- United Kingdom

- /

- Media

- /

- AIM:DNM

Dianomi Leads The Charge With 2 Other UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a decline, influenced by weak trade data from China and the global economic uncertainty that followed. Amid these challenging market conditions, investors often seek opportunities in smaller or newer companies that exhibit strong financial foundations. Penny stocks, though an older term, remain relevant as they can offer surprising value and potential for growth. This article will explore three UK penny stocks that stand out for their financial resilience and potential to deliver long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.235 | £842.18M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.16 | £79.34M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.522 | £234.74M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Dianomi (AIM:DNM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dianomi plc, along with its subsidiaries, offers native advertising services across various sectors including financial services, technology, corporates, and lifestyle in regions such as Europe, the Middle East, Africa, the United States, and Asia Pacific; it has a market cap of £11.41 million.

Operations: The company generates its revenue primarily through advertising, amounting to £29.50 million.

Market Cap: £11.41M

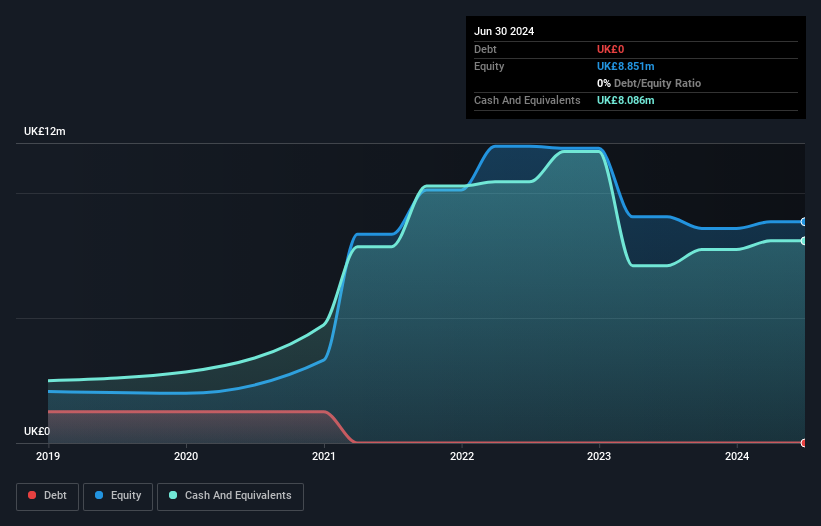

Dianomi plc, with a market cap of £11.41 million, primarily generates revenue through advertising services, reporting £29.50 million in revenue despite being unprofitable. The company benefits from an experienced management team and board of directors, both with average tenures over two years. Dianomi is debt-free and maintains a strong cash runway exceeding three years even as free cash flow shrinks annually by 31.1%. While trading at good value relative to peers and industry standards, its earnings have declined significantly over the past five years by 47.8% per year. Recent guidance suggests stable revenue expectations around £28 million for 2024.

- Click here to discover the nuances of Dianomi with our detailed analytical financial health report.

- Evaluate Dianomi's prospects by accessing our earnings growth report.

Mind Gym (AIM:MIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mind Gym plc is a behavioural science company with operations in the United Kingdom, Singapore, the United States, and Canada, and has a market cap of £23.56 million.

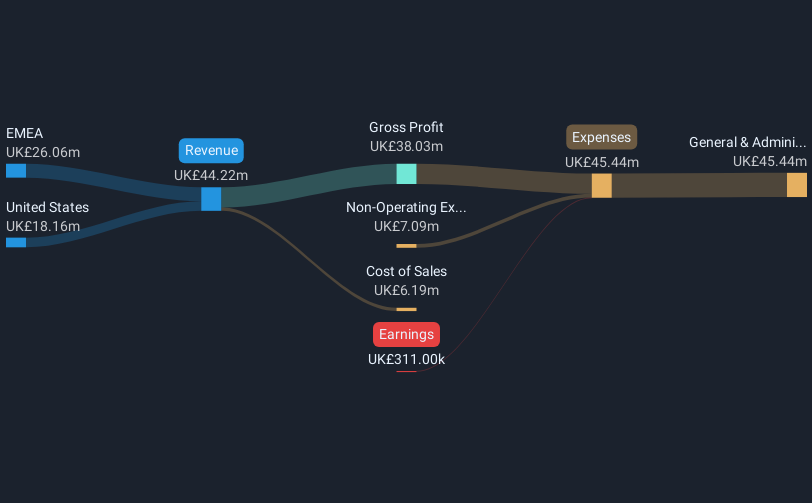

Operations: The company generates revenue of £44.22 million from offering human capital and business improvement solutions.

Market Cap: £23.56M

Mind Gym plc, with a market cap of £23.56 million, reported half-year sales of £20.21 million but remains unprofitable. The company has experienced leadership, with both its board and management team having average tenures over five years. Recent executive changes include the appointment of Adam Maude as Chief Commercial Officer for US operations to enhance commercial strategy and growth. Despite being debt-free, Mind Gym's short-term assets (£7.5M) fall slightly short of covering its short-term liabilities (£7.9M). Although losses have increased by 64.3% annually over five years, underlying revenue growth is anticipated moving forward despite near-term challenges.

- Dive into the specifics of Mind Gym here with our thorough balance sheet health report.

- Learn about Mind Gym's future growth trajectory here.

Worldsec (LSE:WSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Worldsec Limited is a closed-ended investment company focusing on small and medium-sized trading companies in the Greater China and South East Asian regions, with a market cap of £1.70 million.

Operations: The company's revenue segment is Investment Holding, which reported a figure of -$0.21 million.

Market Cap: £1.7M

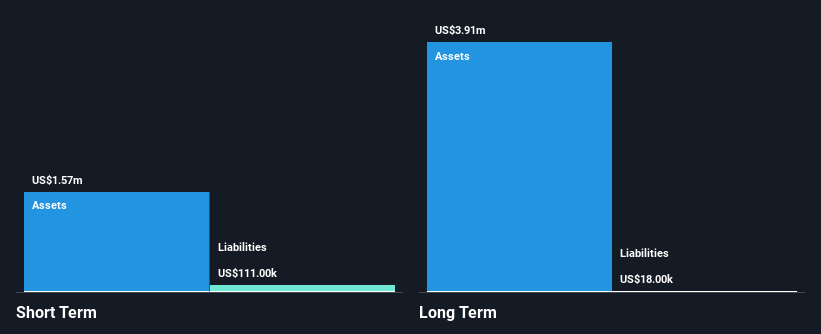

Worldsec Limited, with a market cap of £1.70 million, operates as a pre-revenue investment holding entity focused on Greater China and South East Asia. Despite its lack of revenue, the company maintains a healthy financial position with short-term assets of $1.6 million surpassing both short and long-term liabilities. The board is experienced with an average tenure of 11.6 years, providing stability amid high share price volatility over recent months. While unprofitable, Worldsec has managed to reduce its losses by 2.1% annually over the past five years and remains debt-free with sufficient cash runway for more than three years based on current free cash flow levels.

- Unlock comprehensive insights into our analysis of Worldsec stock in this financial health report.

- Gain insights into Worldsec's historical outcomes by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 444 UK Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DNM

Dianomi

Provides native advertising services for the financial services, technology, corporates, and lifestyle sectors in Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Flawless balance sheet and fair value.

Market Insights

Community Narratives