The CEO of Egdon Resources plc (LON:EDR) is Mark Anthony Abbott, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Egdon Resources

How Does Total Compensation For Mark Anthony Abbott Compare With Other Companies In The Industry?

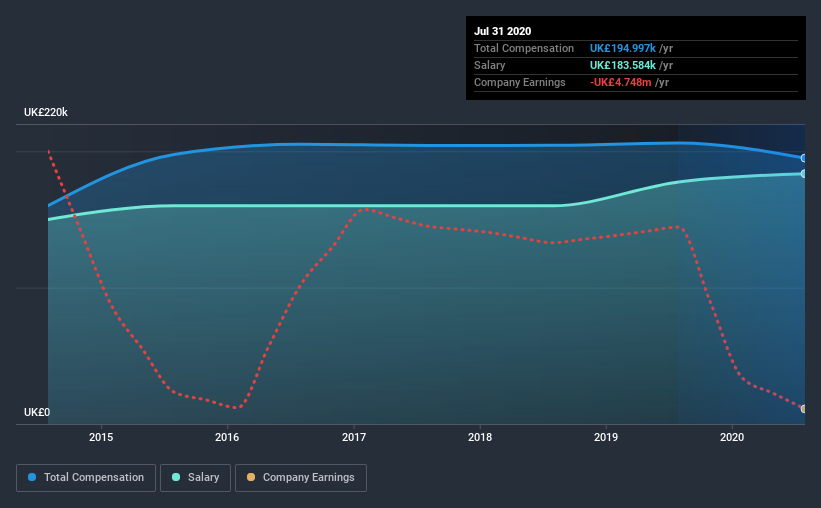

Our data indicates that Egdon Resources plc has a market capitalization of UK£6.9m, and total annual CEO compensation was reported as UK£195k for the year to July 2020. That's a slightly lower by 5.3% over the previous year. In particular, the salary of UK£183.6k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below UK£147m, reported a median total CEO compensation of UK£284k. This suggests that Mark Anthony Abbott is paid below the industry median. Furthermore, Mark Anthony Abbott directly owns UK£250k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£184k | UK£178k | 94% |

| Other | UK£11k | UK£28k | 6% |

| Total Compensation | UK£195k | UK£206k | 100% |

On an industry level, around 64% of total compensation represents salary and 36% is other remuneration. According to our research, Egdon Resources has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Egdon Resources plc's Growth

Over the last three years, Egdon Resources plc has shrunk its earnings per share by 31% per year. Its revenue is down 56% over the previous year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Egdon Resources plc Been A Good Investment?

Given the total shareholder loss of 70% over three years, many shareholders in Egdon Resources plc are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As previously discussed, Mark Anthony is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we are quite underwhelmed with EPS growth, the shareholder returns over the past three years have also failed to impress us. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for Egdon Resources (1 is potentially serious!) that you should be aware of before investing here.

Switching gears from Egdon Resources, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Egdon Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Egdon Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EDR

Egdon Resources

Egdon Resources plc, together with its subsidiaries, explores for and produces hydrocarbons in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026