- United Kingdom

- /

- Hospitality

- /

- LSE:OTB

Undervalued Small Caps With Insider Action On UK Exchange In January 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China, impacting companies closely tied to its economic performance. Amidst this backdrop of global uncertainties and fluctuating commodity prices, identifying small-cap stocks with potential insider action can be a strategic approach for investors seeking opportunities that may not be immediately apparent in larger indices.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| NCC Group | NA | 1.3x | 27.22% | ★★★★★★ |

| 4imprint Group | 17.4x | 1.4x | 32.58% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 33.93% | ★★★★★☆ |

| XPS Pensions Group | 11.2x | 3.2x | 6.52% | ★★★★☆☆ |

| Robert Walters | 35.3x | 0.2x | 29.44% | ★★★★☆☆ |

| Sabre Insurance Group | 11.7x | 1.5x | 9.91% | ★★★★☆☆ |

| iomart Group | 24.2x | 0.6x | 33.77% | ★★★★☆☆ |

| Telecom Plus | 17.5x | 0.7x | 32.25% | ★★★☆☆☆ |

| Warpaint London | 24.2x | 4.2x | 0.74% | ★★★☆☆☆ |

| THG | NA | 0.3x | -537.38% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

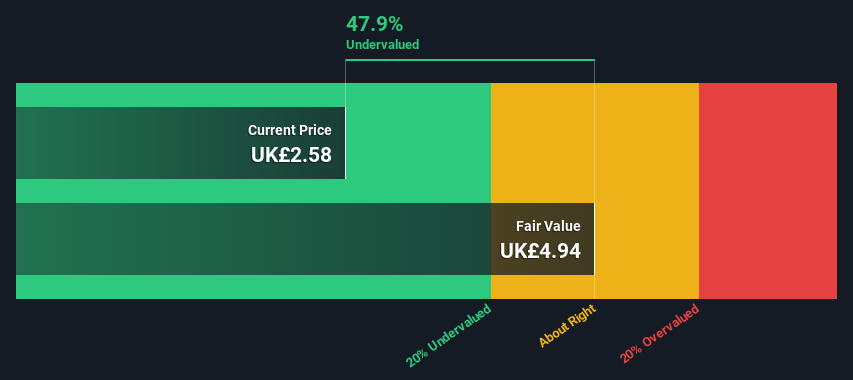

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Warpaint London is a cosmetics company specializing in the production and sale of own-brand beauty products, with a market capitalization of £225.65 million.

Operations: The company's revenue primarily comes from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million. Over recent periods, the net income margin has shown an upward trend, reaching 17.35% by mid-2024. Operating expenses have increased to £19 million as of June 2024, impacting profitability alongside non-operating expenses of £5.14 million in the same period.

PE: 24.2x

Warpaint London, a small player in the UK market, recently completed follow-on equity offerings totaling £15 million at £5.1 per share. This move could enhance liquidity and support growth initiatives. Insider confidence is evident with Eoin MacLeod acquiring 49,019 shares worth approximately £250K, reflecting potential belief in future prospects. Despite relying on higher-risk external borrowing for funding, earnings are projected to grow 13% annually, suggesting an optimistic outlook amidst its industry challenges.

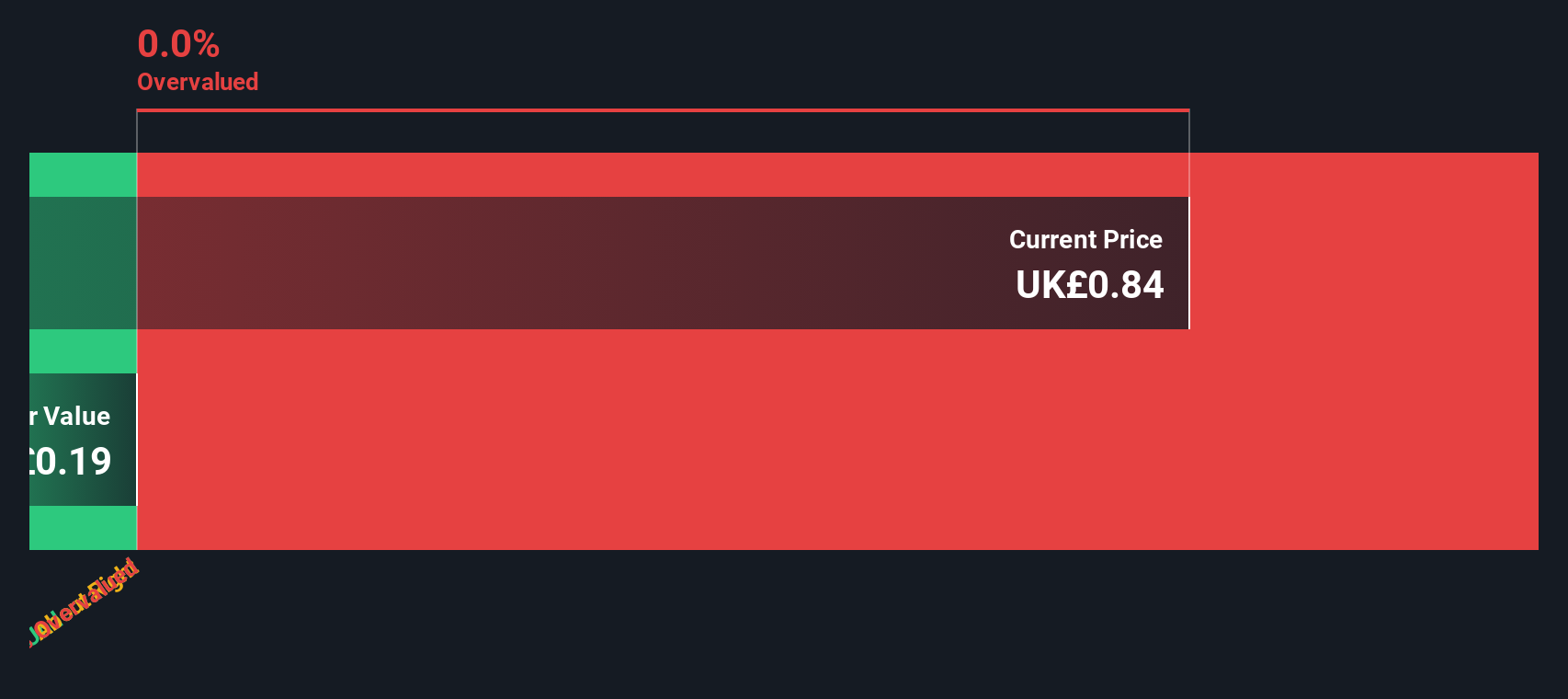

Foresight Environmental Infrastructure (LSE:FGEN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Foresight Environmental Infrastructure focuses on investing in environmental infrastructure projects, with a market cap of £6.5 billion.

Operations: The company experienced fluctuations in revenue, with a notable decline to £-6.50 million by 2025. Operating expenses have consistently increased over time, reaching £9.84 million in the latest period. Despite a gross profit margin of 100%, net income margins showed significant variability, peaking at 95.98% and dropping to -21.22% more recently.

PE: -27.4x

Foresight Environmental Infrastructure, a small player in the UK market, recently reported a net loss of £0.537 million for the half-year ending September 2024, contrasting with a previous net income of £1.87 million. Despite this setback and generating less than US$1m in revenue, insider confidence is evident as insiders have been purchasing shares throughout 2024. The company relies solely on external borrowing for funding, which carries higher risk but also potential for strategic growth if managed effectively.

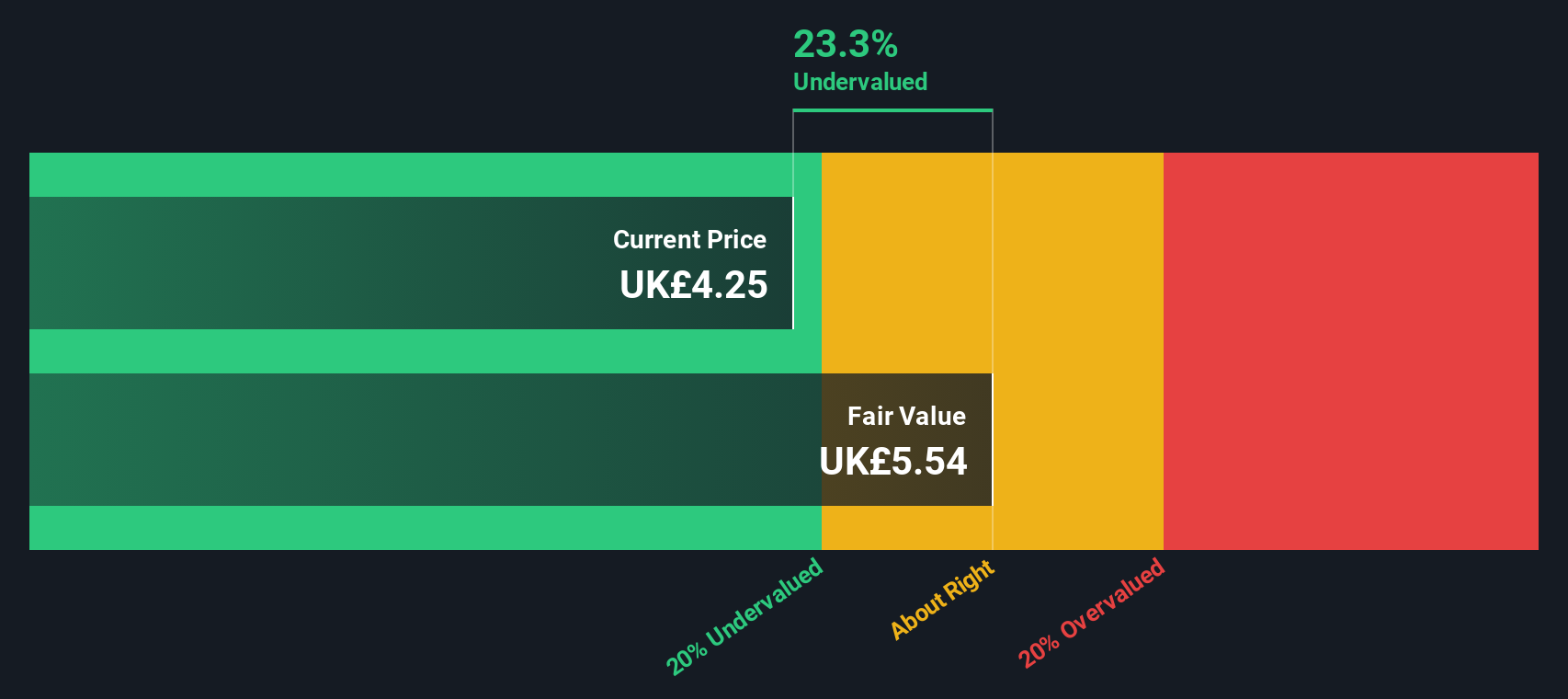

On the Beach Group (LSE:OTB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: On the Beach Group is an online travel retailer specializing in affordable beach holidays, with a market cap of approximately £0.28 billion.

Operations: The company's primary revenue streams are derived from Onthebeach.Co.Uk and Sunshine.Co.Uk, generating £119.2 million, and Classic Package Holidays contributing £9 million. Over time, its net income margin has shown variability, with a recent figure of 15.76% as of September 2024. The gross profit margin has experienced fluctuations but was recorded at 96.26% in the same period. Operating expenses have been significant, particularly in sales and marketing along with general and administrative costs, impacting overall profitability trends.

PE: 21.3x

On the Beach Group, a smaller UK company, has shown promising financial growth with sales rising to £128.2 million and net income increasing to £13 million for the year ending September 2024. Despite recent share price volatility, insider confidence is evident as Simon Cooper purchased 3 million shares worth approximately £6.8 million, marking a significant 46% increase in their holdings. The company has initiated a share repurchase program and announced board changes with Victoria Self joining as an independent director in February 2025.

- Click here to discover the nuances of On the Beach Group with our detailed analytical valuation report.

Examine On the Beach Group's past performance report to understand how it has performed in the past.

Next Steps

- Get an in-depth perspective on all 41 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OTB

On the Beach Group

Operates as an online retailer of short haul beach holidays under the On the Beach brand name in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives