- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

VH Global Sustainable Energy Opportunities And 2 Promising Small Caps To Explore

Reviewed by Simply Wall St

As the United Kingdom's stock market navigates choppy waters, with the FTSE 100 and FTSE 250 indices recently experiencing declines due to weak trade data from China, investors are increasingly on the lookout for opportunities that can weather global economic uncertainties. In this context, identifying stocks with strong fundamentals and sustainable growth prospects becomes crucial, making VH Global Sustainable Energy Opportunities and two promising small-cap companies intriguing options to explore.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

VH Global Sustainable Energy Opportunities (LSE:GSEO)

Simply Wall St Value Rating: ★★★★★★

Overview: VH Global Sustainable Energy Opportunities plc is a closed-ended investment company dedicated to investing in sustainable energy infrastructure assets across EU, OECD, OECD key partner, or OECD Accession countries with a market cap of £276.27 million.

Operations: VH Global Sustainable Energy Opportunities generates revenue primarily through investments in global sustainable energy opportunities, amounting to £25.91 million. The company's market capitalization is £276.27 million.

VH Global Sustainable Energy Opportunities, a small player in the renewable energy sector, recently completed its third solar and storage hybrid system in New South Wales, boosting operational capacity to 69%. Despite reporting a net loss of £16.09 million for H1 2024 compared to a net income of £20.12 million last year, the company remains debt-free and trades at 25.2% below estimated fair value. Earnings have grown by 20%, surpassing industry growth of 12.2%. The firm repurchased over 23 million shares this year for £17.44 million, indicating confidence in long-term prospects despite current challenges.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

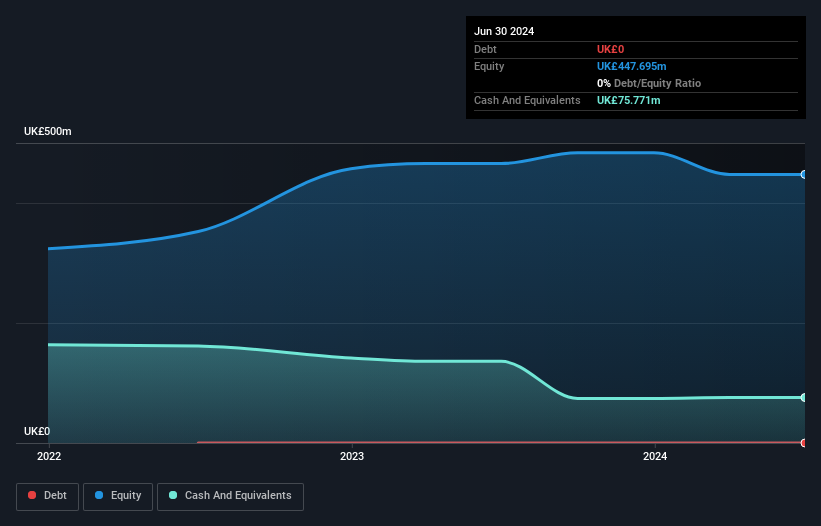

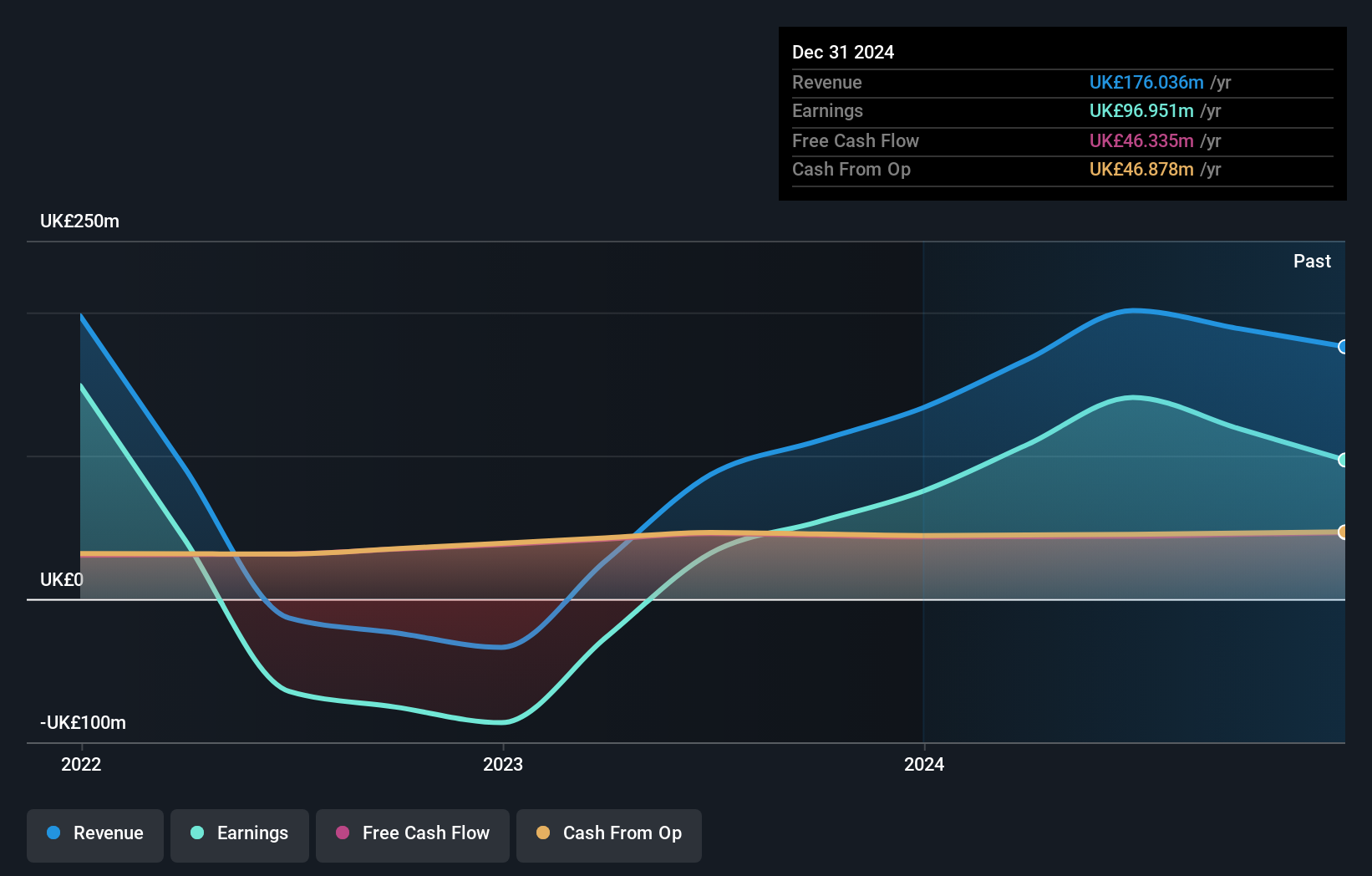

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally to a diverse range of clients, with a market cap of £1.17 billion.

Operations: Law Debenture generates revenue primarily from its investment portfolio (£35.62 million) and independent professional services (£61.55 million). The independent professional services segment contributes a larger share to the total revenue stream.

Law Debenture, a niche player in the UK financial landscape, showcases impressive earnings growth of 340% over the past year, outpacing the Capital Markets industry average of 12%. The company's net debt to equity ratio stands at a satisfactory 15%, indicating prudent financial management. With interest payments well covered by EBIT at 21.9 times, it reflects strong operational efficiency. Additionally, its price-to-earnings ratio of 8.3x offers an attractive valuation compared to the broader UK market's 16.2x. Recent dividend affirmations highlight shareholder value focus with a notable increase in interim dividends by nearly 5% this year.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

