- United Kingdom

- /

- Capital Markets

- /

- LSE:III

3i Group plc (LON:III) Looks Inexpensive But Perhaps Not Attractive Enough

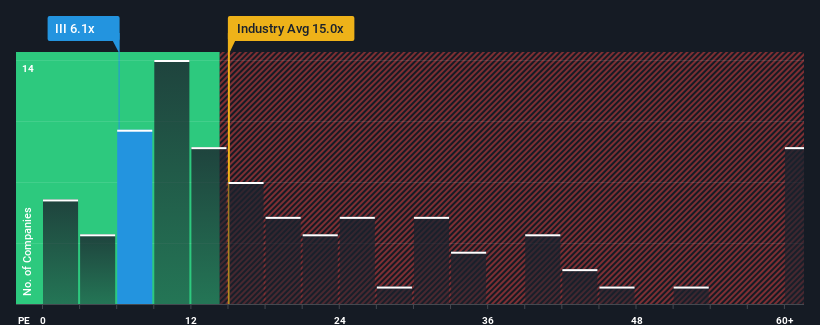

3i Group plc's (LON:III) price-to-earnings (or "P/E") ratio of 6.1x might make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 16x and even P/E's above 28x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, 3i Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for 3i Group

How Is 3i Group's Growth Trending?

3i Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. Pleasingly, EPS has also lifted 534% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 0.09% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% per annum, which is noticeably more attractive.

In light of this, it's understandable that 3i Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From 3i Group's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of 3i Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware 3i Group is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on 3i Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if 3i Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:III

3i Group

A private equity firm specializing in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives