- United Kingdom

- /

- Pharma

- /

- AIM:EAH

February 2025 UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, penny stocks continue to intrigue investors as potential opportunities for growth. Although the term "penny stocks" may seem outdated, it still signifies smaller or less-established companies that could offer significant value when backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.875 | £469.93M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.22 | £836.53M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.862 | £73.17M | ★★★★★★ |

Click here to see the full list of 441 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc, with a market cap of £40.32 million, develops, registers, and markets pharmaceutical products for animals globally.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which accounts for £84.60 million.

Market Cap: £40.32M

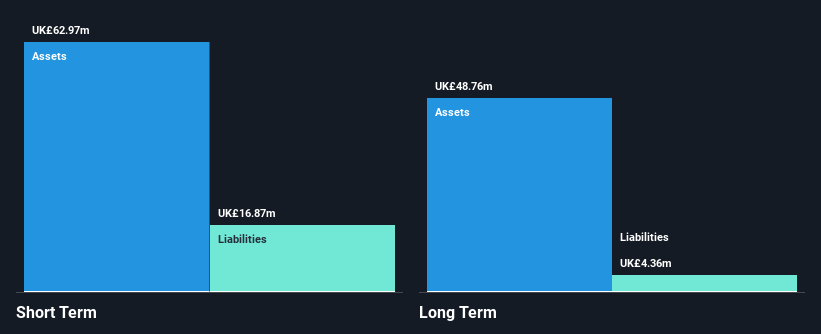

ECO Animal Health Group, with a market cap of £40.32 million, has recently become profitable, though its earnings have been impacted by large one-off items. The company is debt-free and its short-term assets significantly exceed both short and long-term liabilities. Despite trading at 83.8% below estimated fair value, the company's earnings declined over the past five years but are forecasted to grow annually by 39.23%. Recent leadership changes include Dr Joachim Hasenmaier's appointment as Chairman from March 2025, bringing extensive industry experience which could influence future strategic direction positively.

- Click to explore a detailed breakdown of our findings in ECO Animal Health Group's financial health report.

- Learn about ECO Animal Health Group's future growth trajectory here.

Alpha Growth (LSE:ALGW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alpha Growth plc offers advisory and analytical services for senior life settlement assets in North America, with a market capitalization of £7.84 million.

Operations: The company's revenue is derived entirely from its provision of advice and consultancy services, amounting to £5.52 million.

Market Cap: £7.84M

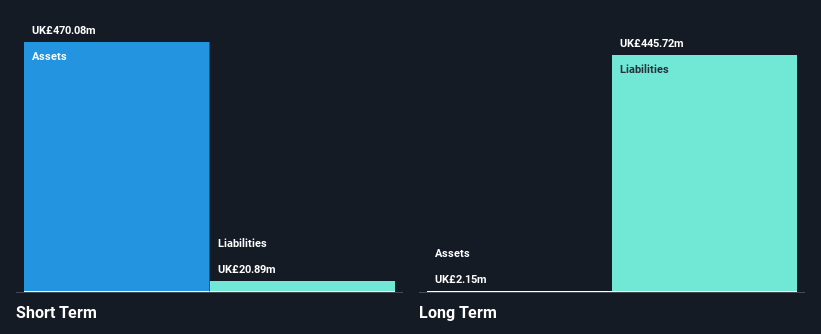

Alpha Growth plc, with a market cap of £7.84 million, focuses on advisory services for senior life settlement assets in North America. Despite being unprofitable, the company has reduced losses over the past five years by 21.9% annually and maintains a strong cash position with short-term assets of £470.1 million exceeding liabilities significantly. Recent changes include adding Lynne Martel as an Independent Non-executive Director to enhance governance and expertise as the company plans its next growth phase. However, its high volatility and increased debt-to-equity ratio from 0% to 188.2% over five years are potential concerns for investors.

- Take a closer look at Alpha Growth's potential here in our financial health report.

- Explore historical data to track Alpha Growth's performance over time in our past results report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £379.25 million.

Operations: The company's revenue is derived entirely from its Internet Information Providers segment, amounting to £28.32 million.

Market Cap: £379.25M

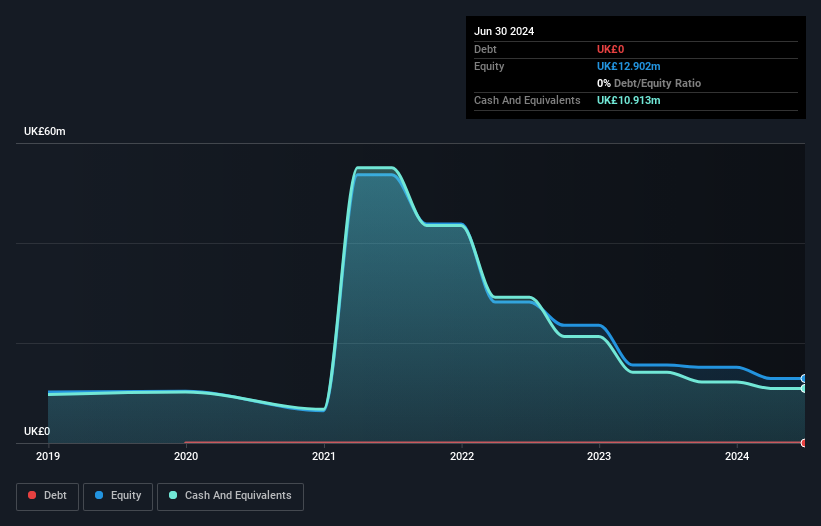

PensionBee Group plc, with a market cap of £379.25 million, is expanding its reach in the U.S. following a successful U.K. presence. The company recently launched an app to simplify pension management and partnered with State Street Global Advisors for investment portfolios. Despite being unprofitable and having negative return on equity, PensionBee is debt-free with sufficient cash runway for over three years. Analysts forecast significant earnings growth at 53.32% annually, although past losses have only reduced by 8.8% per year over five years. Recent share issuance raised $25 million to support further expansion efforts in the U.S., attracting 10,000 new customers since launch in 2024.

- Unlock comprehensive insights into our analysis of PensionBee Group stock in this financial health report.

- Evaluate PensionBee Group's prospects by accessing our earnings growth report.

Make It Happen

- Embark on your investment journey to our 441 UK Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ECO Animal Health Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EAH

ECO Animal Health Group

Develops, registers, and markets pharmaceutical products for animals worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives