- United Kingdom

- /

- Capital Markets

- /

- LSE:ALGW

3 UK Penny Stocks With Market Caps Over £9M To Consider

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, but it is up 6.3% over the past year, with earnings expected to grow by 15% per annum in the coming years. Investing in penny stocks—though a somewhat outdated term—still offers intriguing opportunities for growth, especially when these smaller or newer companies are supported by strong financial health. By focusing on those with robust balance sheets and clear growth potential, investors can uncover promising prospects that might offer both stability and upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.555 | £181.33M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.465 | £361.6M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.275 | £72.73M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2325 | £105.22M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.393 | $228.46M | ★★★★★★ |

Click here to see the full list of 462 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions globally and has a market cap of £115.24 million.

Operations: The company generated $23.99 million in revenue from its distributed denial of service (DDoS) protection solutions worldwide.

Market Cap: £115.24M

Corero Network Security has shown notable progress with its recent profitability and strategic expansions, including a $6 million order boost in Q3 2024. The launch of the CORE platform and NTD 3400 appliance underscores its innovation in DDoS protection, enhancing customer appeal with advanced analytics and flexible deployment. Despite a low return on equity at 4.6% and a highly volatile share price, Corero's financial health is stable with no debt concerns. However, shareholder dilution remains an issue. The management team is relatively new but supported by an experienced board of directors averaging over 11 years in tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Corero Network Security.

- Explore Corero Network Security's analyst forecasts in our growth report.

Alpha Growth (LSE:ALGW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alpha Growth plc provides advisory, strategy, performance monitoring, and analytical services to holders of senior life settlement assets in North America, with a market cap of £9.12 million.

Operations: The company's revenue is derived entirely from the provision of advice and consultancy services, amounting to £5.52 million.

Market Cap: £9.12M

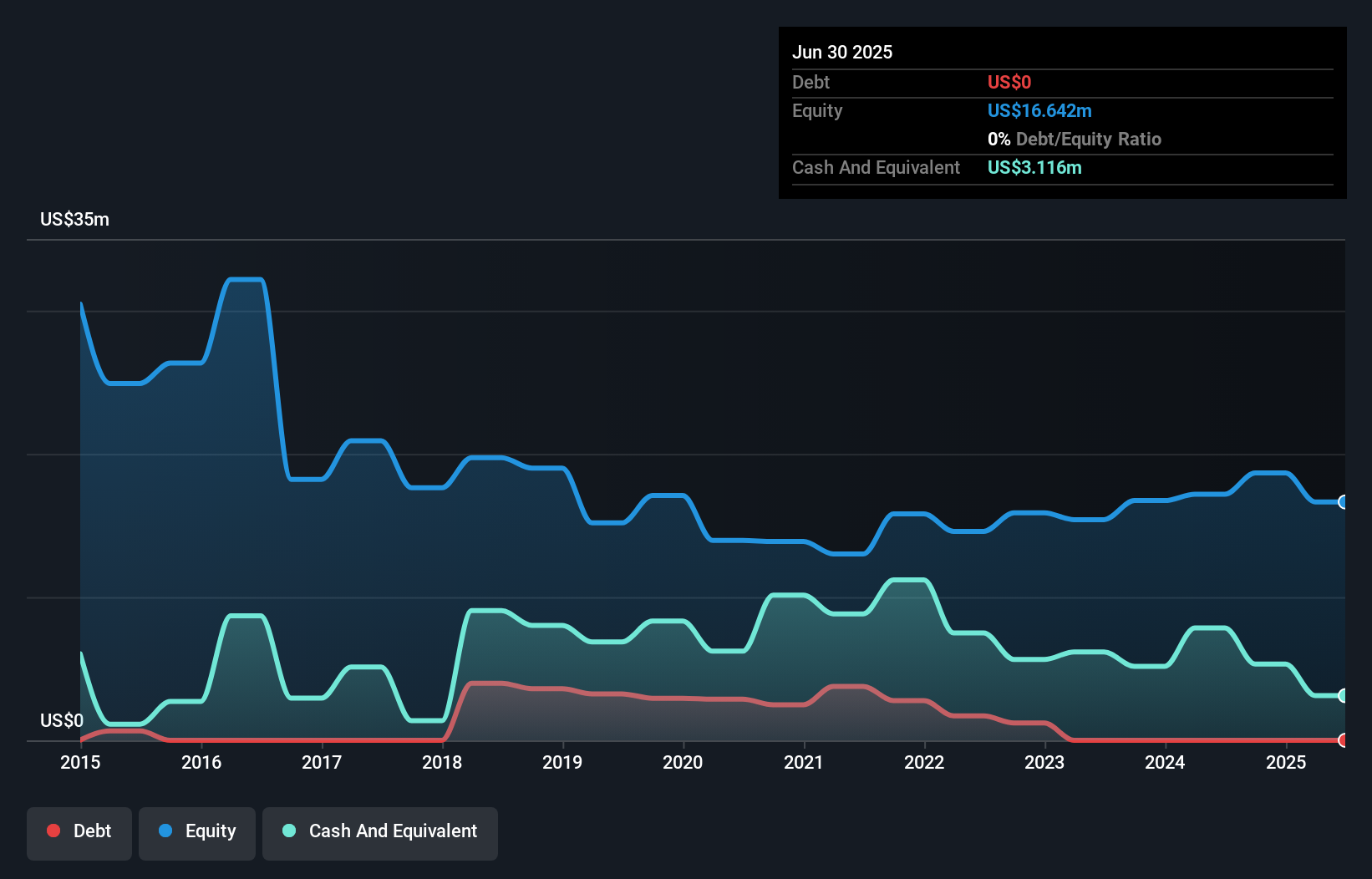

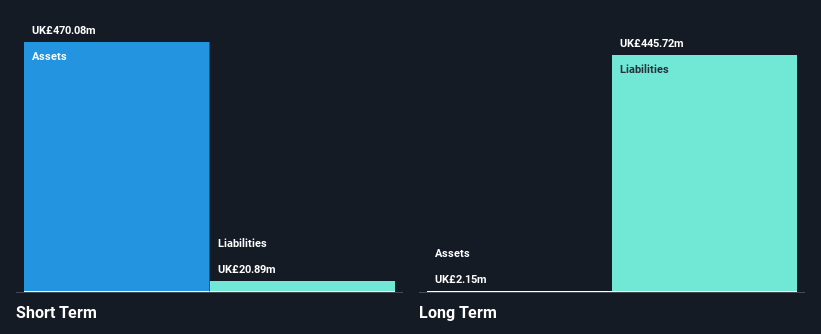

Alpha Growth plc, with a market cap of £9.12 million, reported half-year sales of £2.81 million, showing slight growth from the previous year. Despite being unprofitable, it has reduced losses over five years and maintains a cash runway exceeding three years. The company's short-term assets (£470.1M) comfortably cover both short and long-term liabilities (£20.9M and £445.7M respectively). However, its debt-to-equity ratio has increased significantly to 188.2%. Shareholder dilution has been minimal recently despite high share price volatility over the past three months, reflecting ongoing financial challenges amidst strategic advisory operations in North America.

- Click here to discover the nuances of Alpha Growth with our detailed analytical financial health report.

- Gain insights into Alpha Growth's historical outcomes by reviewing our past performance report.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom with a market cap of £549.81 million.

Operations: The company generates revenue from its recreational activities segment, totaling £224.03 million.

Market Cap: £549.81M

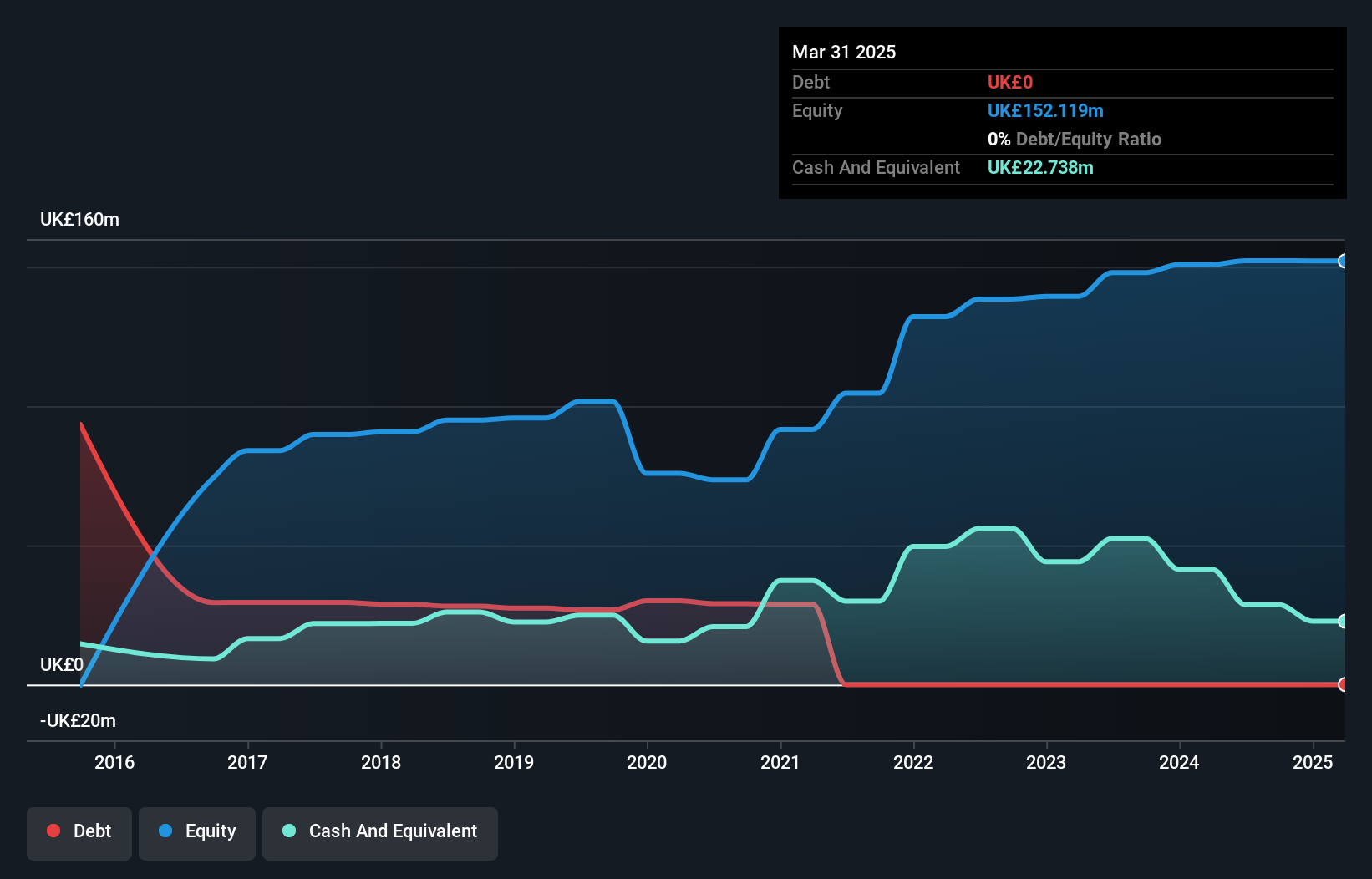

Hollywood Bowl Group plc, with a market cap of £549.81 million and revenue of £224.03 million, demonstrates strong financial health with no debt and high quality earnings. Its return on equity is robust at 23.3%, surpassing industry averages, while its price-to-earnings ratio indicates good value relative to the UK market. Earnings growth has been consistent over five years, although recent growth has decelerated slightly compared to historical trends. The company faces potential leadership changes as Peter Boddy retires as Chairman in January 2025, succeeded by Darren Shapland, who brings extensive retail sector experience to the board.

- Jump into the full analysis health report here for a deeper understanding of Hollywood Bowl Group.

- Review our growth performance report to gain insights into Hollywood Bowl Group's future.

Next Steps

- Gain an insight into the universe of 462 UK Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALGW

Alpha Growth

Focuses on providing advisory services, strategies, performance monitoring, and analytical services to holders of senior life settlement assets in North America.

Excellent balance sheet and slightly overvalued.