The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like 3i Group (LON:III). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide 3i Group with the means to add long-term value to shareholders.

Check out our latest analysis for 3i Group

How Fast Is 3i Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that 3i Group has grown EPS by 48% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

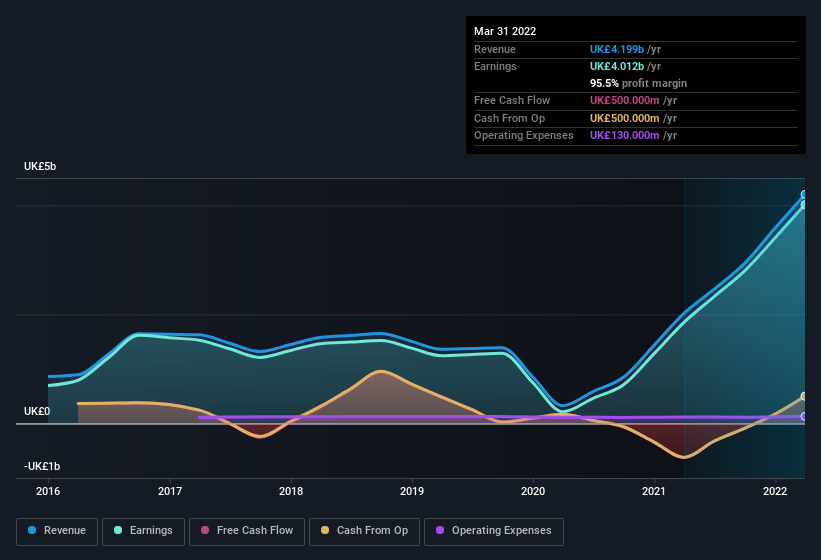

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of 3i Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The music to the ears of 3i Group shareholders is that EBIT margins have grown from 94% to 97% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for 3i Group.

Are 3i Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in 3i Group will be more than happy to see insiders committing themselves to the company, spending UK£286k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was company insider Stephen Daintith who made the biggest single purchase, worth UK£98k, paying UK£11.12 per share.

The good news, alongside the insider buying, for 3i Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at UK£205m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does 3i Group Deserve A Spot On Your Watchlist?

3i Group's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe 3i Group deserves timely attention. Before you take the next step you should know about the 3 warning signs for 3i Group (2 don't sit too well with us!) that we have uncovered.

The good news is that 3i Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 3i Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:III

3i Group

A private equity firm specializing in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins.

Undervalued with excellent balance sheet and pays a dividend.