- United Kingdom

- /

- Hospitality

- /

- LSE:BOWL

December 2024's Top Picks: Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced fluctuations, with the FTSE 100 and FTSE 250 indices facing downward pressure due to weaker trade data from China, highlighting global economic uncertainties. Amidst these challenges, investors often seek opportunities in lesser-known areas of the market, such as penny stocks. Although considered a somewhat outdated term, penny stocks represent smaller or newer companies that may offer growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £774.25M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.52M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.445 | £312.41M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★☆

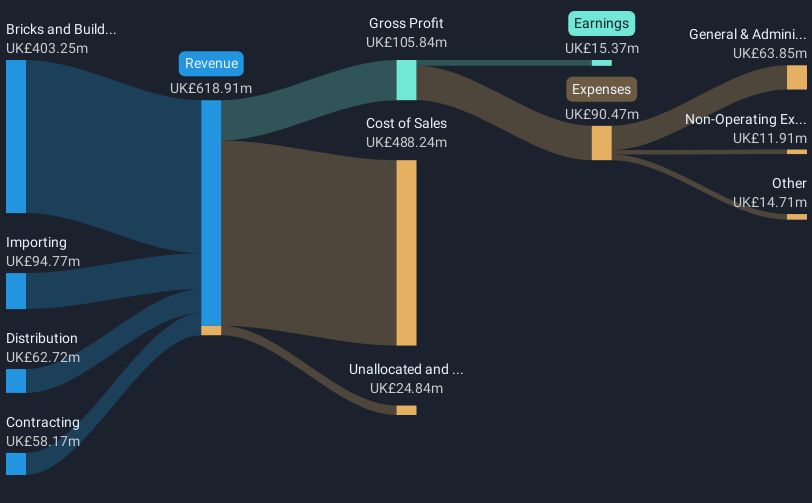

Overview: Brickability Group Plc, along with its subsidiaries, operates in the United Kingdom as a supplier, distributor, and importer of building products with a market cap of £203.99 million.

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment (£380.56 million), followed by Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

Market Cap: £203.99M

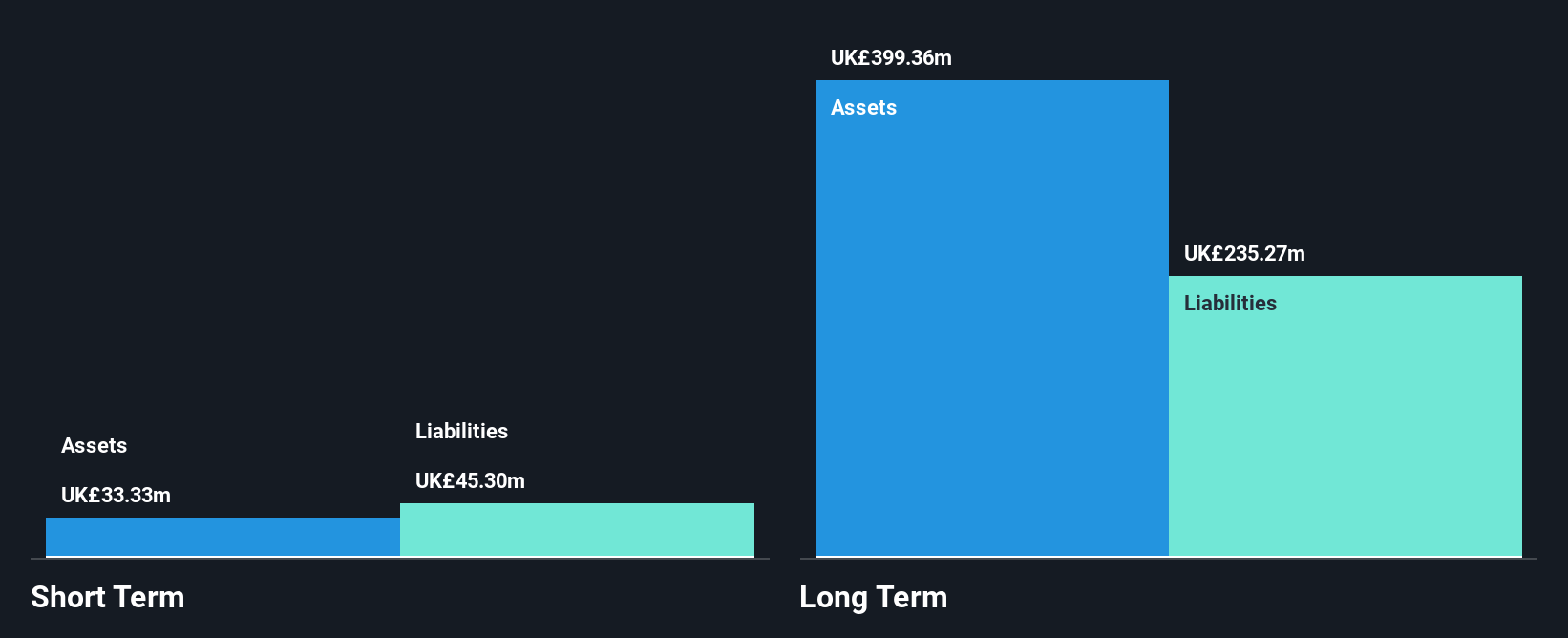

Brickability Group Plc, with a market cap of £203.99 million, has shown mixed financial performance and strategic activity relevant for penny stock investors. The company reported half-year sales of £330.93 million but experienced a significant drop in net income to £4.26 million from the previous year, indicating pressure on profitability with profit margins declining from 4.3% to 1.4%. Despite this, its short-term assets exceed both short- and long-term liabilities, suggesting solid liquidity management. The firm is actively pursuing acquisitions while focusing on de-gearing its balance sheet amidst rising interest rates and recent board changes signal potential shifts in governance strategy.

- Take a closer look at Brickability Group's potential here in our financial health report.

- Evaluate Brickability Group's prospects by accessing our earnings growth report.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom with a market cap of £507.65 million.

Operations: The company generates revenue of £230.40 million from its recreational activities segment.

Market Cap: £507.65M

Hollywood Bowl Group plc, with a market cap of £507.65 million, presents a mixed picture for penny stock investors. The company reported annual sales of £230.4 million, but net income decreased to £29.91 million from the previous year, reflecting challenges in maintaining profit margins which fell from 15.9% to 13%. Despite being debt-free and trading at a favorable price-to-earnings ratio compared to industry peers, its short-term assets (£42.3M) do not cover liabilities (£44.7M), indicating potential liquidity concerns. Recent board changes introduce seasoned leadership that may influence future strategic direction amidst stable weekly volatility and high-quality earnings performance.

- Unlock comprehensive insights into our analysis of Hollywood Bowl Group stock in this financial health report.

- Assess Hollywood Bowl Group's future earnings estimates with our detailed growth reports.

Intuitive Investments Group (LSE:IIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intuitive Investments Group Plc focuses on investing in early and later-stage life sciences businesses primarily in the UK, continental Europe, and the US, with a market cap of £253.47 million.

Operations: Intuitive Investments Group Plc does not have any classified revenue segments to report.

Market Cap: £253.47M

Intuitive Investments Group Plc, with a market cap of £253.47 million, remains pre-revenue and unprofitable, focusing on life sciences investments. Recent capital raising through a £6.15 million follow-on equity offering extends its cash runway beyond the initial nine months based on free cash flow estimates. Despite no long-term liabilities and short-term assets (£5.1M) covering liabilities (£82K), shareholder dilution occurred over the past year with shares outstanding increasing by 3.4%. The board's recent addition of Richard Kilsby as an independent non-executive director brings seasoned leadership experience across various sectors, potentially enhancing strategic oversight amidst ongoing volatility management challenges.

- Navigate through the intricacies of Intuitive Investments Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Intuitive Investments Group's track record.

Seize The Opportunity

- Reveal the 471 hidden gems among our UK Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hollywood Bowl Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOWL

Hollywood Bowl Group

Operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives