- United Kingdom

- /

- Capital Markets

- /

- LSE:OCI

Here's Why Oakley Capital Investments (LON:OCI) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Oakley Capital Investments (LON:OCI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Oakley Capital Investments

How Quickly Is Oakley Capital Investments Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Oakley Capital Investments' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 43%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

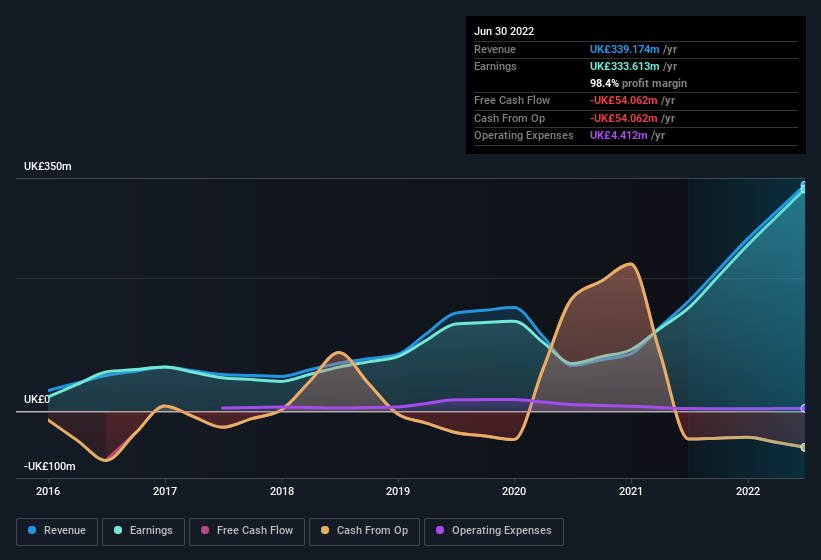

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Oakley Capital Investments' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Oakley Capital Investments remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 105% to UK£339m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Oakley Capital Investments' balance sheet strength, before getting too excited.

Are Oakley Capital Investments Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Oakley Capital Investments will be more than happy to see insiders committing themselves to the company, spending UK£522k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Senior Partner & Co-Founder David Till for UK£200k worth of shares, at about UK£4.01 per share.

The good news, alongside the insider buying, for Oakley Capital Investments bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping UK£76m worth of shares as a group, insiders have plenty riding on the company's success. At 11% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Does Oakley Capital Investments Deserve A Spot On Your Watchlist?

Oakley Capital Investments' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Oakley Capital Investments belongs near the top of your watchlist. We should say that we've discovered 1 warning sign for Oakley Capital Investments that you should be aware of before investing here.

The good news is that Oakley Capital Investments is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCI

Oakley Capital Investments

Oakley Capital Investments Limited is private equity and venture capital firm specializing in investments in early, series B, growth, late stage, small and mid markets, corporate carve-outs, buyouts, restructuring, management buy-outs, management buy-ins, public to privates, re-financings, secondary purchases, growth capital, turnarounds, industry consolidation, business roll-outs and buy-and-build investments as well as investments in other funds.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives