- United Kingdom

- /

- Capital Markets

- /

- LSE:PBEE

Top UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such a climate, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, though often seen as riskier investments due to their smaller size or newer market presence, can still offer intriguing possibilities when backed by solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.76M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £426.51M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.62 | £88.11M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.60 | £358.04M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.08 | £92.27M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

| QinetiQ Group (LSE:QQ.) | £3.872 | £2.16B | ★★★★★☆ |

Click here to see the full list of 441 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions globally and has a market cap of £90.91 million.

Operations: The company generated $23.99 million in revenue from its distributed denial of service (DDoS) protection solutions worldwide.

Market Cap: £90.91M

Corero Network Security has shown significant progress as a penny stock, becoming profitable this year with earnings forecasted to grow by 61.33% annually. Recent developments include a $1.2 million contract with Forte Telecom in Brazil and the launch of their innovative CORE platform, enhancing security infrastructure flexibility and cost-efficiency. Despite having no debt, Corero's return on equity remains low at 4.6%. The management team is relatively new with an average tenure of 1.4 years, while the board is experienced with an average tenure of 11.3 years, providing stability amidst high share price volatility recently observed in UK stocks.

- Take a closer look at Corero Network Security's potential here in our financial health report.

- Gain insights into Corero Network Security's outlook and expected performance with our report on the company's earnings estimates.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genel Energy plc operates as an independent oil and gas exploration and production company with a market cap of £182.11 million.

Operations: The company generates revenue primarily from its production segment, totaling $74.4 million.

Market Cap: £182.11M

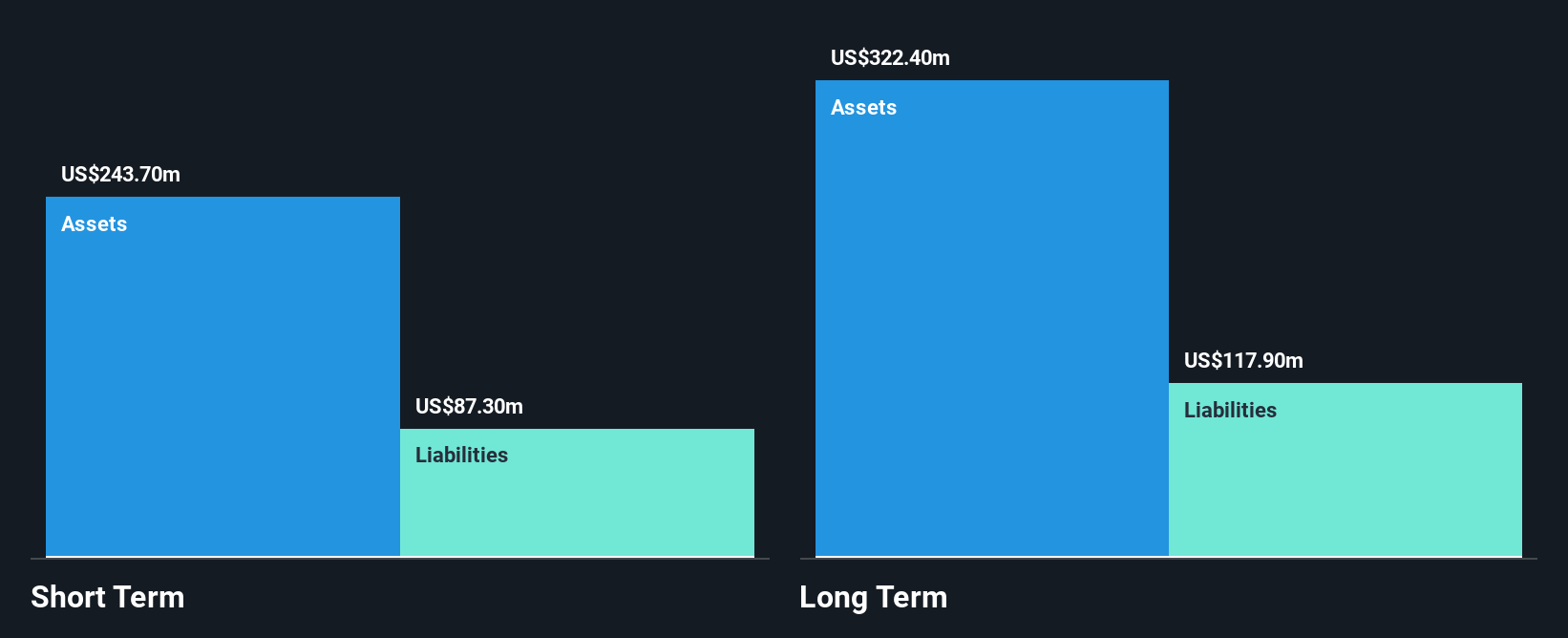

Genel Energy, with a market cap of £182.11 million, has demonstrated resilience despite its unprofitability. The company reported gross production of 84,210 bopd in Q3 2024, slightly increasing its year-to-date production to 80,120 bopd. While the share price remains volatile and the return on equity is negative at -8.1%, Genel's financial position is bolstered by short-term assets ($400.6M) exceeding both short-term and long-term liabilities ($76.1M and $298.4M respectively). Analysts anticipate a potential stock price rise by 41.7%, supported by forecasts of earnings growth at 49.33% annually.

- Click to explore a detailed breakdown of our findings in Genel Energy's financial health report.

- Understand Genel Energy's earnings outlook by examining our growth report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £408.49 million.

Operations: The company generates £28.32 million in revenue from its Internet Information Providers segment.

Market Cap: £408.49M

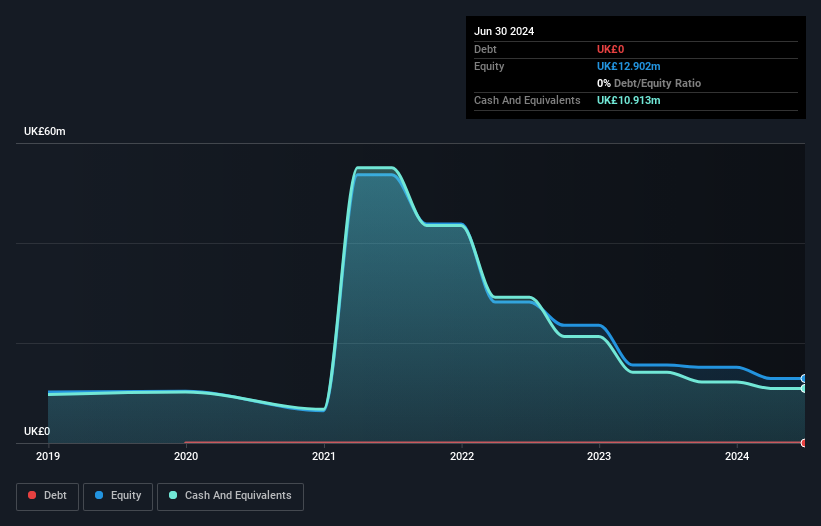

PensionBee Group, with a market cap of £408.49 million, is debt-free and has a strong cash position to support its operations for over three years. Despite being unprofitable, it has reduced losses by 8.8% annually over the past five years and forecasts suggest earnings growth of 53.49% per year. Recent strategic moves include launching a new app in the U.S., which enhances user experience by consolidating pensions into IRAs and offering investment insights through State Street Global Advisors' portfolios. To fund its U.S. expansion, PensionBee raised approximately £20 million through equity offerings in late 2024.

- Dive into the specifics of PensionBee Group here with our thorough balance sheet health report.

- Gain insights into PensionBee Group's future direction by reviewing our growth report.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 441 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PBEE

PensionBee Group

A direct-to-consumer financial technology company, provides online pension services in the United Kingdom and the United States.

Excellent balance sheet with reasonable growth potential.