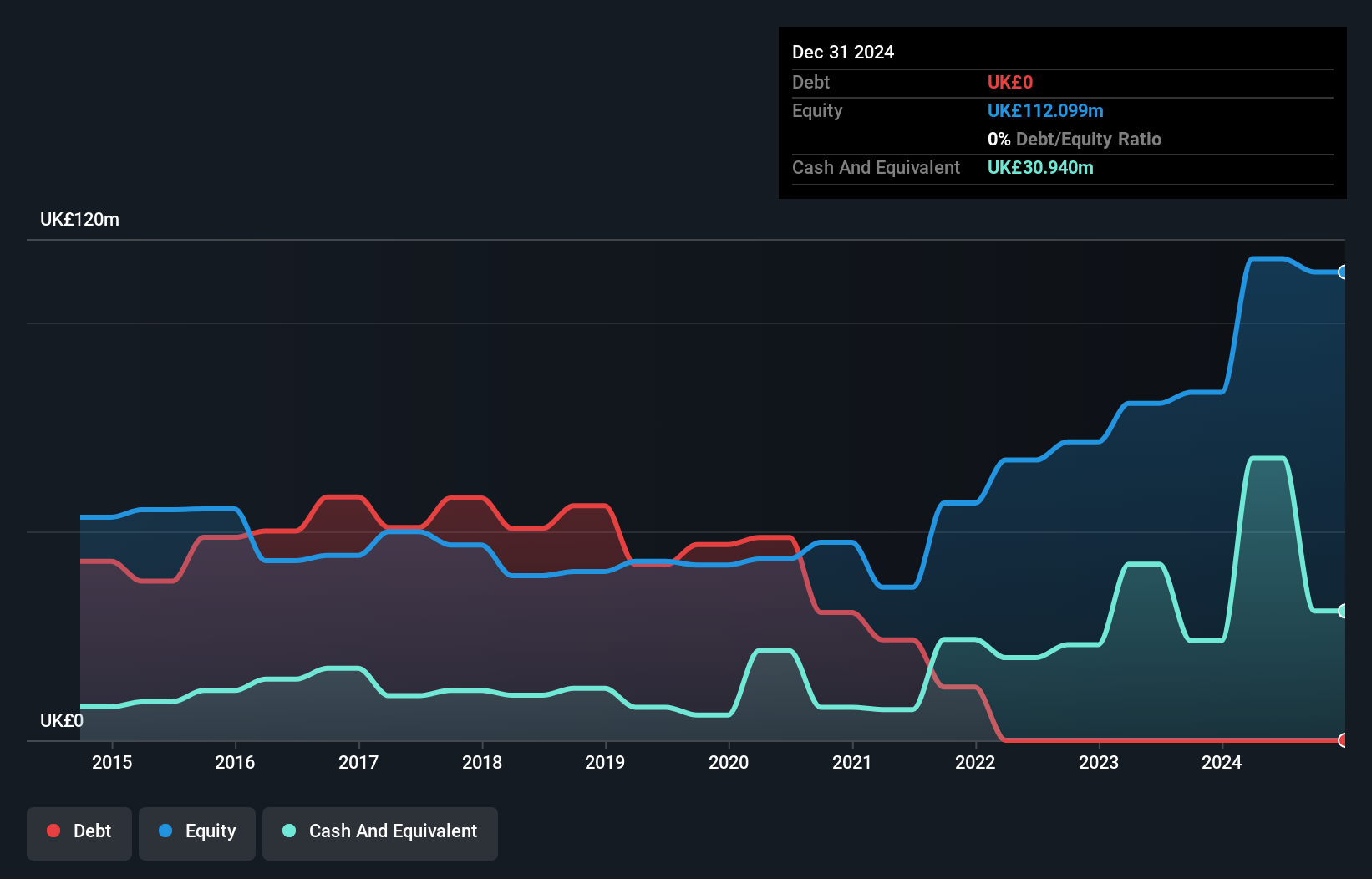

Overview: Wilmington plc, along with its subsidiaries, offers data, information, training, and education solutions to professional markets globally and has a market capitalization of £350.92 million.

Operations: Wilmington plc generates revenue primarily from its Finance segment (£68.85 million), followed by Legal (£15.99 million) and Health, Safety and Environment (HSE) (£4.84 million).

Wilmington, a nimble player in the UK market, has shown resilience with earnings growth of 0.1% over the past year, outpacing the Professional Services industry's -6%. The company is debt-free, a significant shift from five years ago when its debt to equity ratio stood at 98%, indicating stronger financial health. Despite recent insider selling and an earnings forecast of 7.34% annual growth, Wilmington's shares trade at 42.1% below estimated fair value. Recent events include a dividend increase to 11.3 pence per share and a follow-on equity offering of £0.03 million, reflecting ongoing strategic adjustments in capital structure.

- Get an in-depth perspective on Wilmington's performance by reading our health report here.

Understand Wilmington's track record by examining our Past report.

Key Takeaways

- Reveal the 73 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.