- Sweden

- /

- Specialty Stores

- /

- OM:BMAX

3 Top Undervalued Small Caps In Global With Recent Insider Action

Reviewed by Simply Wall St

In the current global market landscape, trade tensions and tariff uncertainties have created volatility, impacting investor sentiment and leading to mixed performances across key indices like the S&P 600 for small-cap stocks. Despite these challenges, some small-cap companies may present attractive opportunities due to their potential for growth and resilience in navigating economic fluctuations. Identifying such stocks often involves looking at factors like financial health, market positioning, and recent insider actions that could signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.3x | 0.5x | 44.46% | ★★★★★★ |

| Security Bank | 4.6x | 1.1x | 40.86% | ★★★★★★ |

| Bytes Technology Group | 22.9x | 5.8x | 6.90% | ★★★★★☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 41.99% | ★★★★☆☆ |

| FRP Advisory Group | 12.4x | 2.2x | 10.05% | ★★★☆☆☆ |

| Italmobiliare | 10.5x | 1.4x | -244.92% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.7x | 1.6x | 48.47% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -3.28% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.3x | 3.8x | 39.05% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 1.6x | -136.38% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

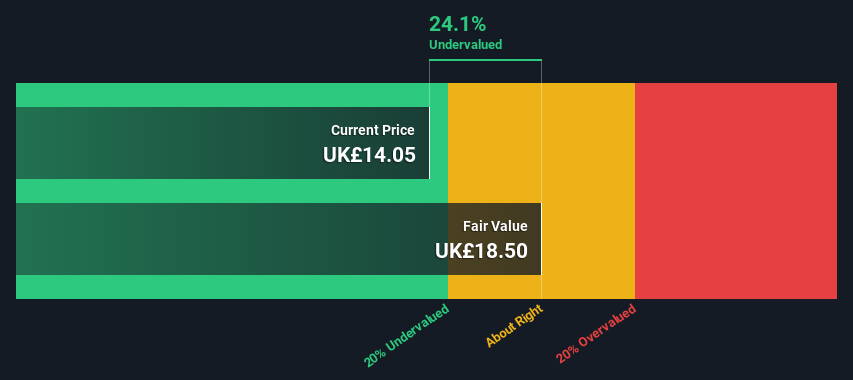

Brooks Macdonald Group (LSE:BRK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Brooks Macdonald Group is a UK-based investment management firm providing wealth management services to private clients, charities, and institutions with a market cap of approximately £0.37 billion.

Operations: The company generates revenue primarily through its gross profit, consistently achieving a gross profit margin of 100%. Operating expenses form a significant portion of costs, with general and administrative expenses being the primary component. Net income margin has shown variability over time, reaching as high as 19.16% in some periods while dipping to lower levels in others.

PE: 34.0x

Brooks Macdonald Group, a smaller company in the investment management sector, recently reported a turnaround in financial performance with net income reaching £9.6 million for H1 2025 compared to a loss of £3.38 million the previous year. This improvement is underscored by insider confidence through share purchases within the past year and an ongoing share repurchase program initiated in January 2025 to boost earnings per share. Despite relying solely on external borrowing, their profit margins have improved significantly over last year's figures, suggesting potential for future growth.

- Click here and access our complete valuation analysis report to understand the dynamics of Brooks Macdonald Group.

Assess Brooks Macdonald Group's past performance with our detailed historical performance reports.

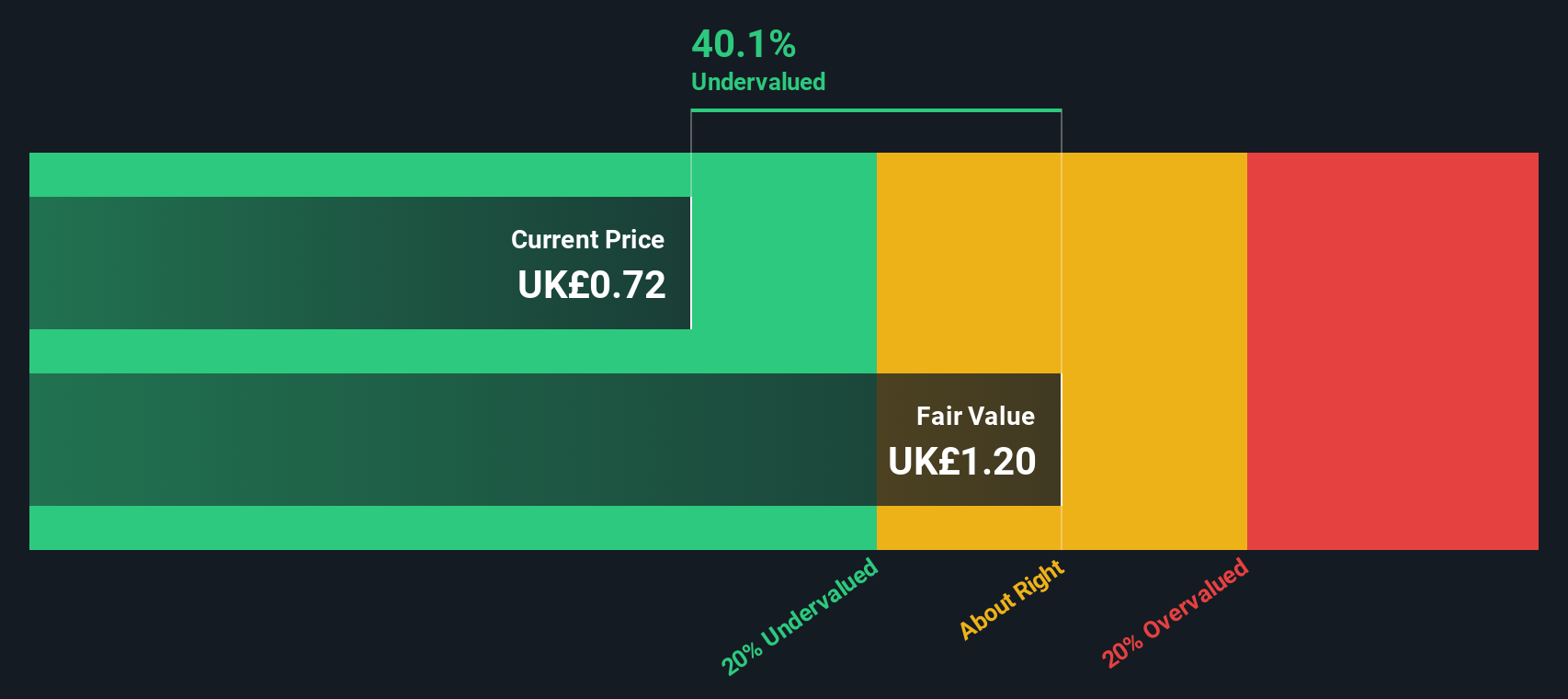

NewRiver REIT (LSE:NRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NewRiver REIT is a UK-based real estate investment trust specializing in the ownership and management of retail and leisure properties, with a market capitalization of approximately £0.25 billion.

Operations: NewRiver REIT's revenue is primarily derived from its operations, with significant costs attributed to COGS and operating expenses. The company's gross profit margin has shown fluctuations, reaching 71.32% in the latest period ending April 16, 2025. Operating expenses remain a notable component of the cost structure, consistently impacting net income figures over time.

PE: 24.5x

NewRiver REIT, a smaller company in the real estate sector, is attracting attention with its strategic moves and growth potential. They recently partnered with Royal Mail to introduce parcel lockers across over 60 shopping centres, enhancing convenience for shoppers and potentially increasing retail footfall. Additionally, a new Sainsbury's lease at Cuckoo Bridge Retail Park promises improved rental income and job creation. Despite higher risk funding through external borrowing, earnings are forecasted to grow significantly by 48% annually.

- Take a closer look at NewRiver REIT's potential here in our valuation report.

Explore historical data to track NewRiver REIT's performance over time in our Past section.

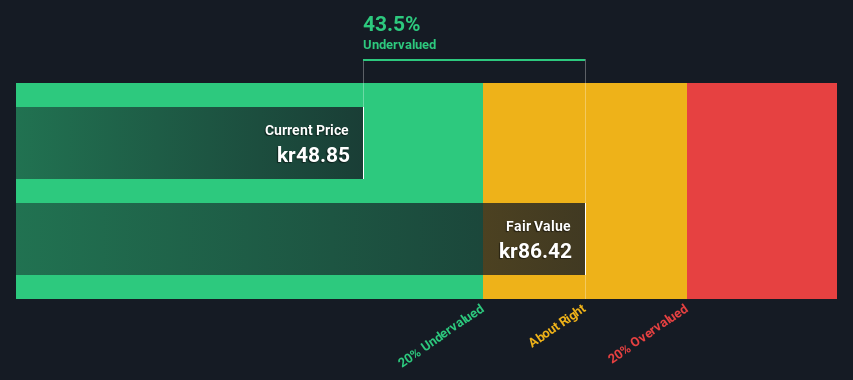

Byggmax Group (OM:BMAX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Byggmax Group operates as a retailer of building materials and home improvement products, serving customers primarily in the Nordic region, with a market capitalization of approximately SEK 3.5 billion.

Operations: Byggmax Group generates revenue primarily through sales, with recent data showing a gross profit margin of 35.16%. The company's cost structure is heavily influenced by the cost of goods sold (COGS), which has been consistently significant relative to revenue. Operating expenses, including general and administrative costs, also play a substantial role in its financial performance. Notably, Byggmax's net income margin shows variability, reflecting fluctuations in profitability over time.

PE: 27.7x

Byggmax Group, a smaller player in the market, recently showed signs of potential with insider confidence as their Chief Commercial Officer purchased 27,027 shares worth approximately SEK 998,150. Despite reporting a net loss of SEK 112 million for Q1 2025, the company improved from a larger loss last year. Earnings are projected to grow by over 51% annually. The board proposed a dividend increase for the financial year 2024 to SEK 0.75 per share, reflecting optimism about future prospects despite reliance on external borrowing for funding.

- Navigate through the intricacies of Byggmax Group with our comprehensive valuation report here.

Gain insights into Byggmax Group's past trends and performance with our Past report.

Make It Happen

- Unlock our comprehensive list of 151 Undervalued Global Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byggmax Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BMAX

Byggmax Group

Sells building materials and related products for DIY projects in Sweden, Norway, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives