- United Kingdom

- /

- Consumer Durables

- /

- LSE:BTRW

3 UK Stocks That May Be Undervalued In September 2024

Reviewed by Simply Wall St

The UK stock market has been facing headwinds, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China and declining commodity prices. Despite these challenges, there are opportunities to find undervalued stocks that may offer potential for growth as the market adjusts. In this article, we will explore three UK stocks that may be undervalued in September 2024. Identifying such stocks involves looking for companies with strong fundamentals that have been overlooked due to broader market concerns.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.39 | £0.76 | 48.9% |

| GlobalData (AIM:DATA) | £2.18 | £4.10 | 46.8% |

| Topps Tiles (LSE:TPT) | £0.4755 | £0.91 | 47.8% |

| AstraZeneca (LSE:AZN) | £125.40 | £245.12 | 48.8% |

| Mercia Asset Management (AIM:MERC) | £0.355 | £0.68 | 48.1% |

| Redcentric (AIM:RCN) | £1.29 | £2.46 | 47.5% |

| Ricardo (LSE:RCDO) | £5.20 | £10.18 | 48.9% |

| Foxtons Group (LSE:FOXT) | £0.618 | £1.21 | 48.9% |

| Velocity Composites (AIM:VEL) | £0.425 | £0.83 | 48.6% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

Let's uncover some gems from our specialized screener.

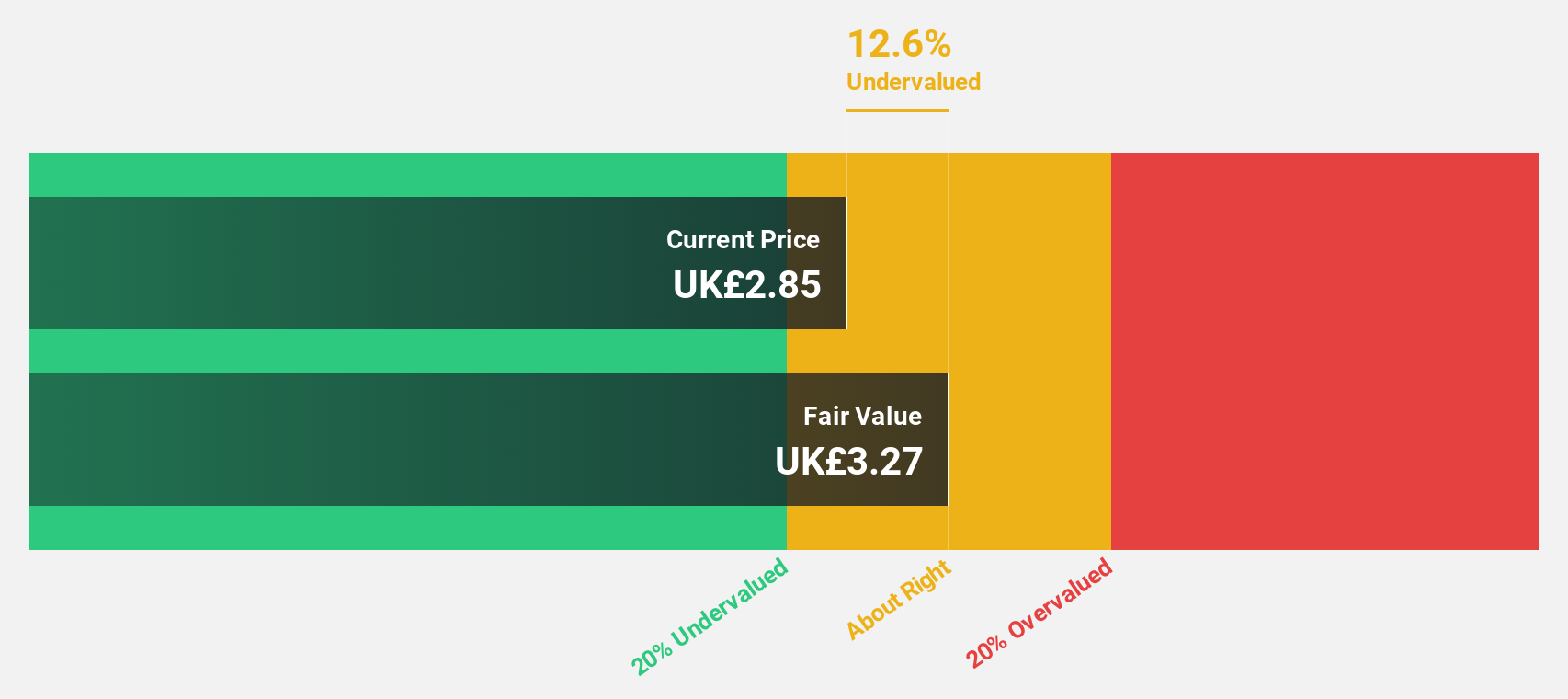

Barratt Developments (LSE:BDEV)

Overview: Barratt Developments plc is a UK-based company specializing in housebuilding, with a market cap of £7.31 billion.

Operations: The company's revenue segments include private housing at £3.92 billion, affordable housing at £0.68 billion, and commercial developments at £0.09 billion.

Estimated Discount To Fair Value: 40.5%

Barratt Developments plc reported a significant decline in earnings for the year ended June 30, 2024, with net income dropping to £114.1 million from £530.3 million a year ago. Despite this, the stock is trading at 40.5% below its estimated fair value of £8.5 per share and is expected to see annual profit growth of 45.9%. However, dividends have been reduced and are not well covered by earnings or free cash flows, reflecting current financial pressures.

- The analysis detailed in our Barratt Developments growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Barratt Developments' balance sheet health report.

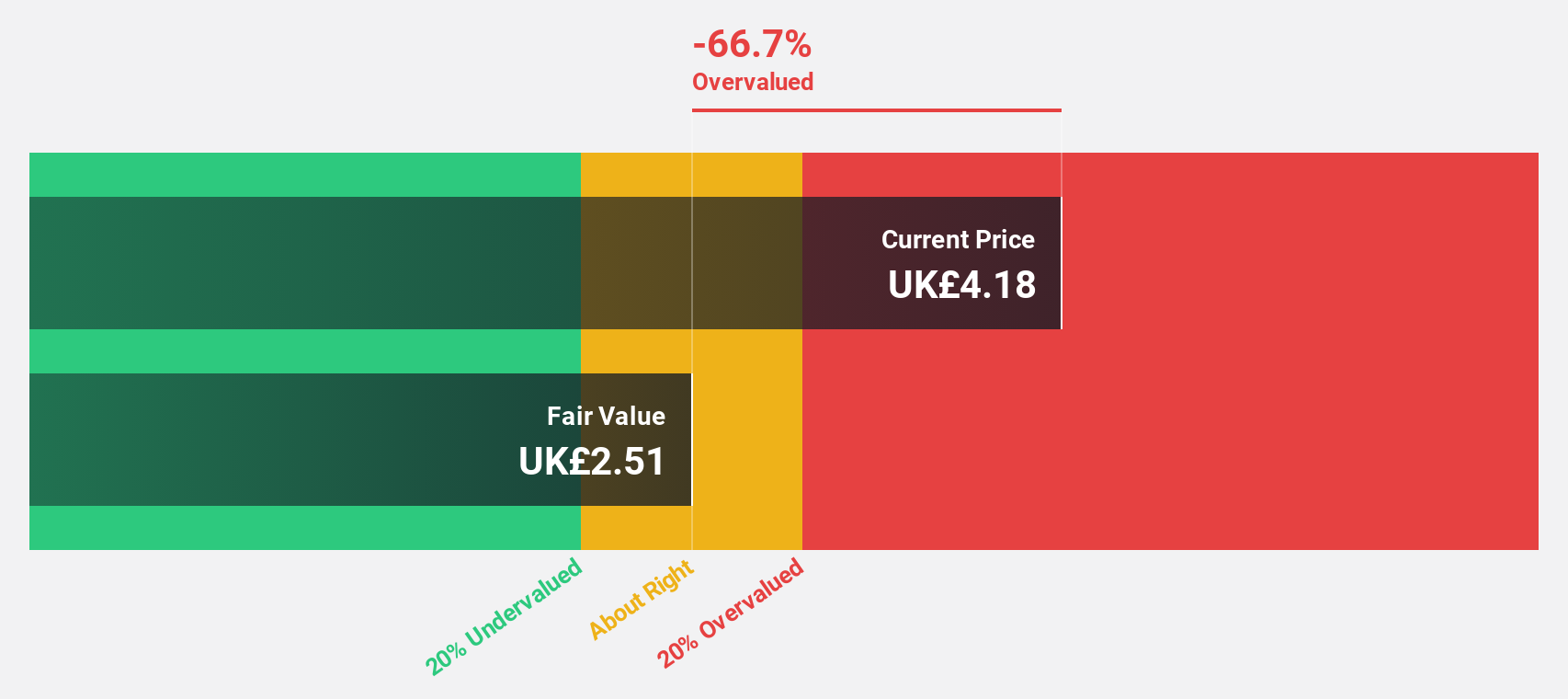

Bridgepoint Group (LSE:BPT)

Overview: Bridgepoint Group plc is a private equity and private credit firm focusing on middle market, small mid cap, small cap, growth capital, buyouts investments, syndicate debt, infrastructure, direct lending and credit opportunities in private credit investments with a market cap of £2.48 billion.

Operations: The company's revenue segments include £3.60 million from Central operations, £74.50 million from Private Credit, and £285.60 million from Private Equity.

Estimated Discount To Fair Value: 21.3%

Bridgepoint Group plc is trading at £3.02, significantly below its estimated fair value of £3.84, indicating potential undervaluation based on discounted cash flows. Despite recent earnings showing a decline in net income to £43.1 million from £48.2 million last year, the company forecasts robust revenue growth of 18.3% annually and earnings growth of 33.2% per year over the next three years, outpacing the broader UK market's expected growth rates.

- Insights from our recent growth report point to a promising forecast for Bridgepoint Group's business outlook.

- Navigate through the intricacies of Bridgepoint Group with our comprehensive financial health report here.

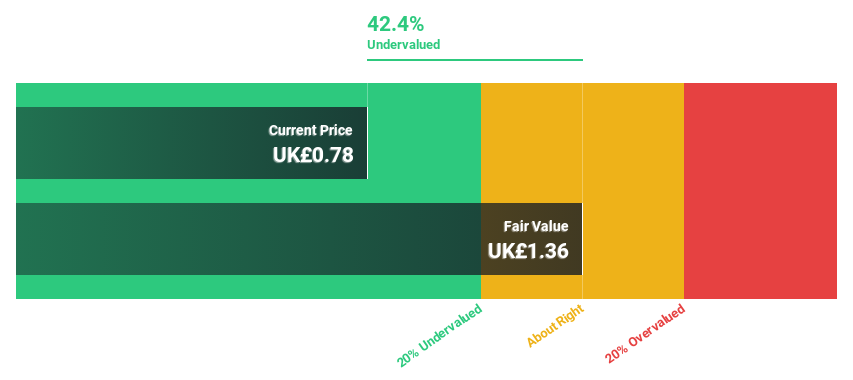

Rank Group (LSE:RNK)

Overview: The Rank Group Plc, with a market cap of £358.82 million, provides gaming services in Great Britain, Spain, and India through its subsidiaries.

Operations: The company's revenue segments include Mecca (£138.90 million), Digital (£226 million), Enracha Venues (£38.50 million), and Grosvenor Casinos (£331.30 million).

Estimated Discount To Fair Value: 43.1%

Rank Group is trading at £0.77, well below its estimated fair value of £1.35, suggesting it may be undervalued based on discounted cash flows. The company has turned profitable this year with a net income of £12.5 million compared to a net loss of £96.2 million last year and forecasts earnings growth of 35.7% annually over the next three years, surpassing the UK market's expected growth rate. However, one-off items have impacted financial results and its return on equity is forecasted to remain low at 11.3%.

- The growth report we've compiled suggests that Rank Group's future prospects could be on the up.

- Get an in-depth perspective on Rank Group's balance sheet by reading our health report here.

Taking Advantage

- Dive into all 56 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barratt Redrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BTRW

Barratt Redrow

Engages in the housebuilding business in the United Kingdom.

Flawless balance sheet with reasonable growth potential.