- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

Discovering January 2025's Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices face headwinds from weak trade data in China and declining commodity prices, investors are increasingly cautious about the broader market outlook. In this climate of uncertainty, identifying small-cap stocks with strong fundamentals and growth potential becomes crucial for those looking to uncover hidden opportunities in January 2025.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Somero Enterprises | NA | 8.19% | 7.39% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC invests in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £250.11 million.

Operations: The primary revenue stream for B.P. Marsh & Partners comes from the provision of consultancy services and trading investments in financial services, generating £64.99 million.

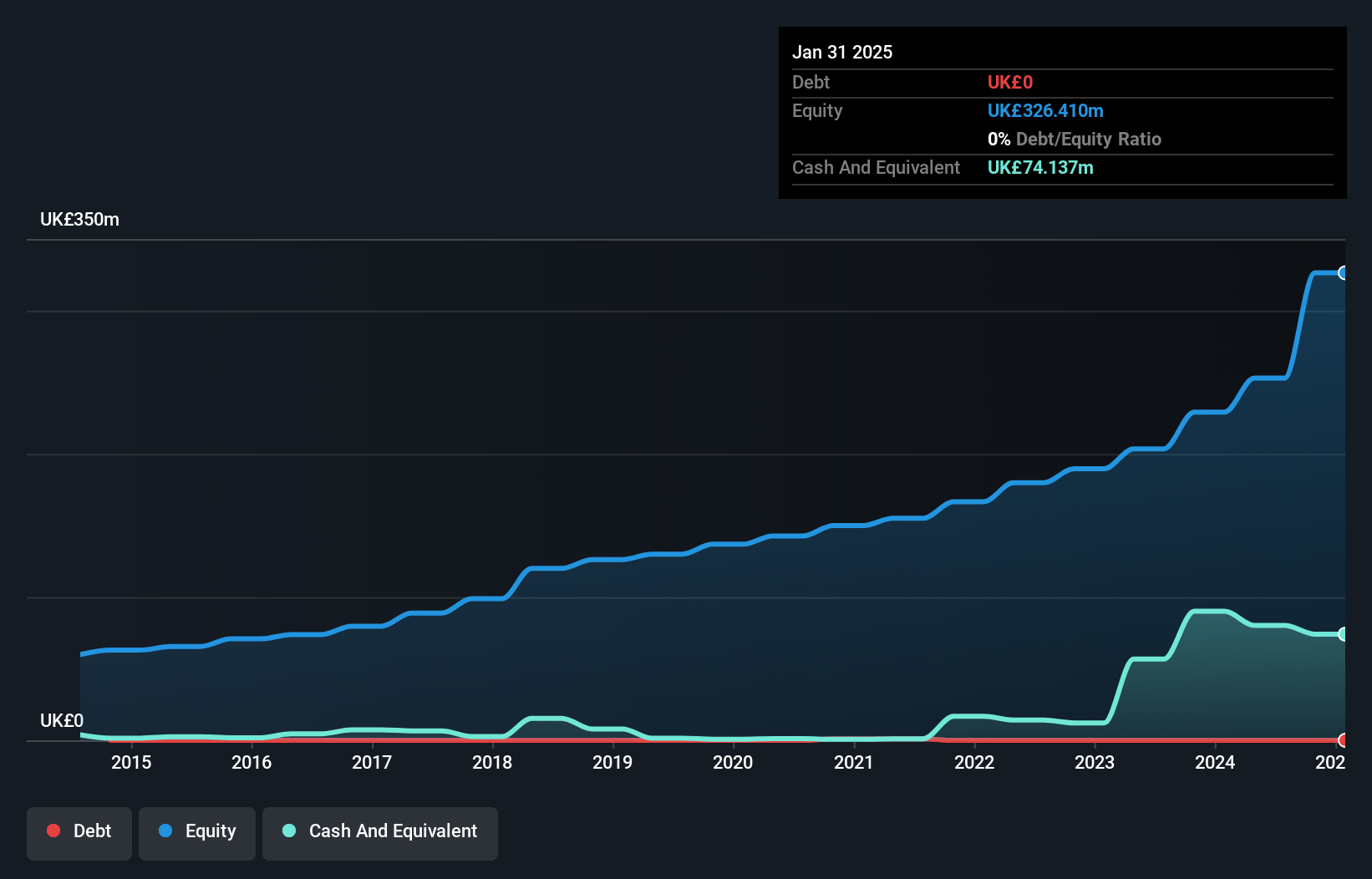

B.P. Marsh & Partners, a financial entity in the UK, seems to be carving out a strong position with its impressive earnings growth of 111.9% over the past year, significantly outpacing the Capital Markets industry average of 12.5%. The company remains debt-free, which likely contributes to its high-quality earnings and robust financial health. Recent results highlight revenue climbing to £32.51 million from £18.68 million and net income reaching £26.62 million from £15.55 million compared to last year’s figures for the same period, showcasing solid performance amidst ongoing share repurchases totaling 79,637 shares for £0.38 million recently completed.

- Navigate through the intricacies of B.P. Marsh & Partners with our comprehensive health report here.

VH Global Energy Infrastructure (LSE:ENRG)

Simply Wall St Value Rating: ★★★★★★

Overview: VH Global Energy Infrastructure PLC is a closed-ended investment company that concentrates on sustainable energy infrastructure assets in EU, OECD, and related countries, with a market cap of £241.44 million.

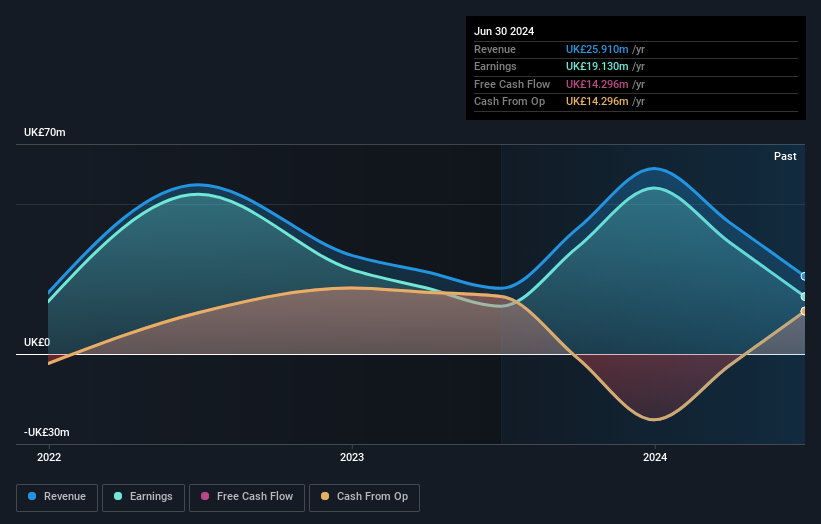

Operations: VH Global Energy Infrastructure generates revenue primarily through its investments in global sustainable energy opportunities, amounting to £25.91 million. The company's market cap is £241.44 million.

VH Global Energy Infrastructure, a notable player in the renewable energy sector, has seen its earnings grow by 20% over the past year, surpassing the industry's 12.5%. Trading at 34.3% below estimated fair value suggests potential upside for investors. The company remains debt-free and boasts high-quality earnings, which is reassuring for stakeholders concerned about financial stability. Recent developments include the completion of a third solar and storage hybrid system in New South Wales, enhancing their operational portfolio to 69%. Additionally, they announced an interim dividend of £0.0142 per share with part designated as interest distribution.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally, with a market cap of £1.19 billion.

Operations: Law Debenture generates revenue from two primary segments: an investment portfolio contributing £35.62 million and independent professional services adding £61.55 million.

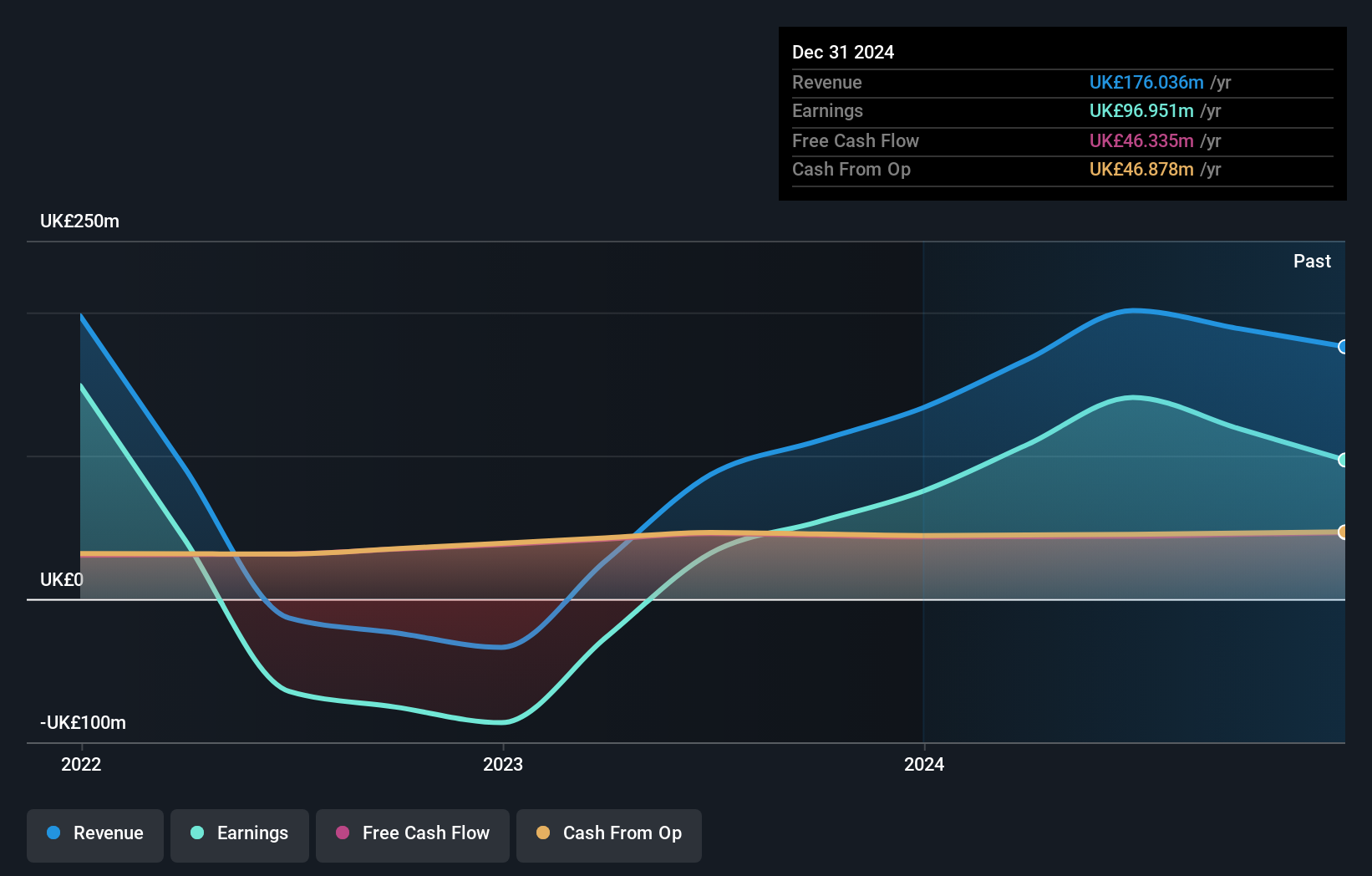

With a net debt to equity ratio of 15%, Law Debenture stands on solid financial ground. Its earnings have surged by 340% over the past year, surpassing industry growth of 12%. This performance is complemented by high-quality earnings and an attractive price-to-earnings ratio of 8.5x, well below the UK market average of 16x. Interest payments are comfortably covered at 21.9 times by EBIT, indicating robust operational efficiency. Recent news highlights a third interim dividend increase to £0.08 per share, payable in January 2025, reflecting confidence in its financial stability and shareholder value enhancement strategy.

- Dive into the specifics of Law Debenture here with our thorough health report.

Gain insights into Law Debenture's historical performance by reviewing our past performance report.

Key Takeaways

- Discover the full array of 63 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage financial services intermediary businesses in the United Kingdom and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives