- United Kingdom

- /

- Capital Markets

- /

- LSE:AJB

AJ Bell plc (LON:AJB) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

The AJ Bell plc (LON:AJB) share price has done very well over the last month, posting an excellent gain of 31%. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

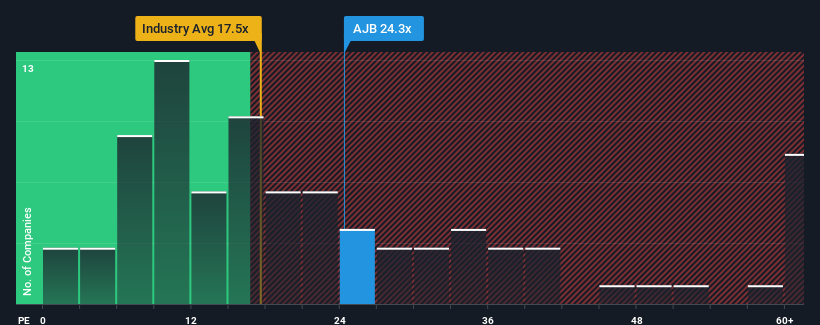

After such a large jump in price, given around half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 17x, you may consider AJ Bell as a stock to potentially avoid with its 24.3x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for AJ Bell as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for AJ Bell

Is There Enough Growth For AJ Bell?

The only time you'd be truly comfortable seeing a P/E as high as AJ Bell's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 46% last year. The strong recent performance means it was also able to grow EPS by 74% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 9.2% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 15% per annum growth forecast for the broader market.

With this information, we find it concerning that AJ Bell is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

AJ Bell shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that AJ Bell currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for AJ Bell that you need to be mindful of.

You might be able to find a better investment than AJ Bell. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AJB

AJ Bell

Through its subsidiaries, operates investment platforms in the United Kingdom.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives