- United Kingdom

- /

- Diversified Financial

- /

- AIM:TRU

A Piece Of The Puzzle Missing From TruFin plc's (LON:TRU) 26% Share Price Climb

TruFin plc (LON:TRU) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

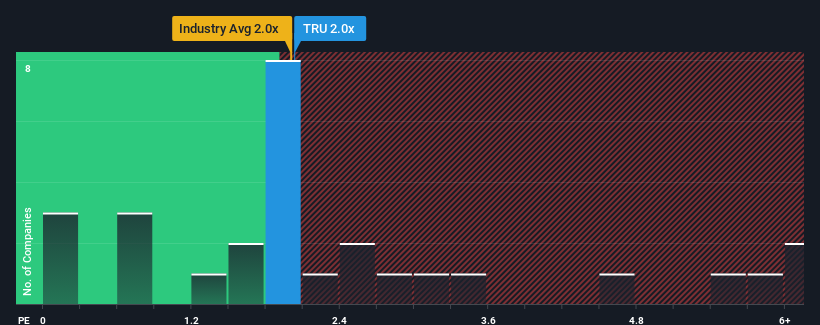

In spite of the firm bounce in price, it's still not a stretch to say that TruFin's price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" compared to the Diversified Financial industry in the United Kingdom, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for TruFin

What Does TruFin's Recent Performance Look Like?

TruFin's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TruFin.How Is TruFin's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TruFin's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 151% gain to the company's top line. Pleasingly, revenue has also lifted 134% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 19% as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to contract by 19%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that TruFin's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What Does TruFin's P/S Mean For Investors?

Its shares have lifted substantially and now TruFin's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that TruFin currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for TruFin that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TruFin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRU

TruFin

Provides niche lending, early payment services, and video game publishing in the United Kingdom.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives