- United Kingdom

- /

- Capital Markets

- /

- LSE:BBGI

BBGI Global Infrastructure's (LON:BBGI) Shareholders Will Receive A Bigger Dividend Than Last Year

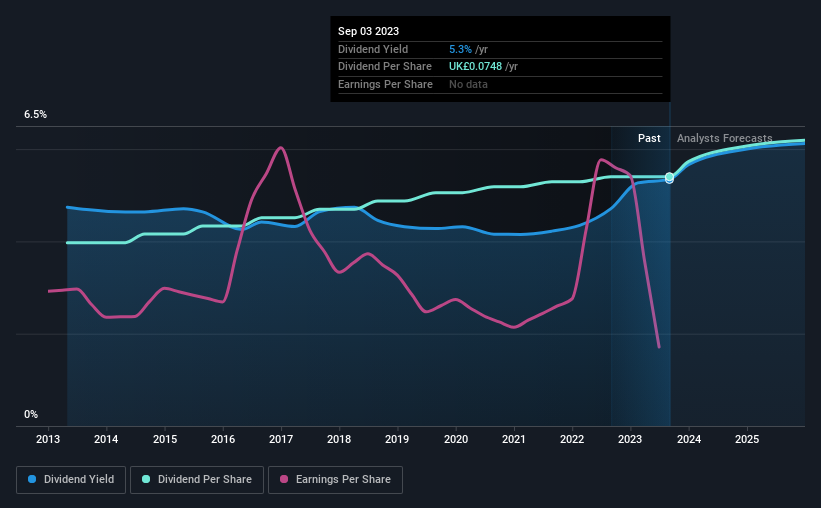

The board of BBGI Global Infrastructure S.A. (LON:BBGI) has announced that the dividend on 19th of October will be increased to £0.0397, which will be 6.0% higher than last year's payment of £0.0374 which covered the same period. This takes the dividend yield to 5.3%, which shareholders will be pleased with.

View our latest analysis for BBGI Global Infrastructure

BBGI Global Infrastructure Doesn't Earn Enough To Cover Its Payments

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, BBGI Global Infrastructure's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. Generally, we think that this would be a risky long term practice.

EPS is set to fall by 14.4% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could reach 175%, which could put the dividend in jeopardy if the company's earnings don't improve.

BBGI Global Infrastructure Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2013, the dividend has gone from £0.055 total annually to £0.0748. This implies that the company grew its distributions at a yearly rate of about 3.1% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. BBGI Global Infrastructure's earnings per share has shrunk at 14% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for BBGI Global Infrastructure that investors should take into consideration. Is BBGI Global Infrastructure not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BBGI Global Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BBGI

BBGI Global Infrastructure

An investment firm specializing in infrastructure investments in operational or near operational assets.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion