- United Kingdom

- /

- Capital Markets

- /

- LSE:ALGW

CML Microsystems Leads The Charge In UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, some investors are turning their attention to penny stocks—smaller or newer companies that can offer unique opportunities for growth and value. While the term "penny stocks" may seem outdated, these investments remain relevant today for those seeking affordable options with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| LSL Property Services (LSE:LSL) | £2.67 | £276.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.62 | £260.57M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.568 | £272.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.825 | £309.01M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.365 | £381.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.03 | £388.48M | ✅ 4 ⚠️ 1 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.22 | £347.37M | ✅ 5 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.015 | £161.88M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.926 | £2.17B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.335 | £36.25M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £35.34 million, designs, manufactures, and markets semiconductor products for the communications industry across the United Kingdom, the Americas, Far East, and internationally.

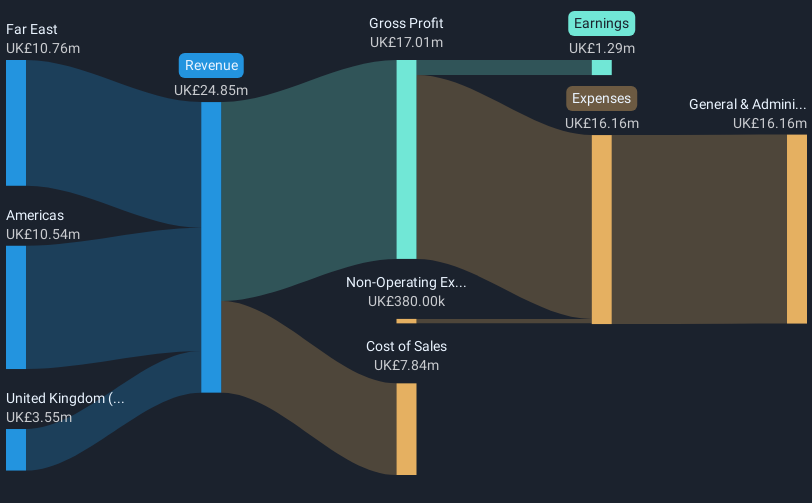

Operations: The company's revenue is primarily derived from its semiconductor components for the communications industry, totaling £24.85 million.

Market Cap: £35.34M

CML Microsystems, with a market cap of £35.34 million, has demonstrated high-quality earnings and remains debt-free, which alleviates concerns over interest payments. Despite a seasoned management team and board of directors, the company faces challenges such as declining profit margins from 20.8% to 5.2% and negative earnings growth of -70.8% in the past year compared to the semiconductor industry average decline of -13.5%. The dividend yield of 5% is not well covered by earnings or free cash flows, highlighting potential sustainability issues amidst stable weekly volatility at 4%.

- Click here and access our complete financial health analysis report to understand the dynamics of CML Microsystems.

- Examine CML Microsystems' past performance report to understand how it has performed in prior years.

Parkmead Group (AIM:PMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Parkmead Group plc is an independent oil and gas company involved in the exploration and production of oil and gas properties in Europe, with a market cap of £15.30 million.

Operations: No specific revenue segments have been reported for the company.

Market Cap: £15.3M

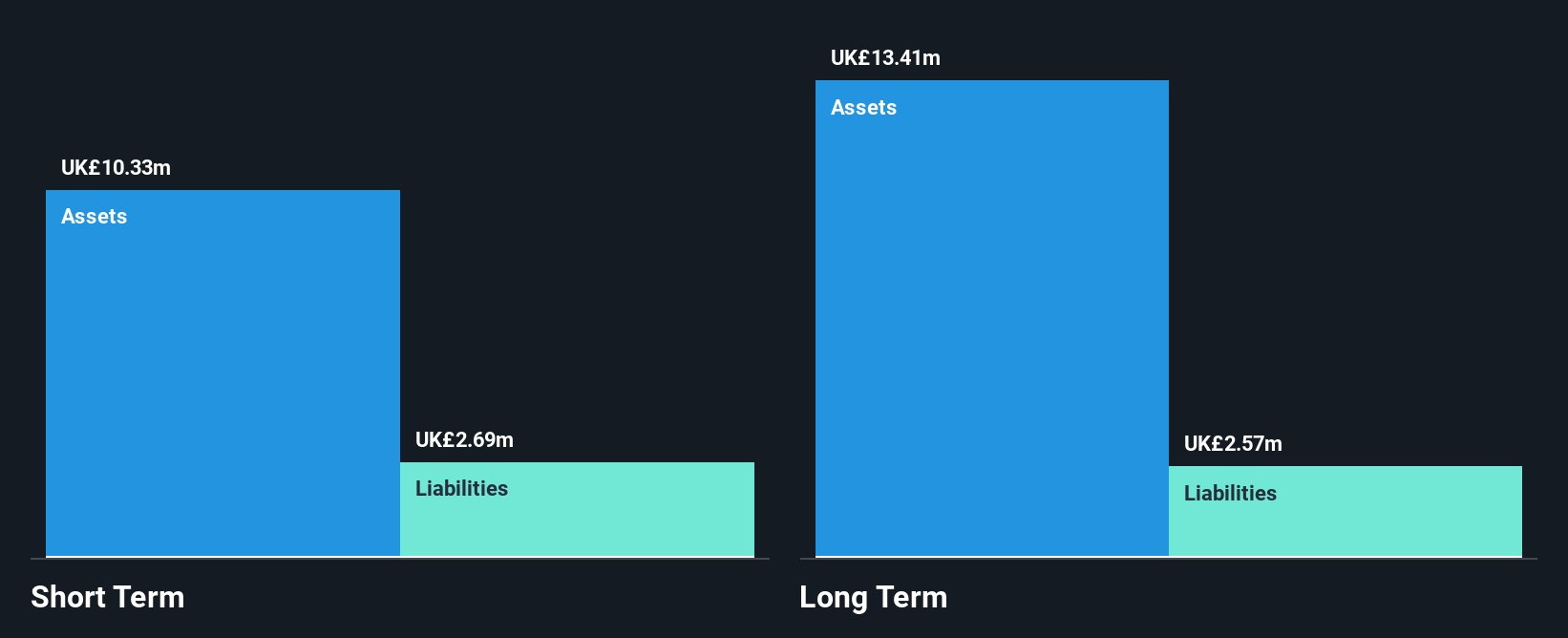

Parkmead Group, with a market cap of £15.30 million, has recently transitioned to profitability but reported a net loss of £1.19 million for the half year ending December 2024, compared to a net income previously. The company is debt-free with short-term assets (£10.3M) exceeding both short and long-term liabilities, indicating financial stability despite recent earnings challenges. Its Price-To-Earnings ratio (5.1x) suggests it may be undervalued relative to the UK market average (15.1x). Management and board tenure reflect experience; however, high non-cash earnings and low Return on Equity (16.3%) could warrant caution amidst stable volatility at 6%.

- Click to explore a detailed breakdown of our findings in Parkmead Group's financial health report.

- Assess Parkmead Group's previous results with our detailed historical performance reports.

Alpha Growth (LSE:ALGW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha Growth plc offers advisory and analytical services for senior life settlement assets in North America, with a market cap of £3.74 million.

Operations: The company's revenue is primarily derived from the provision of advice and consultancy services, totaling £5.90 million.

Market Cap: £3.74M

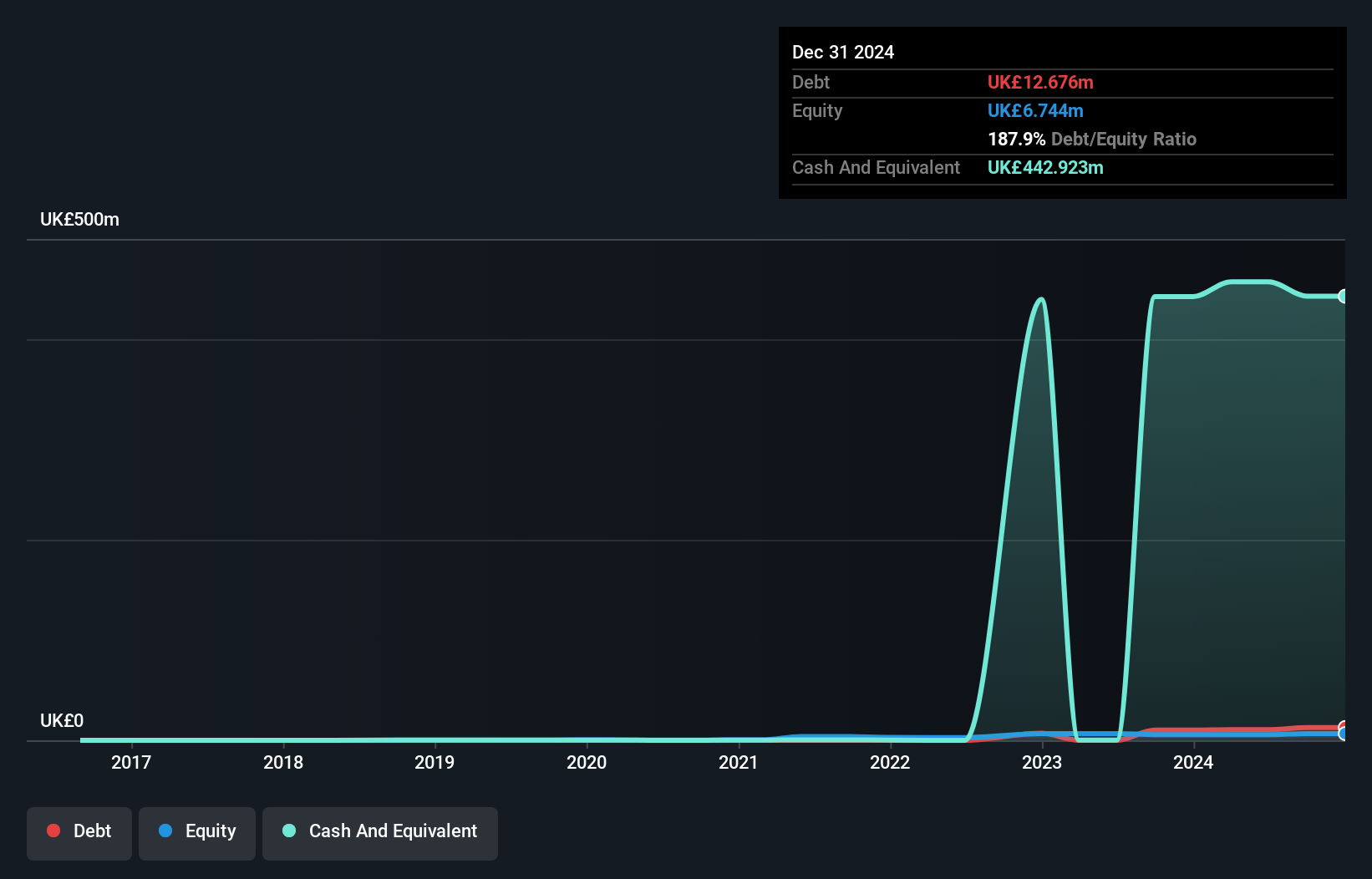

Alpha Growth plc, with a market cap of £3.74 million, has recently achieved profitability, reporting a net income of £1.03 million for the year ending December 2024, compared to a net loss previously. Its revenue increased to £5.9 million from £5.21 million the prior year. The company maintains more cash than debt and its short-term assets (£471.4M) exceed both short and long-term liabilities, indicating solid financial footing despite negative operating cash flow and increased debt-to-equity ratio over five years (0% to 187.9%). The Price-To-Earnings ratio (3.6x) suggests potential undervaluation against the UK market average (15.1x).

- Click here to discover the nuances of Alpha Growth with our detailed analytical financial health report.

- Evaluate Alpha Growth's historical performance by accessing our past performance report.

Summing It All Up

- Reveal the 392 hidden gems among our UK Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALGW

Alpha Growth

Focuses on providing advisory services, strategies, performance monitoring, and analytical services to holders of senior life settlement assets in North America.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives