- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

Uncovering B.P. Marsh & Partners And 2 Other Hidden Small Cap Gems In The UK

Reviewed by Simply Wall St

As the United Kingdom's markets navigate a challenging landscape marked by faltering trade data from China and fluctuating commodity prices, small-cap stocks offer an intriguing opportunity for investors seeking growth potential beyond the blue-chip indices. In this environment, identifying promising small-cap companies like B.P. Marsh & Partners can be key to uncovering hidden gems that may thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC is a company that focuses on investing in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market capitalization of £261.23 million.

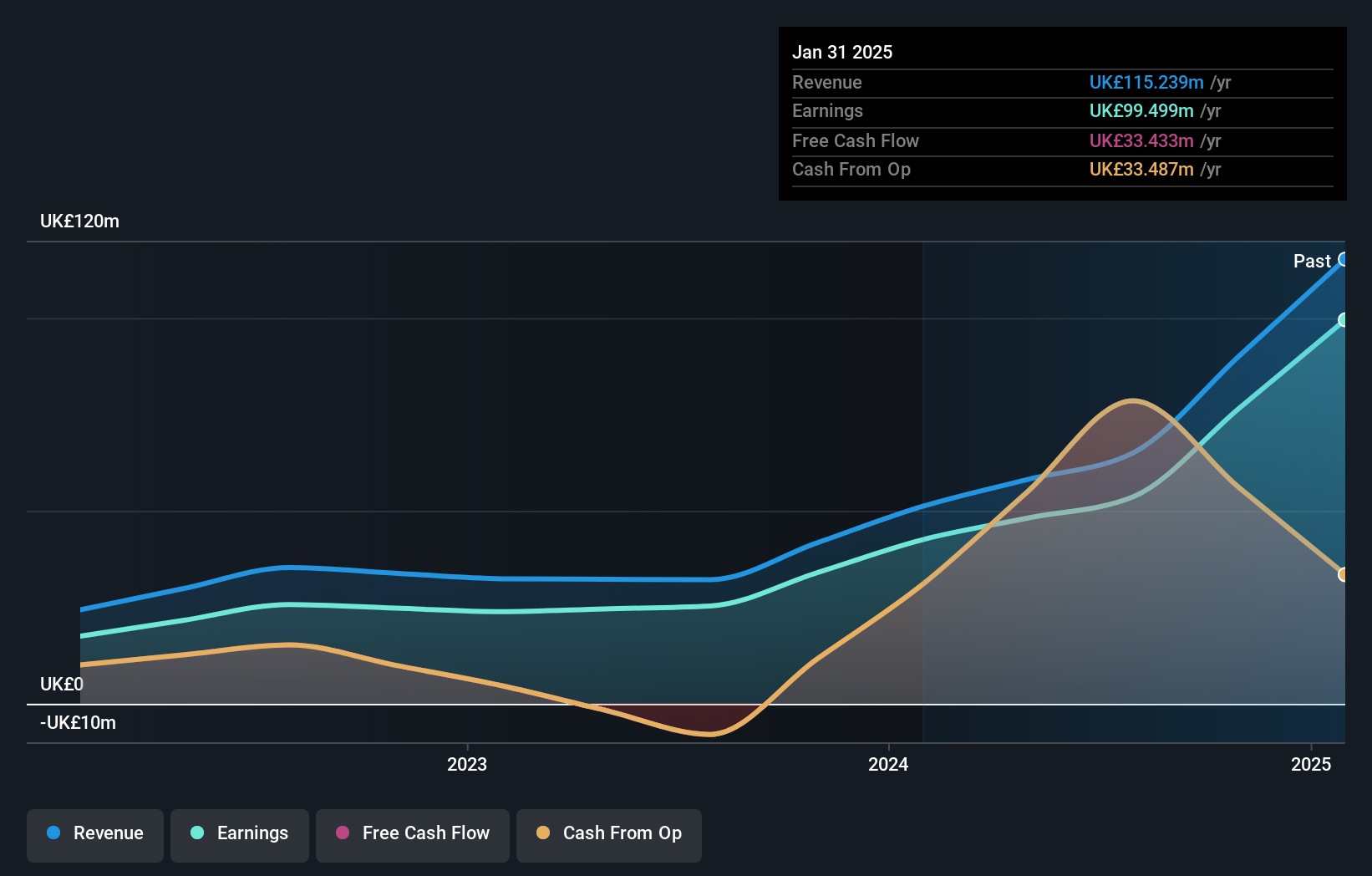

Operations: Revenue primarily stems from consultancy services and trading investments in financial services, totaling £64.99 million.

B.P. Marsh & Partners, with its nimble size, stands out by trading at 12.2% below its estimated fair value and boasting a debt-free balance sheet for over five years. The firm's earnings surged by 111.9% last year, outpacing the Capital Markets industry growth of 17.4%, highlighting robust performance despite recent insider selling activity over the past three months. With high-quality earnings and positive free cash flow, B.P. Marsh is committed to paying an annual dividend of at least £5 million through 2028, reflecting confidence in sustained profitability and shareholder returns in the coming years.

- Click here and access our complete health analysis report to understand the dynamics of B.P. Marsh & Partners.

Understand B.P. Marsh & Partners' track record by examining our Past report.

VH Global Energy Infrastructure (LSE:ENRG)

Simply Wall St Value Rating: ★★★★★★

Overview: VH Global Energy Infrastructure PLC is a closed-ended investment company that invests in sustainable energy infrastructure assets across EU, OECD, OECD key partner, or OECD Accession countries and has a market cap of £233.52 million.

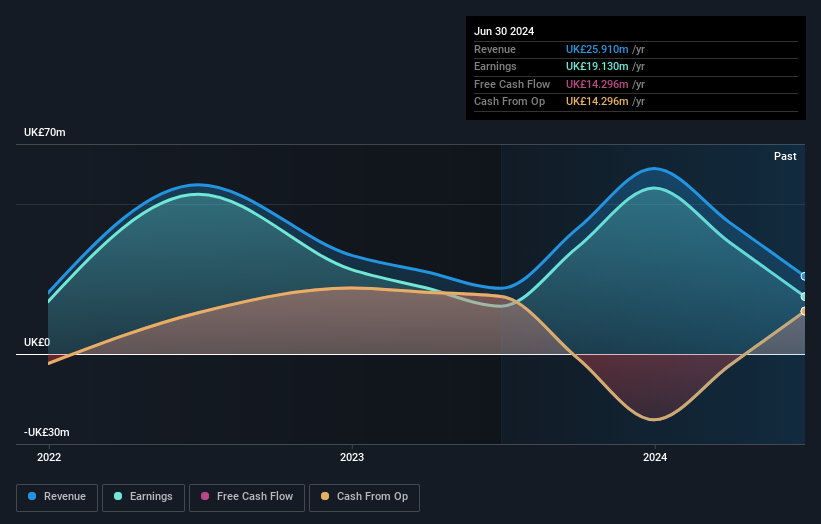

Operations: VH Global Energy Infrastructure generates revenue primarily from its investments in global sustainable energy opportunities, amounting to £25.91 million. The company's market capitalization stands at £233.52 million.

VH Global Energy Infrastructure, a nimble player in the UK market, has shown robust earnings growth of 20% over the past year, surpassing the Capital Markets industry's 17.4%. Trading at a notable 30.2% below its estimated fair value, it presents an intriguing opportunity for investors. With no debt on its books for five years and positive free cash flow figures such as £14.30 million in recent quarters, financial stability seems assured. The company recently announced an interim dividend increase to 1.45 pence per share for Q4 2024 and appointed Patrick Firth as an independent non-executive director to bolster governance strength.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally to various entities and individuals, with a market capitalization of £1.20 billion.

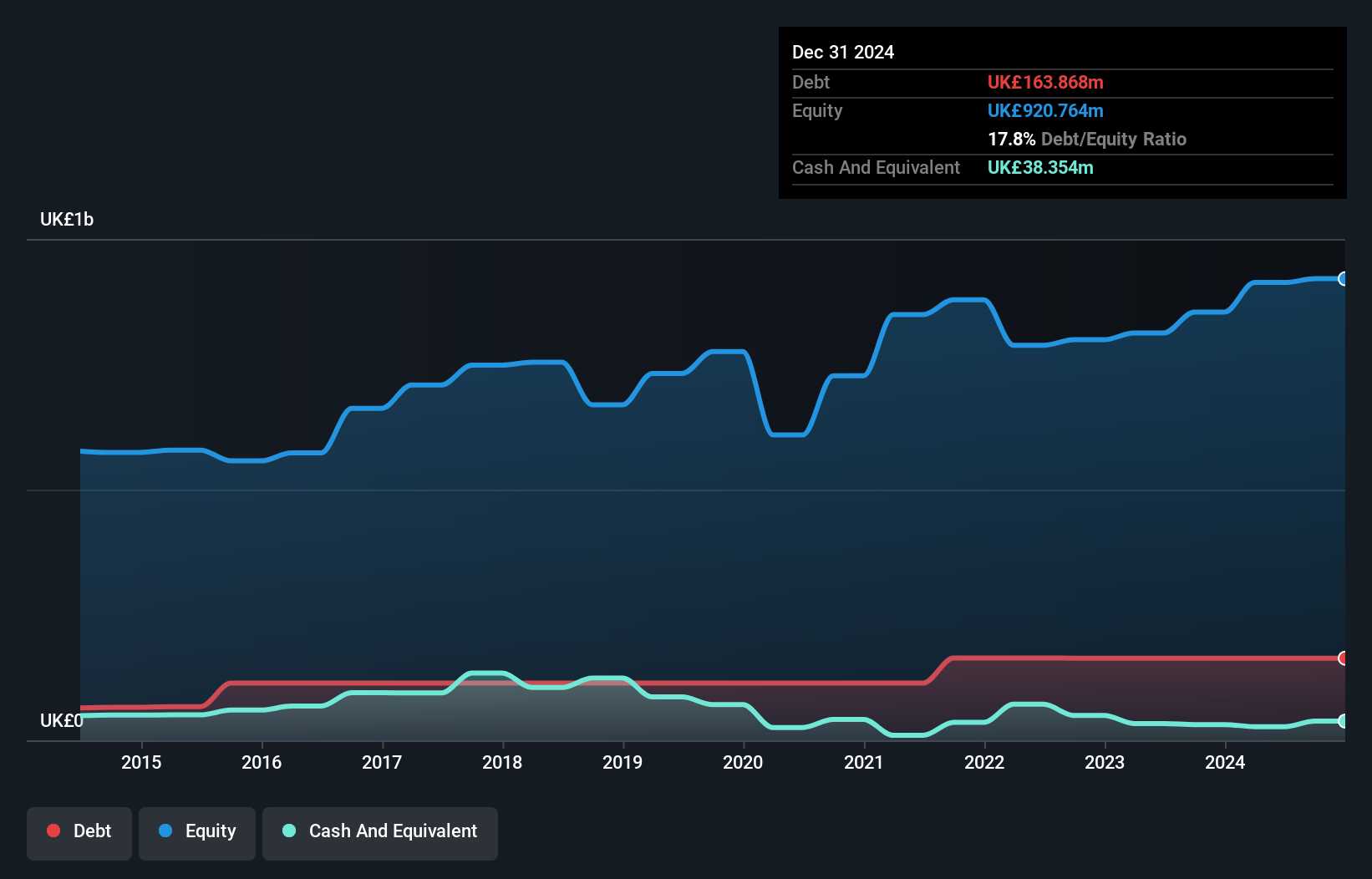

Operations: Law Debenture generates revenue from its investment portfolio (£35.91 million) and independent professional services (£61.66 million). The company has a market capitalization of £1.20 billion.

Law Debenture, a UK-based investment trust, showcases a compelling performance with its earnings growth of 29% outpacing the Capital Markets industry average of 17.4%. The company maintains a satisfactory net debt to equity ratio at 13.6%, indicating prudent financial management. With an EBIT covering interest payments 18.2 times over, their ability to manage debt is robust. Recent results highlight revenue climbing to £176 million from £133 million and net income reaching £96.95 million from £75.15 million year-on-year, reflecting strong operational efficiency and profitability, while the proposed dividend increase underscores confidence in sustained cash flow generation capabilities.

- Delve into the full analysis health report here for a deeper understanding of Law Debenture.

Gain insights into Law Debenture's historical performance by reviewing our past performance report.

Summing It All Up

- Gain an insight into the universe of 64 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.