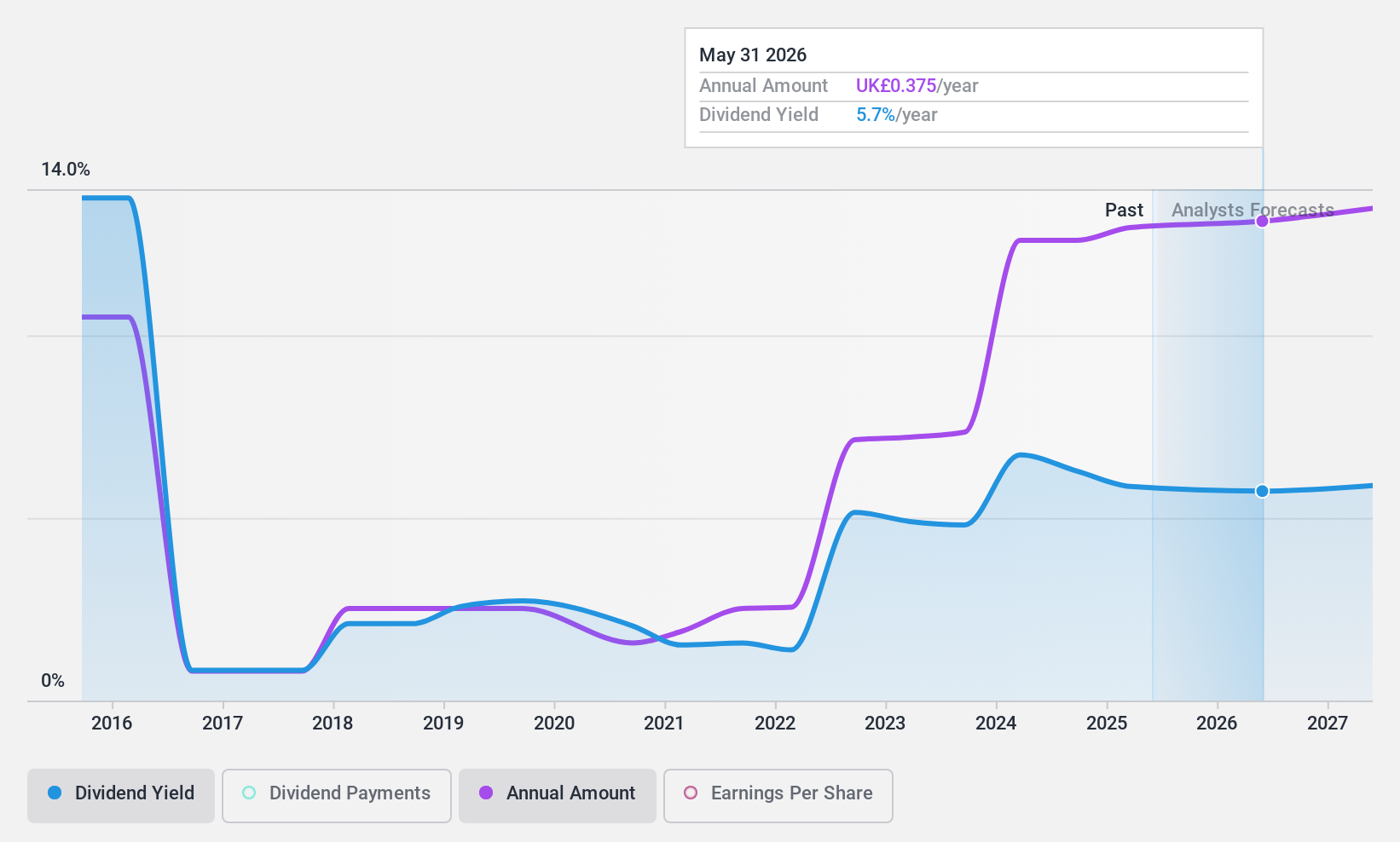

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and other international markets with a market cap of £214.25 million.

Operations: Hargreaves Services Plc generates revenue through its segments, with £219.11 million from Services and £10.54 million from Hargreaves Land.

Dividend Yield: 5.7%

Hargreaves Services has shown a 2.8% increase in its interim dividend to 18.5 pence, reflecting an expected full-year rise to 37 pence. Despite this growth, the company's dividend payments have been volatile and not well covered by free cash flows, with a high cash payout ratio of 108.6%. Recent earnings improvement is notable, with net income reaching £3.99 million for the half year ended November 2024; however, sustainability concerns remain due to insufficient coverage by earnings and cash flows.

- Dive into the specifics of Hargreaves Services here with our thorough dividend report.

- Our valuation report unveils the possibility Hargreaves Services' shares may be trading at a premium.

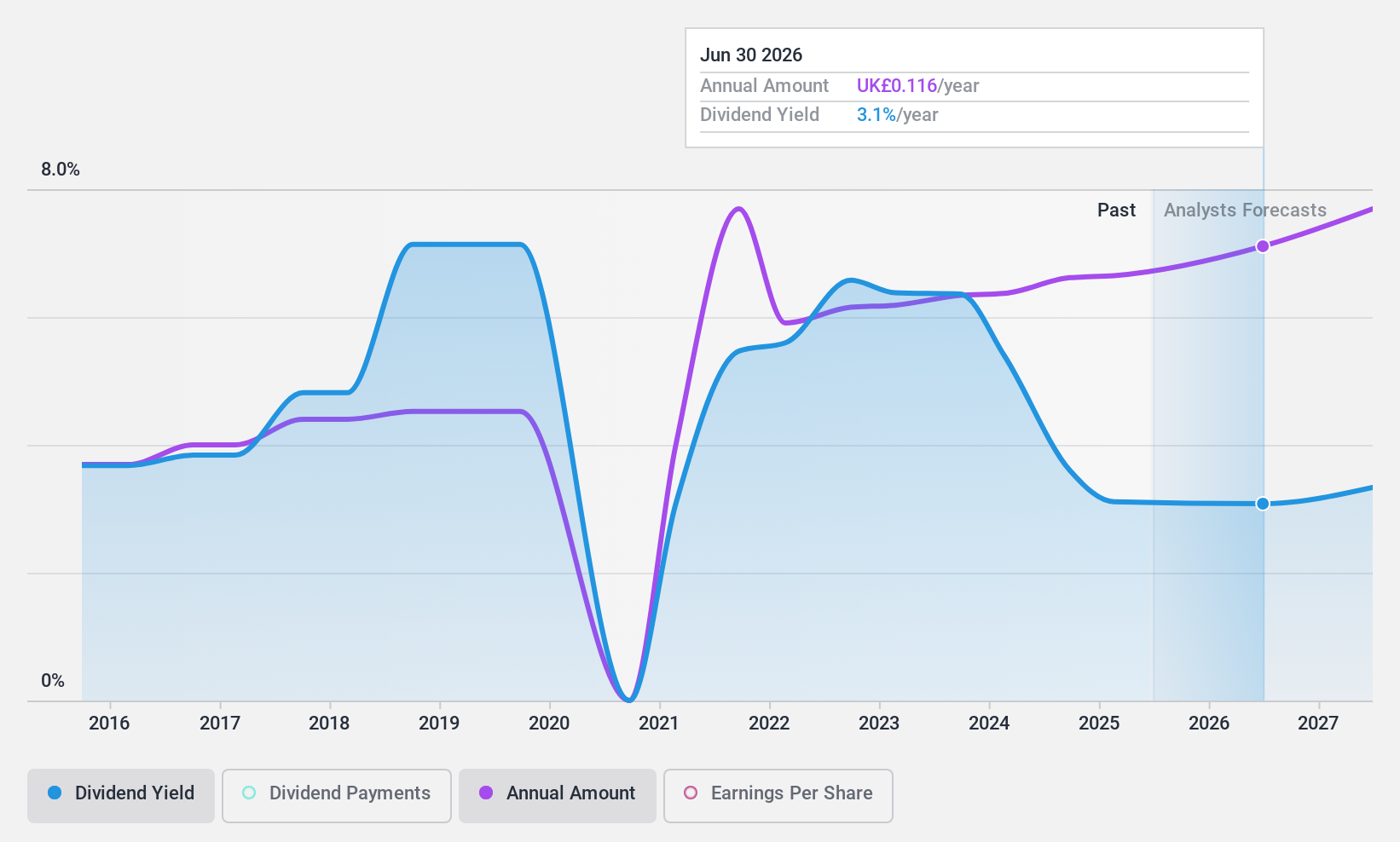

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial services both in the United Kingdom and internationally, with a market cap of £38.68 billion.

Operations: Lloyds Banking Group plc generates revenue through its diverse offerings in banking and financial services, catering to both domestic and international markets.

Dividend Yield: 4.5%

Lloyds Banking Group's dividend payments have been volatile over the past decade, although they are currently well covered by earnings with a payout ratio of 41.5%, forecasted to increase to 47.5% in three years. Despite trading at a significant discount to its estimated fair value, Lloyds' dividend yield of 4.54% is below the top quartile in the UK market. Recent strategic moves include debt redemption and leadership appointments, potentially impacting future financial stability and growth strategies.

- Delve into the full analysis dividend report here for a deeper understanding of Lloyds Banking Group.

- Our valuation report here indicates Lloyds Banking Group may be undervalued.

Seize The Opportunity

- Access the full spectrum of 59 Top UK Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives