- United Kingdom

- /

- Capital Markets

- /

- LSE:PLUS

Have Insiders Been Buying Plus500 Ltd. (LON:PLUS) Shares This Year?

It is not uncommon to see companies perform well in the years after insiders buy shares. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Plus500 Ltd. (LON:PLUS).

What Is Insider Selling?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for Plus500

Plus500 Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Senior Strategy Advisor Alon Gonen bought UK£8.6m worth of shares at a price of UK£7.99 per share. We do like to see buying, but this purchase was made at well below the current price of UK£15.85. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

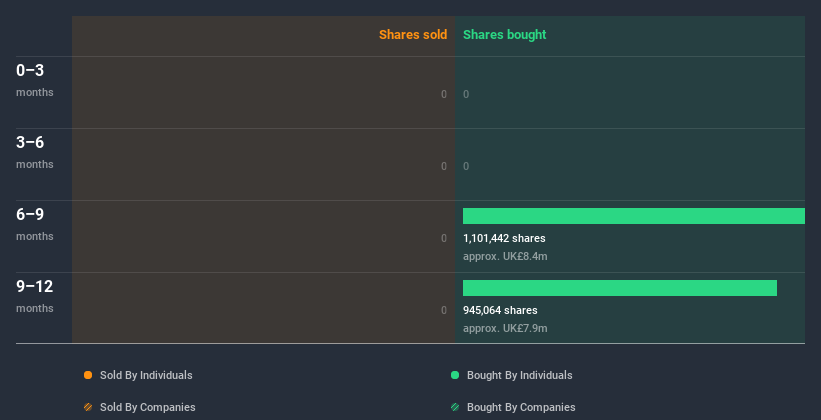

Alon Gonen bought 1.55m shares over the last 12 months at an average price of UK£8.27. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Plus500 is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Plus500 Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Plus500 insiders own 7.2% of the company, worth about UK£119m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Plus500 Insiders?

The fact that there have been no Plus500 insider transactions recently certainly doesn't bother us. On a brighter note, the transactions over the last year are encouraging. With high insider ownership and encouraging transactions, it seems like Plus500 insiders think the business has merit. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Be aware that Plus500 is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Plus500 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:PLUS

Plus500

A fintech company, operates technology-based trading platforms in Europe, the United Kingdom, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives