- United Kingdom

- /

- Diversified Financial

- /

- LSE:CABP

3 UK Penny Stocks With Market Caps Over £100M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors may turn their attention to penny stocks—smaller or newer companies that can offer intriguing opportunities despite their somewhat outdated label. By focusing on those with strong financial foundations and growth potential, investors might uncover valuable prospects among these lesser-known entities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.675 | £534.05M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.11 | £170.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.83 | £12.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.53 | £259.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, supranationals, and governments globally, with a market cap of £131.50 million.

Operations: The company's revenue segment includes Unclassified Services, generating £88.73 million.

Market Cap: £131.5M

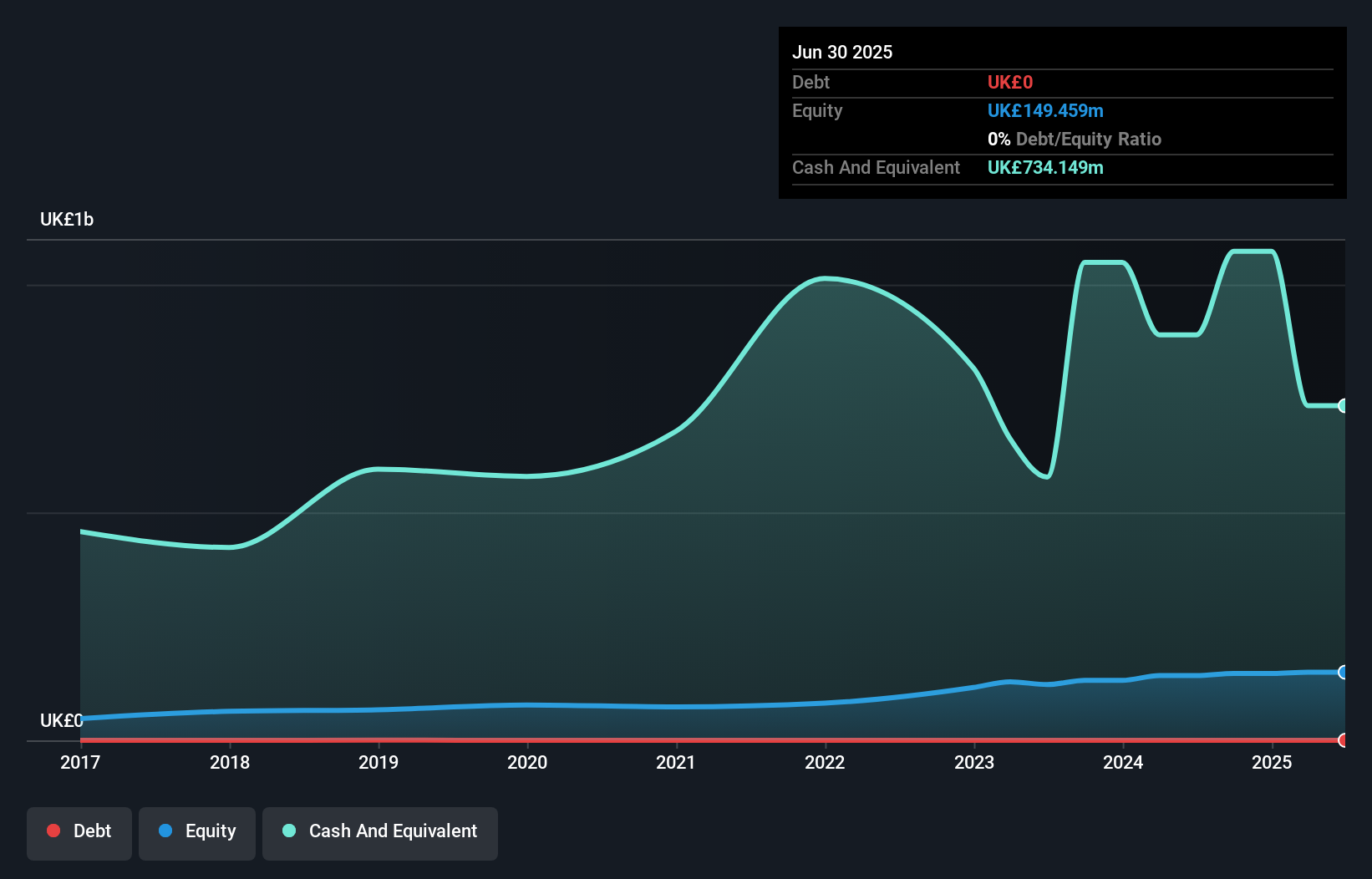

CAB Payments Holdings, with a market cap of £131.50 million, recently reported a decline in revenue to £51.82 million for the half year ending June 2025, down from £55.97 million the previous year, and net income fell significantly to £2.3 million from £10.24 million. Despite being debt-free and trading at 58.1% below estimated fair value, the company faces challenges such as lower profit margins and an inexperienced management team with just 0.8 years average tenure. The company's short-term assets (£1.1B) do not cover its short-term liabilities (£1.4B), indicating liquidity concerns despite having no long-term debt issues.

- Navigate through the intricacies of CAB Payments Holdings with our comprehensive balance sheet health report here.

- Evaluate CAB Payments Holdings' prospects by accessing our earnings growth report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £186.91 million.

Operations: The company generates revenue of $73.04 million from its asset management operations.

Market Cap: £186.91M

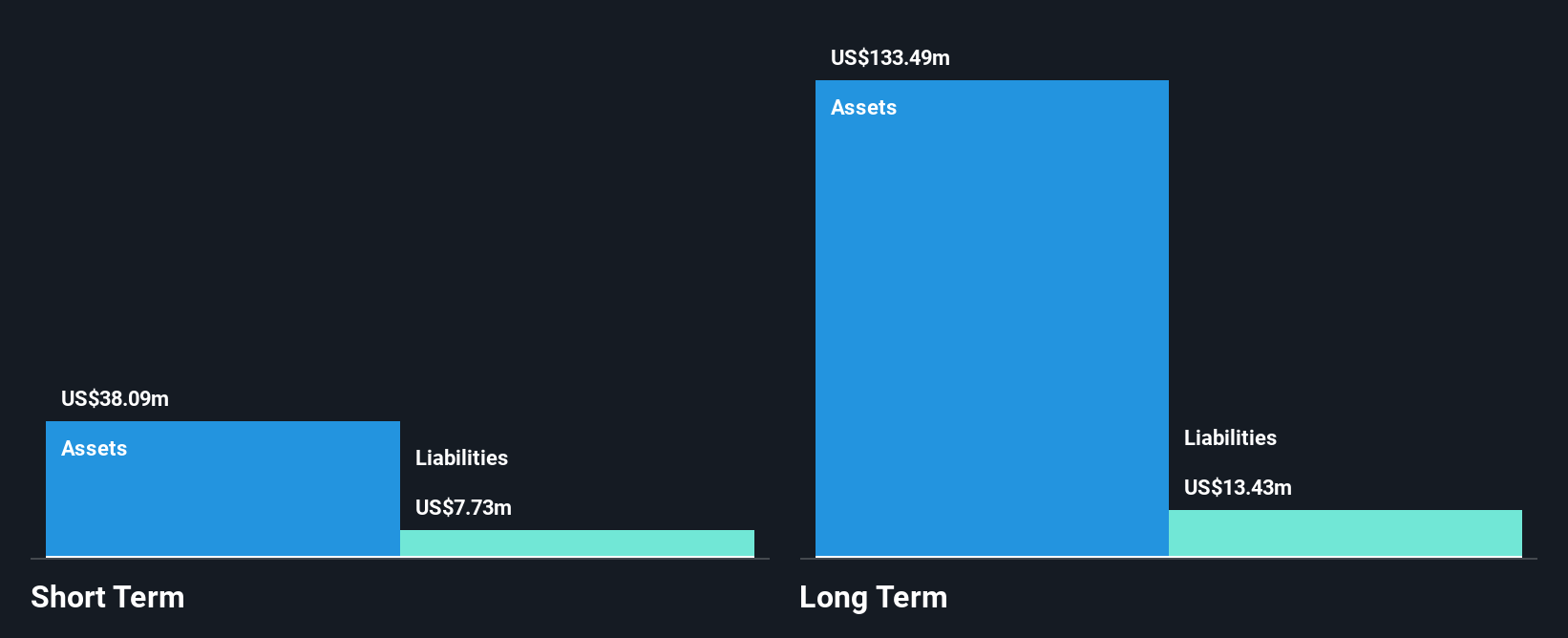

City of London Investment Group, with a market cap of £186.91 million, is debt-free and has shown strong financial performance with net income rising to US$19.68 million for the year ending June 2025. Its earnings growth of 15% over the past year surpasses both its five-year average and industry standards, reflecting high-quality earnings and improved profit margins. The company's price-to-earnings ratio (12.6x) suggests good value compared to the UK market average (16.7x). Despite these positives, auditors have expressed concerns about its ability to continue as a going concern, highlighting potential underlying risks for investors in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of City of London Investment Group.

- Assess City of London Investment Group's previous results with our detailed historical performance reports.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £534.05 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

Market Cap: £534.05M

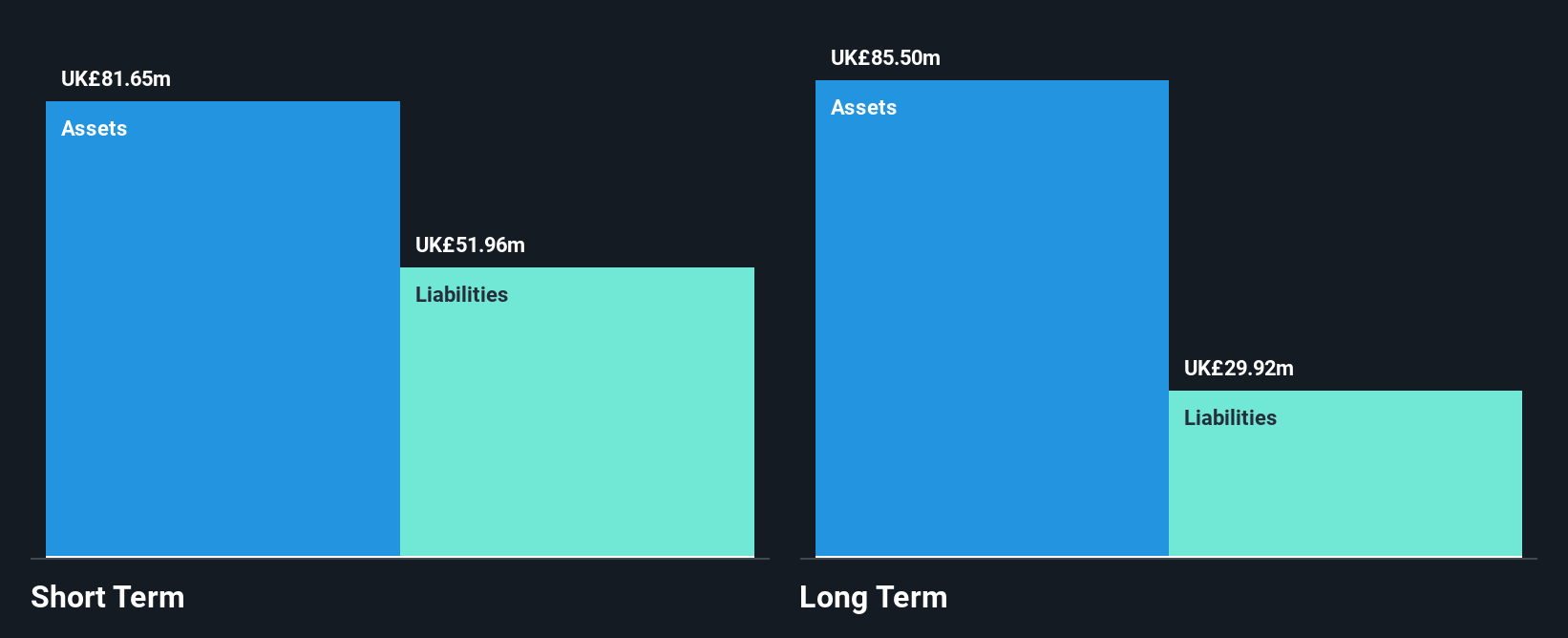

Foresight Group Holdings, with a market cap of £534.05 million, demonstrates robust financial health and growth potential. Its earnings have grown by 25.8% over the past year, surpassing industry averages, supported by high-quality earnings and a strong return on equity of 39%. The company's debt is well-managed with more cash than total debt and short-term assets exceeding liabilities. Analysts anticipate further stock price appreciation by 28.2%. Recent events include an approved dividend increase to 16.8 pence per share for the financial year ended March 2025, reflecting confidence in its financial stability amidst steady operational performance.

- Get an in-depth perspective on Foresight Group Holdings' performance by reading our balance sheet health report here.

- Gain insights into Foresight Group Holdings' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Investigate our full lineup of 296 UK Penny Stocks right here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CABP

CAB Payments Holdings

Through its subsidiaries, provides foreign exchange (FX) and cross-border payments services to banks, fintech companies, supranationals, and governments in the United Kingdom and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives