- United Kingdom

- /

- Capital Markets

- /

- LSE:ENRG

Exploring Undiscovered Gems In The United Kingdom Market

Reviewed by Simply Wall St

The United Kingdom market has recently experienced fluctuations, with the FTSE 100 and FTSE 250 indices dipping due to weak trade data from China, highlighting global economic interdependencies. As investors navigate these uncertain waters, identifying stocks that demonstrate resilience and potential for growth despite broader market challenges becomes increasingly important.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Law Debenture | 17.95% | 8.43% | 4.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC is a company that invests in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £265.86 million.

Operations: B.P. Marsh & Partners generates revenue primarily through the provision of consultancy services and trading investments in financial services, amounting to £64.99 million.

B.P. Marsh & Partners, a financial services firm, showcases robust performance with earnings surging by 111.9% over the past year, outpacing industry growth of 4.4%. The company is debt-free and trades at a value 16.6% below its estimated fair value, indicating potential undervaluation in the market. Recent half-year results highlight revenue of £32.51 million and net income of £26.62 million, both significantly up from last year’s figures of £18.68 million and £15.55 million respectively. Additionally, the company repurchased 79,637 shares for £0.38 million this year under its buyback program announced in November 2023.

VH Global Energy Infrastructure (LSE:ENRG)

Simply Wall St Value Rating: ★★★★★★

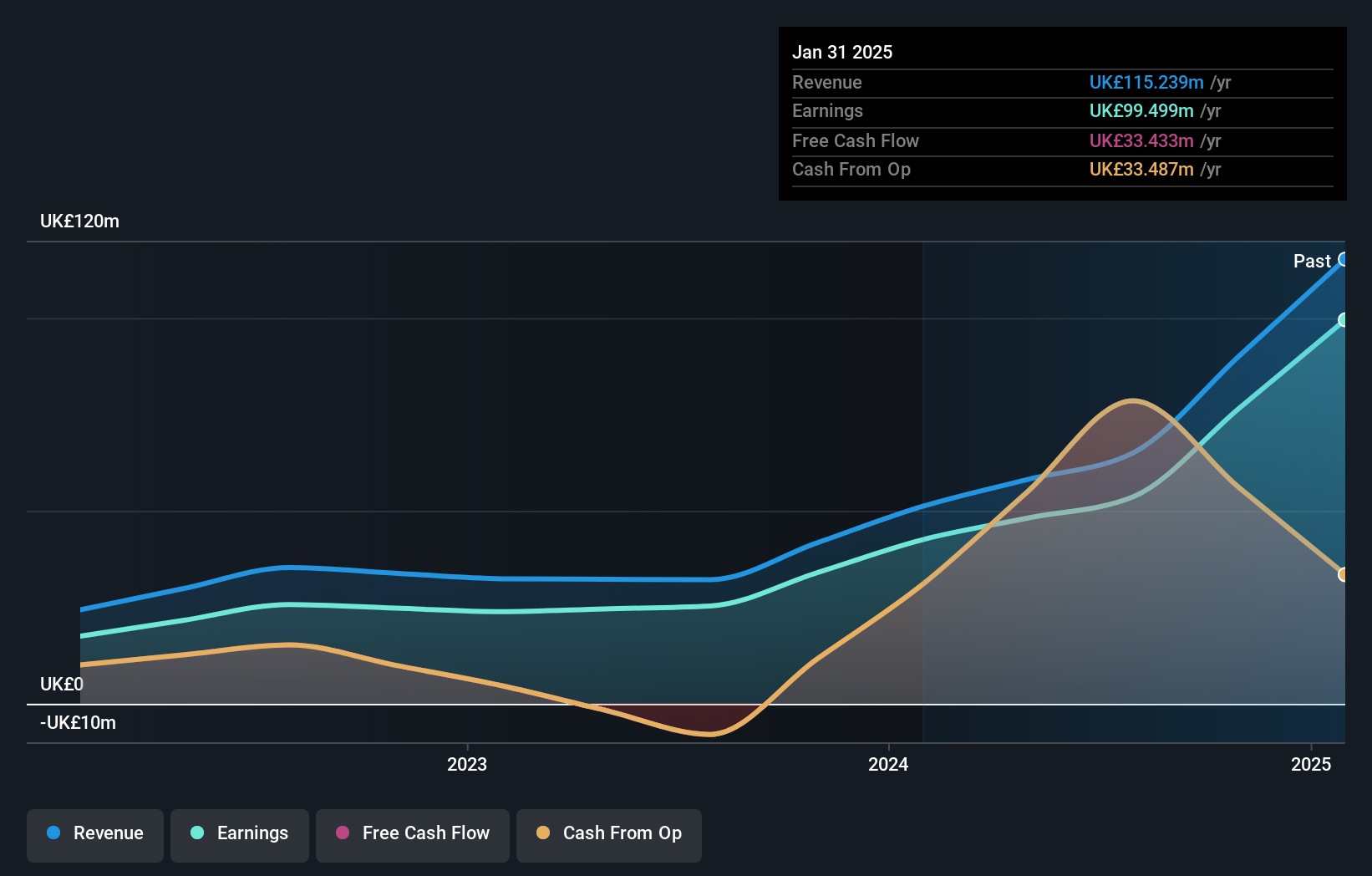

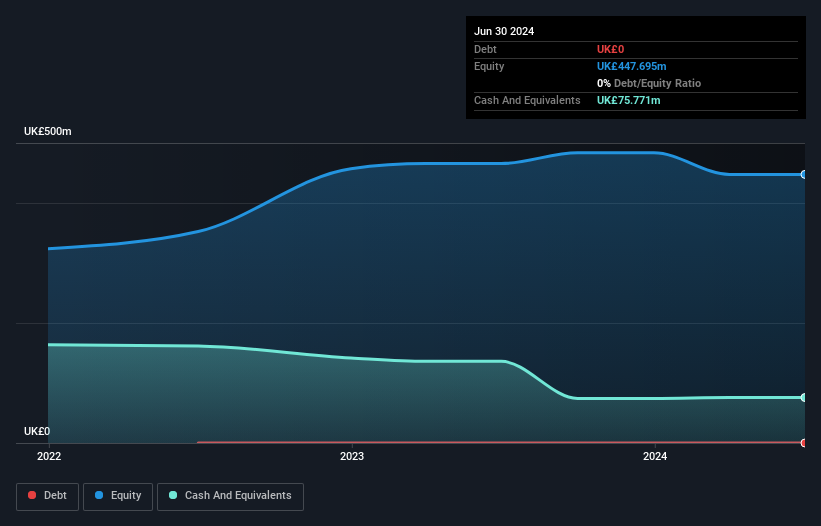

Overview: VH Global Sustainable Energy Opportunities plc is a closed-ended investment company that invests in sustainable energy infrastructure assets across various regions, with a market cap of £253.31 million.

Operations: VH Global Sustainable Energy Opportunities generates revenue primarily from investments in global sustainable energy opportunities, totaling £25.91 million. The company's financial performance is reflected through its market cap of £253.31 million.

VH Global Energy Infrastructure, a small cap player in the renewable energy sector, has been making strides with its recent name and ticker change to ENRG. The company reported earnings growth of 20% over the past year, outpacing the Capital Markets industry average of 4.4%. Notably debt-free for five years, ENRG’s financial health is robust with high-quality past earnings. Recent developments include the commissioning of a third solar and storage hybrid system in New South Wales, enhancing operational capacity to 69%. Trading at 30.8% below estimated fair value suggests potential upside for investors seeking undervalued opportunities.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

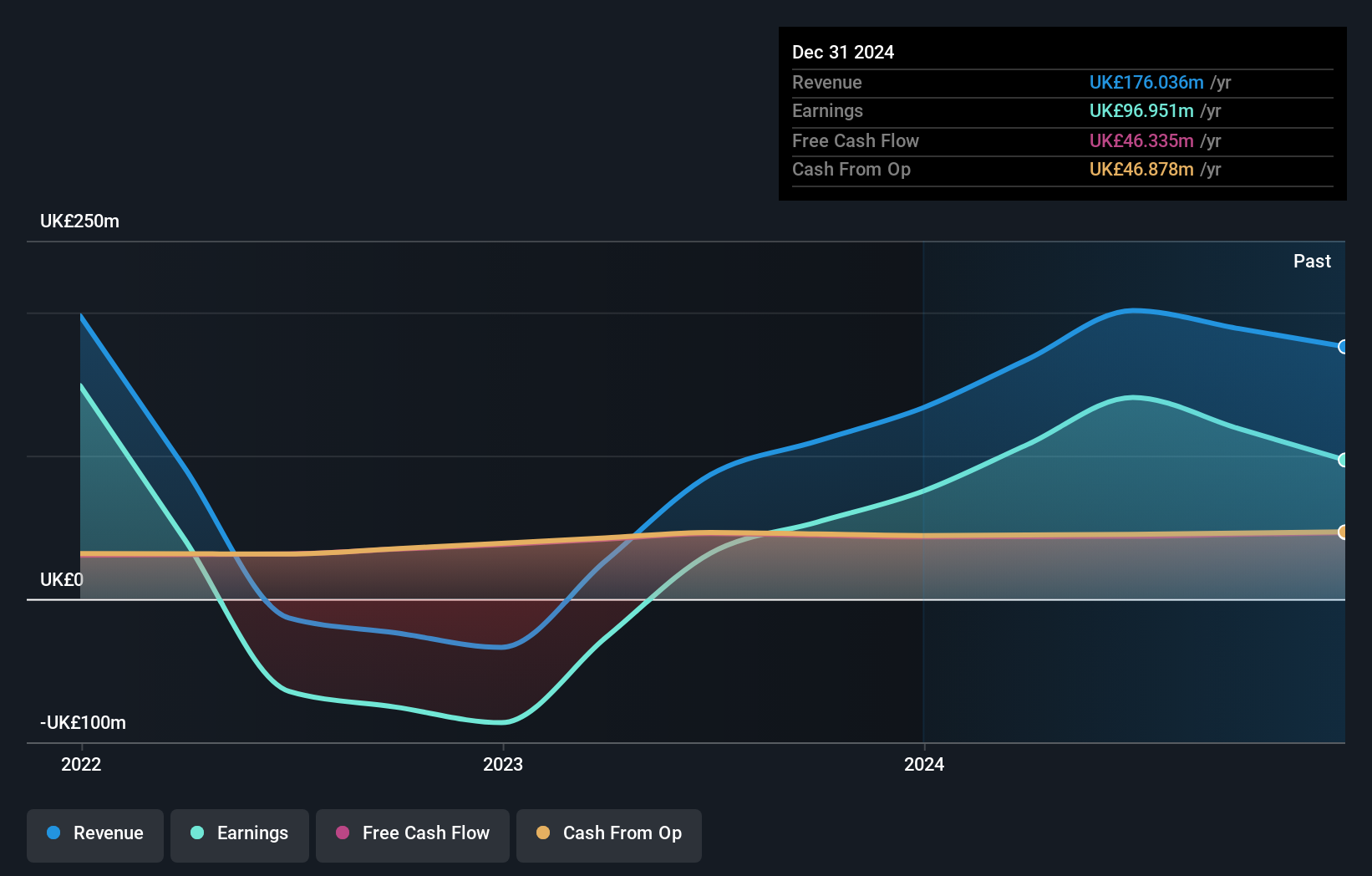

Overview: The Law Debenture Corporation p.l.c. is an investment trust offering independent professional services globally, with a market capitalization of £1.16 billion.

Operations: Law Debenture generates revenue primarily from its investment portfolio (£35.62 million) and independent professional services (£61.55 million). The focus on these two segments reflects its dual business model, with the latter contributing a larger share to overall revenues.

With a robust earnings growth of 340.1% over the past year, Law Debenture stands out in the capital markets sector, surpassing industry growth of 4.4%. The company's price-to-earnings ratio of 8.3x is attractive compared to the UK market average of 16x, suggesting it might be undervalued. Its net debt to equity ratio at 15% is satisfactory, indicating prudent financial management despite an increase from 15.6% five years ago to 17.9%. Additionally, Law Debenture declared a third interim dividend increase by nearly 5%, reflecting confidence in its financial health and future prospects for shareholders.

- Navigate through the intricacies of Law Debenture with our comprehensive health report here.

Explore historical data to track Law Debenture's performance over time in our Past section.

Key Takeaways

- Reveal the 66 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENRG

VH Global Energy Infrastructure

A closed-ended investment company, focuses on investing in sustainable energy infrastructure assets in EU, OECD, OECD key partner, or OECD Accession countries.

Flawless balance sheet and fair value.