- United Kingdom

- /

- Capital Markets

- /

- LSE:OCI

If You Like EPS Growth Then Check Out Oakley Capital Investments (LON:OCI) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Oakley Capital Investments (LON:OCI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Oakley Capital Investments

Oakley Capital Investments's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Oakley Capital Investments has grown EPS by 39% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

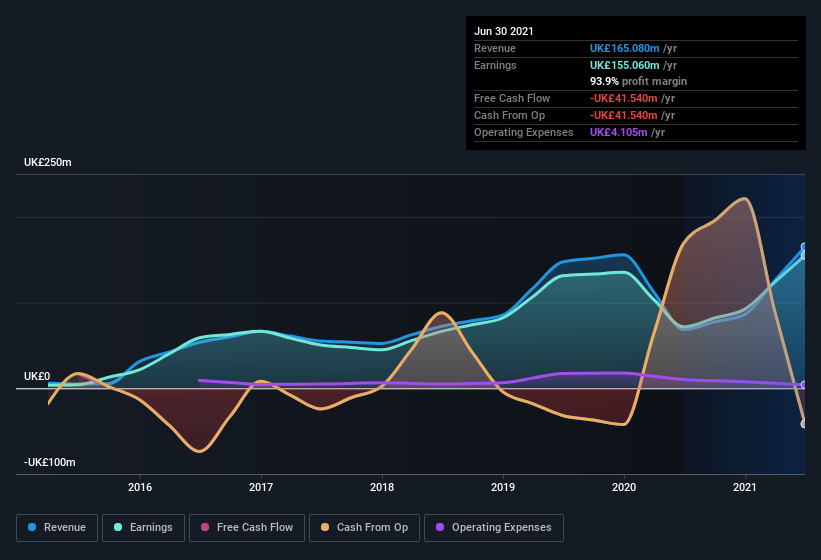

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Oakley Capital Investments's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Oakley Capital Investments shareholders can take confidence from the fact that EBIT margins are up from 85% to 98%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Oakley Capital Investments Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Oakley Capital Investments insiders spent a whopping UK£604k on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Senior Partner & Co-Founder David Till who made the biggest single purchase, worth UK£467k, paying UK£3.59 per share.

Along with the insider buying, another encouraging sign for Oakley Capital Investments is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth UK£77m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Oakley Capital Investments Worth Keeping An Eye On?

Oakley Capital Investments's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Oakley Capital Investments belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Oakley Capital Investments you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Oakley Capital Investments, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Oakley Capital Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCI

Oakley Capital Investments

Oakley Capital Investments Limited is private equity and venture capital firm specializing in investments in early, series B, growth, late stage, small and mid markets, corporate carve-outs, buyouts, restructuring, management buy-outs, management buy-ins, public to privates, re-financings, secondary purchases, growth capital, turnarounds, industry consolidation, business roll-outs and buy-and-build investments as well as investments in other funds.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives