- United Kingdom

- /

- Capital Markets

- /

- LSE:BRW

Would Shareholders Who Purchased Brewin Dolphin Holdings' (LON:BRW) Stock Three Years Be Happy With The Share price Today?

Brewin Dolphin Holdings PLC (LON:BRW) shareholders should be happy to see the share price up 16% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 25% in the last three years, falling well short of the market return.

View our latest analysis for Brewin Dolphin Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

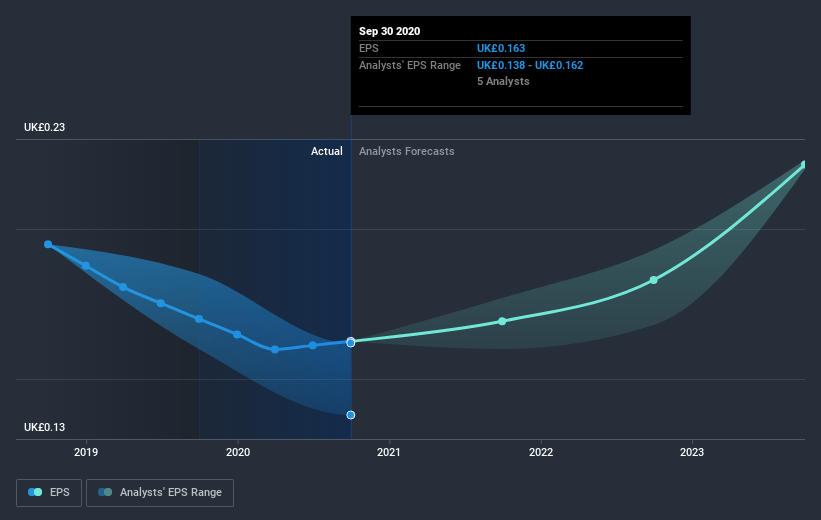

During the three years that the share price fell, Brewin Dolphin Holdings' earnings per share (EPS) dropped by 0.6% each year. This reduction in EPS is slower than the 9% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Brewin Dolphin Holdings' earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Brewin Dolphin Holdings' TSR for the last 3 years was -13%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Brewin Dolphin Holdings shareholders are down 18% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 7.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Brewin Dolphin Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brewin Dolphin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:BRW

Brewin Dolphin Holdings

Brewin Dolphin Holdings PLC, together with its subsidiaries, provides wealth management services in the United Kingdom, the Channel Islands, and the Republic of Ireland.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives