- United Kingdom

- /

- Semiconductors

- /

- AIM:IQE

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, impacting companies closely tied to the Chinese economy. In such a climate, investors might find opportunities in penny stocks—smaller or newer companies that can offer value and growth potential. Despite being an outdated term, penny stocks remain relevant for those seeking hidden gems backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £1.984 | £747.6M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.86M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.47 | £66.18M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.70 | £423.89M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.206 | £186M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.42 | £340.14M | ★★★★☆☆ |

| Alumasc Group (AIM:ALU) | £3.065 | £110.23M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.95 | £12.93M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

IQE (AIM:IQE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IQE plc, along with its subsidiaries, is involved in the development, manufacturing, and sale of advanced semiconductor materials with a market cap of £108.91 million.

Operations: The company generates revenue from three main segments: CMOS++ (£1.19 million), Wireless (£70.22 million), and Photonics, including Infra-Red (£57.85 million).

Market Cap: £108.91M

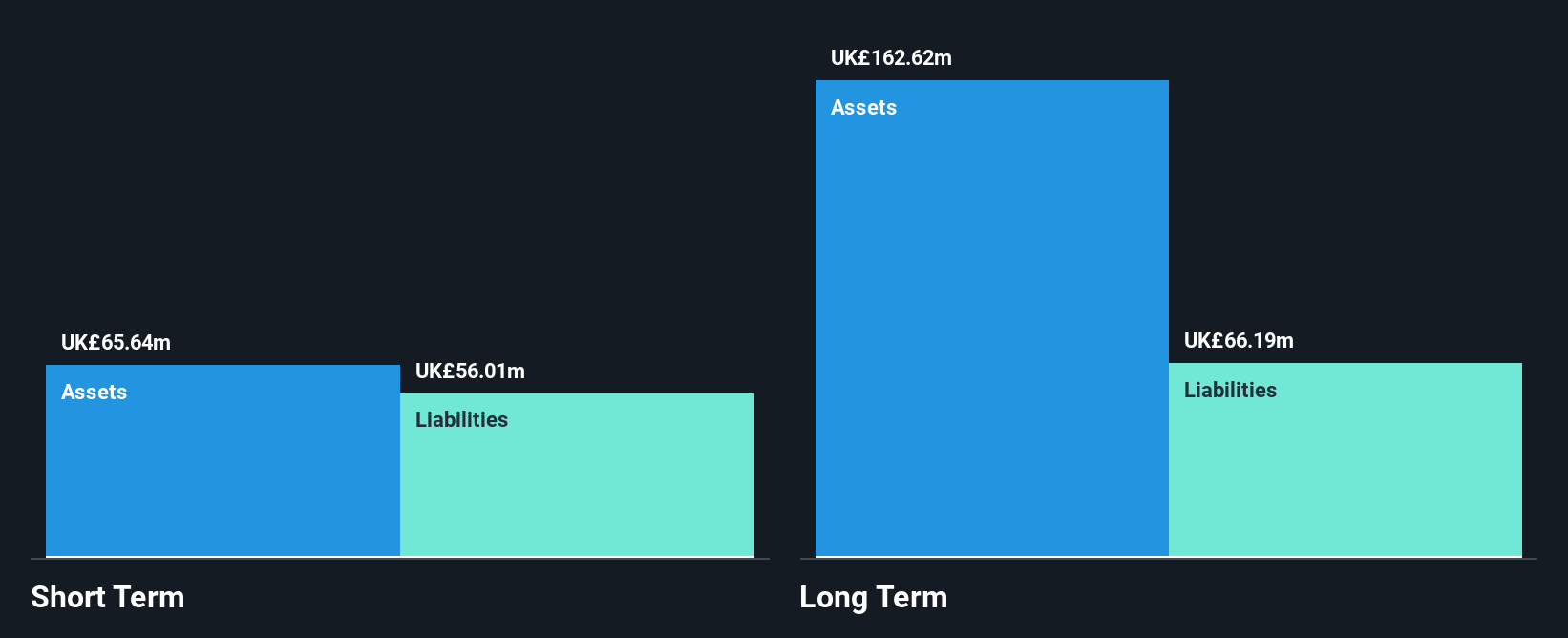

IQE plc, with a market cap of £108.91 million, is navigating challenges typical of penny stocks, such as high volatility and unprofitability. While the company has a seasoned management team and short-term assets exceeding both its short- and long-term liabilities, it remains unprofitable with increasing losses over the past five years. Recent executive changes and strategic reviews indicate efforts to stabilize operations amidst industry-wide slowdowns. Despite sufficient cash runway after raising additional capital, IQE's share price remains highly volatile. The board's strategic review aims to leverage its semiconductor expertise while exploring options like an IPO for Taiwan operations to strengthen its capital position.

- Unlock comprehensive insights into our analysis of IQE stock in this financial health report.

- Examine IQE's earnings growth report to understand how analysts expect it to perform.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc, with a market cap of £22.39 million, develops plant-based polymers for home and personal care applications across North America and Europe.

Operations: The company generates revenue from two main segments: Formulation Solutions, contributing $1.51 million, and Performance Ingredients, accounting for $5.10 million.

Market Cap: £22.39M

Itaconix plc, with a market cap of £22.39 million, is characterized by its unprofitability and high share price volatility typical of penny stocks. The company generates revenue from its Formulation Solutions and Performance Ingredients segments, totaling US$6.61 million. Despite having no debt and sufficient cash runway for over a year, Itaconix's negative return on equity reflects ongoing financial challenges. Recent initiatives like the SPARX program aim to accelerate product innovation in sustainable home care products through collaborations with industry partners. However, changes in auditors signal internal adjustments as the company seeks to stabilize operations amidst these developments.

- Take a closer look at Itaconix's potential here in our financial health report.

- Understand Itaconix's earnings outlook by examining our growth report.

TMT Investments (AIM:TMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TMT Investments PLC is a venture capital and private equity firm focusing on startups, early stage, small, and mid-sized companies, with a market cap of $95.61 million.

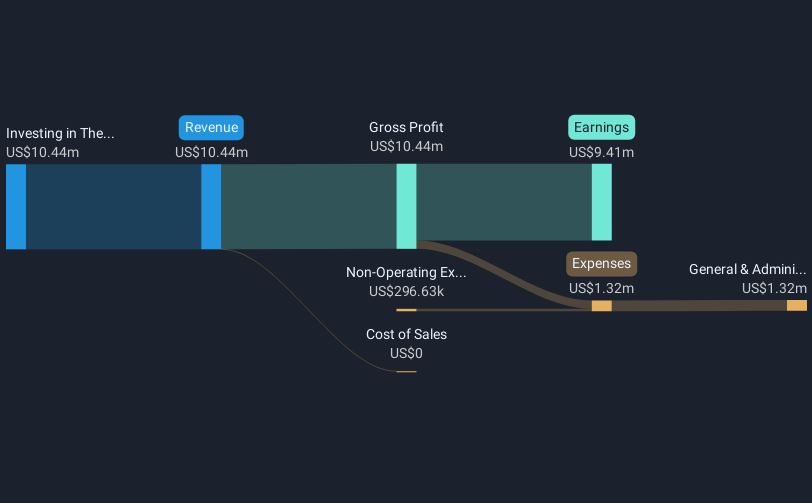

Operations: The company generates revenue of $10.44 million from its investments in the technology, media, and telecommunications sector.

Market Cap: $95.61M

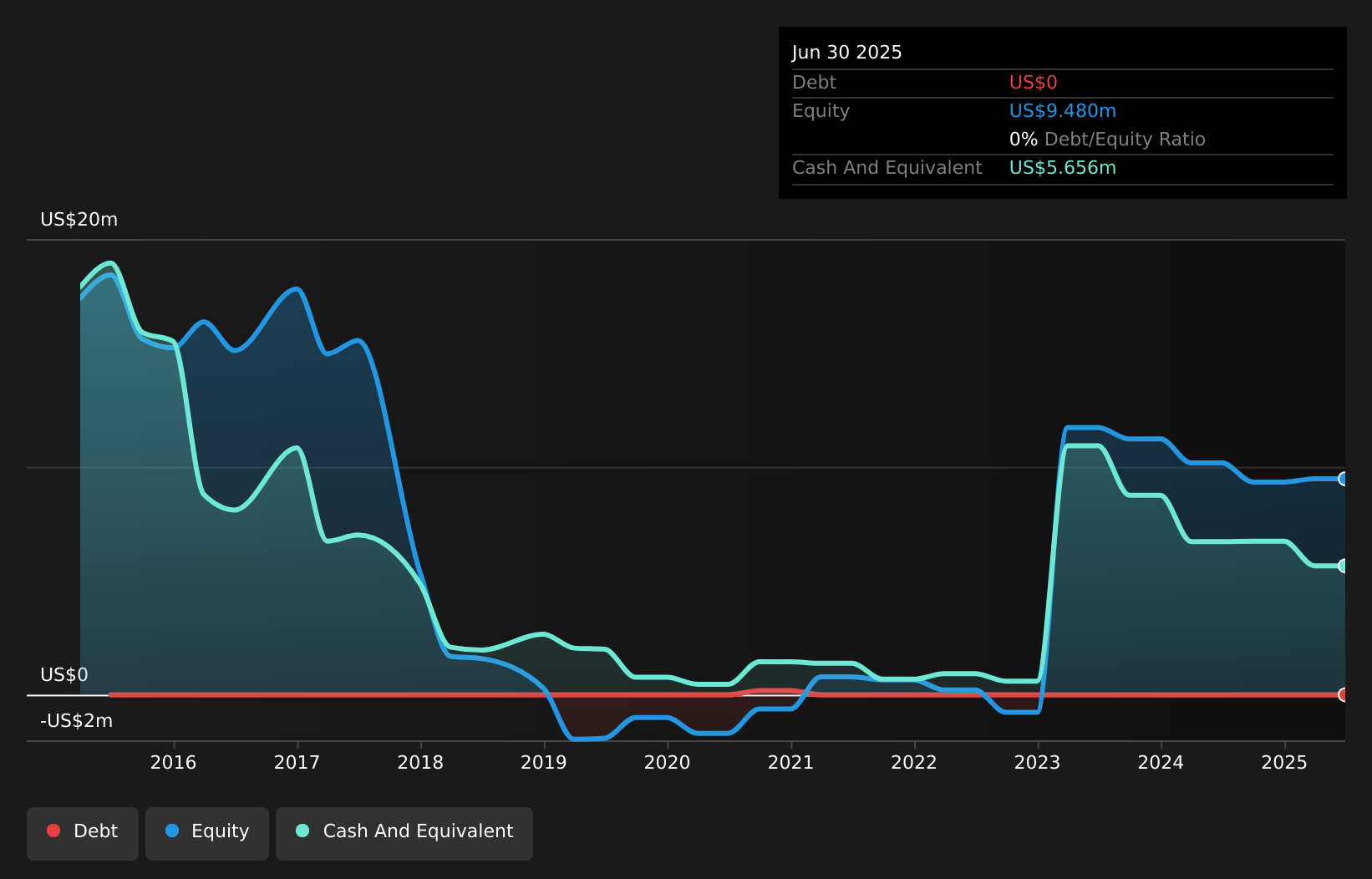

TMT Investments PLC, with a market cap of $95.61 million, has transitioned to profitability in the past year, distinguishing it from typical penny stocks. The firm focuses on technology, media, and telecommunications investments, generating revenue of $10.44 million. TMT is debt-free and benefits from a seasoned management team with an average tenure of 12.6 years. Its short-term assets ($10M) comfortably cover liabilities ($1.5M), reflecting sound financial health despite a low return on equity (4.5%). With high-quality earnings and no shareholder dilution recently, TMT's price-to-earnings ratio (10.2x) suggests it may offer good value compared to the broader UK market (16.1x).

- Dive into the specifics of TMT Investments here with our thorough balance sheet health report.

- Explore historical data to track TMT Investments' performance over time in our past results report.

Key Takeaways

- Explore the 467 names from our UK Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IQE

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives