- United Kingdom

- /

- Capital Markets

- /

- LSE:HL.

Here's Why Shareholders May Want To Be Cautious With Increasing Hargreaves Lansdown plc's (LON:HL.) CEO Pay Packet

The underwhelming share price performance of Hargreaves Lansdown plc (LON:HL.) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 15 October 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Hargreaves Lansdown

How Does Total Compensation For Chris Hill Compare With Other Companies In The Industry?

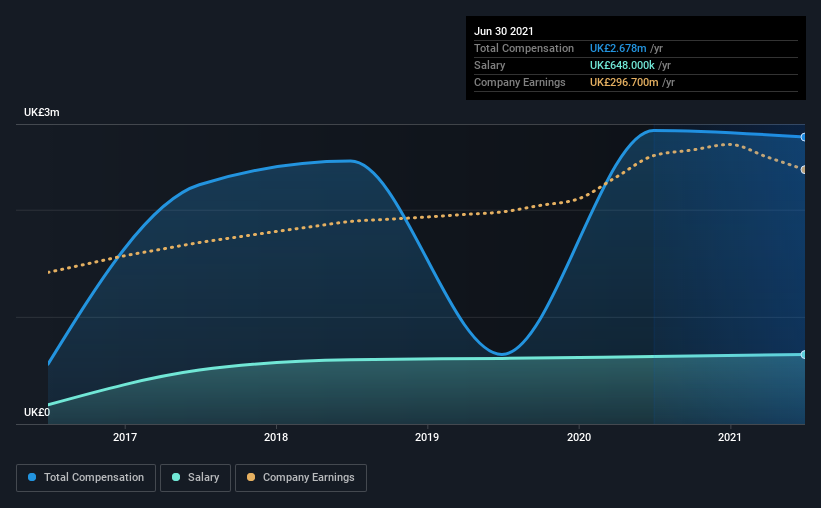

According to our data, Hargreaves Lansdown plc has a market capitalization of UK£6.6b, and paid its CEO total annual compensation worth UK£2.7m over the year to June 2021. This means that the compensation hasn't changed much from last year. While we always look at total compensation first, our analysis shows that the salary component is less, at UK£648k.

For comparison, other companies in the same industry with market capitalizations ranging between UK£2.9b and UK£8.8b had a median total CEO compensation of UK£2.7m. So it looks like Hargreaves Lansdown compensates Chris Hill in line with the median for the industry. Moreover, Chris Hill also holds UK£951k worth of Hargreaves Lansdown stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£648k | UK£630k | 24% |

| Other | UK£2.0m | UK£2.1m | 76% |

| Total Compensation | UK£2.7m | UK£2.7m | 100% |

Speaking on an industry level, nearly 45% of total compensation represents salary, while the remainder of 55% is other remuneration. Hargreaves Lansdown sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Hargreaves Lansdown plc's Growth

Hargreaves Lansdown plc has seen its earnings per share (EPS) increase by 7.9% a year over the past three years. It achieved revenue growth of 15% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Hargreaves Lansdown plc Been A Good Investment?

With a three year total loss of 15% for the shareholders, Hargreaves Lansdown plc would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Hargreaves Lansdown (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Hargreaves Lansdown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:HL.

Hargreaves Lansdown

Provides investment services for individuals and corporates in the United Kingdom and Poland.

Flawless balance sheet average dividend payer.