For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like 3i Group (LON:III). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide 3i Group with the means to add long-term value to shareholders.

View our latest analysis for 3i Group

How Fast Is 3i Group Growing Its Earnings Per Share?

3i Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, 3i Group's EPS soared from UK£3.71 to UK£4.65, over the last year. That's a impressive gain of 25%.

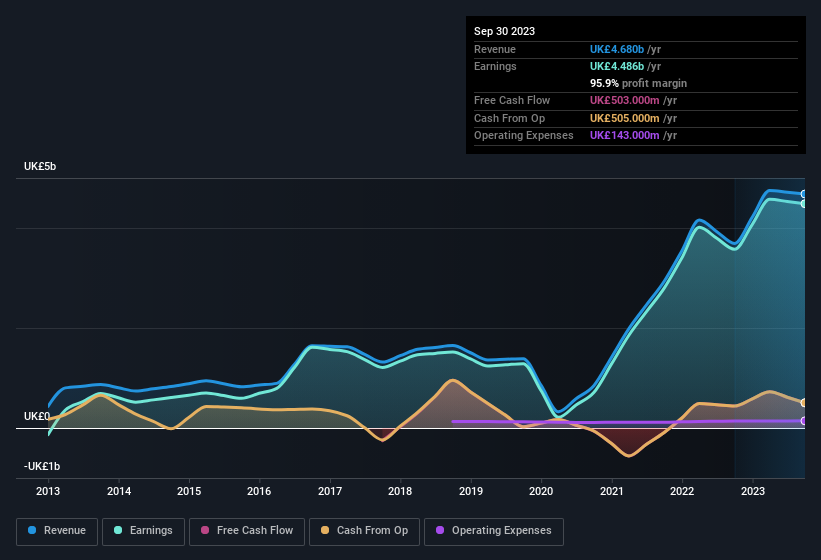

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that 3i Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. 3i Group maintained stable EBIT margins over the last year, all while growing revenue 27% to UK£4.7b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for 3i Group's future profits.

Are 3i Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold UK£74k worth of shares. But that's far less than the UK£721k insiders spent purchasing stock. This adds to the interest in 3i Group because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Independent Chairman of the Board David A. Hutchison who made the biggest single purchase, worth UK£230k, paying UK£16.34 per share.

Along with the insider buying, another encouraging sign for 3i Group is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at UK£405m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does 3i Group Deserve A Spot On Your Watchlist?

You can't deny that 3i Group has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with 3i Group (at least 2 which make us uncomfortable) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of 3i Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 3i Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:III

3i Group

A private equity firm specializing in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026