- United Kingdom

- /

- Capital Markets

- /

- LSE:ALGW

Discover Shield Therapeutics And 2 Other UK Penny Stocks

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market uncertainties, penny stocks remain an intriguing investment area for those interested in smaller or newer companies. While the term "penny stocks" might seem outdated, these investments can offer potential value when they are backed by strong financials and a clear growth path.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.06 | £776.24M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.76M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £426.51M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.60 | £358.04M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.62 | £88.11M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.08 | £92.27M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.274 | £196.49M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 441 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Shield Therapeutics (AIM:STX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shield Therapeutics plc is a commercial stage specialty pharmaceutical company that focuses on the commercialization of pharmaceuticals to treat unmet medical needs, with a market cap of £18.57 million.

Operations: The company's revenue is derived entirely from its Feraccru®/Accrufer® product, totaling $21.47 million.

Market Cap: £18.57M

Shield Therapeutics plc has faced financial challenges, evident from its high net debt to equity ratio of 2140.5% and negative return on equity of -6685.03%, as it remains unprofitable. Despite this, the company recently bolstered its cash position through follow-on equity offerings totaling £16.48 million, which could extend its cash runway beyond the current 1.1 years if free cash flow continues to decline at historical rates. While revenue is projected to grow by nearly 50% annually, management's inexperience and a volatile share price add layers of risk for investors considering this penny stock opportunity.

- Take a closer look at Shield Therapeutics' potential here in our financial health report.

- Examine Shield Therapeutics' earnings growth report to understand how analysts expect it to perform.

Westminster Group (AIM:WSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westminster Group PLC is a specialist security and services company that designs and supplies technology security solutions and services globally, with a market cap of £5.62 million.

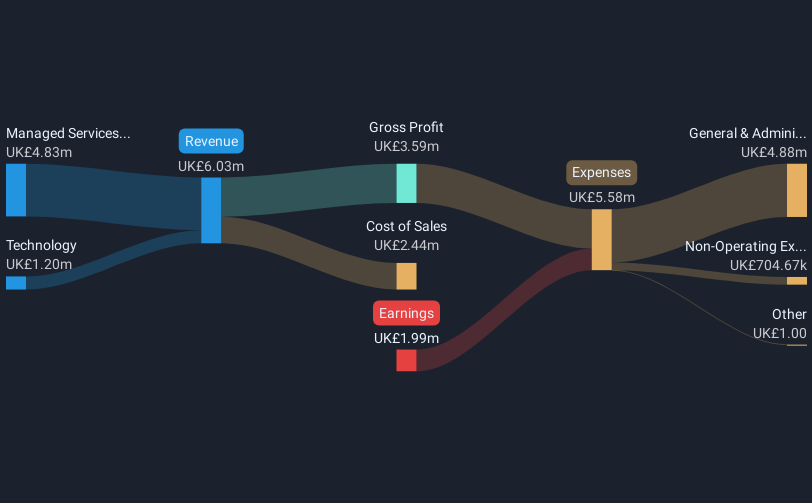

Operations: The company's revenue is derived from two main segments: Technology, contributing £1.20 million, and Managed Services (including Managed Services Guarding), which accounts for £4.83 million.

Market Cap: £5.62M

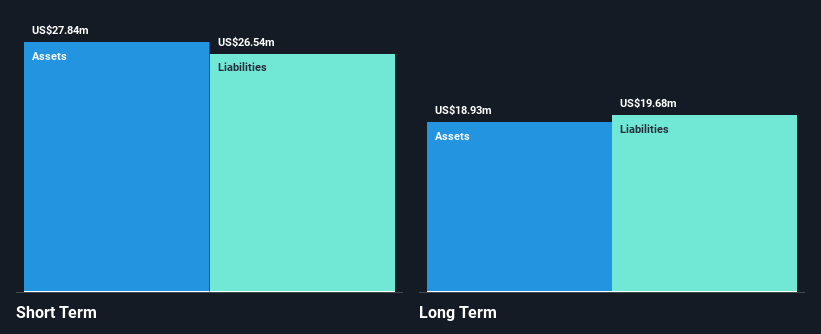

Westminster Group PLC, with a market cap of £5.62 million, is navigating financial challenges typical for penny stocks. Despite being unprofitable and experiencing increased losses over the past five years, its short-term assets exceed both short- and long-term liabilities, suggesting some financial stability. The company has reduced its debt to equity ratio significantly from 269.9% to 29.7%, indicating improved debt management. However, the share price remains highly volatile, reflecting broader market concerns about liquidity and capital costs. A strategic review is underway to enhance shareholder value amidst these challenges and opportunities in the security solutions sector.

- Get an in-depth perspective on Westminster Group's performance by reading our balance sheet health report here.

- Examine Westminster Group's past performance report to understand how it has performed in prior years.

Alpha Growth (LSE:ALGW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alpha Growth plc provides advisory services, strategies, performance monitoring, and analytical services for senior life settlement assets in North America, with a market cap of £7.02 million.

Operations: The company's revenue is derived entirely from the provision of advice and consultancy services, amounting to £5.52 million.

Market Cap: £7.02M

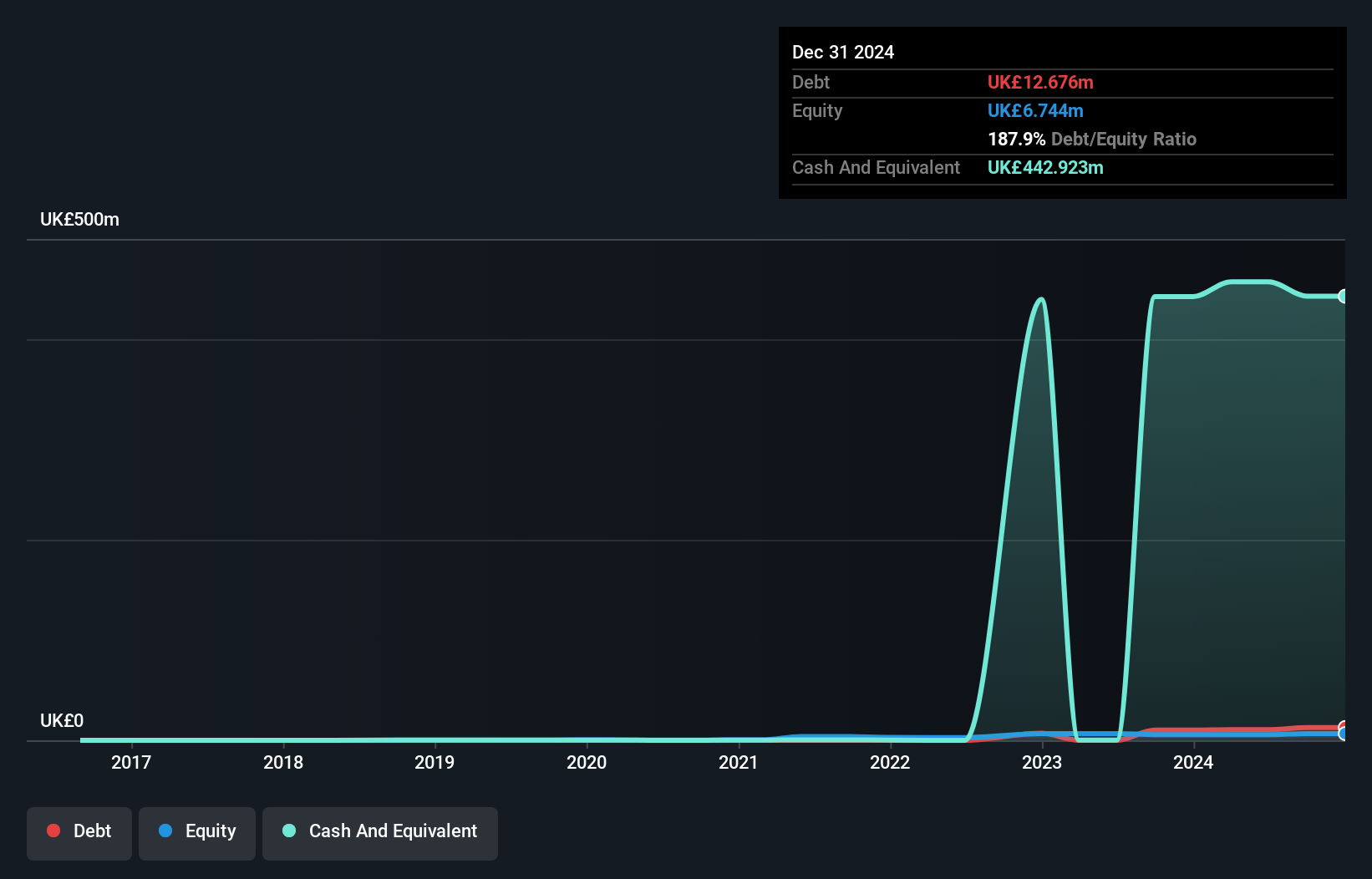

Alpha Growth plc, with a market cap of £7.02 million, is unprofitable but has managed to reduce losses by 21.9% annually over the past five years. The company holds more cash than its total debt and maintains a robust cash runway exceeding three years, assuming historical reductions in free cash flow persist. Its short-term assets significantly surpass both short- and long-term liabilities, indicating solid financial footing despite high share price volatility over recent months. Recent board changes include the addition of Lynne Martel as an Independent Non-executive Director to strengthen governance and strategic direction as it progresses toward growth objectives.

- Navigate through the intricacies of Alpha Growth with our comprehensive balance sheet health report here.

- Gain insights into Alpha Growth's historical outcomes by reviewing our past performance report.

Make It Happen

- Take a closer look at our UK Penny Stocks list of 441 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALGW

Alpha Growth

Focuses on providing advisory services, strategies, performance monitoring, and analytical services to holders of senior life settlement assets in North America.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives