- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Discovering 3 UK Penny Stocks With Market Caps Below £300M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and its impact on global economic sentiment. Despite these broader market pressures, investors can still find opportunities in niche areas like penny stocks, which refer to shares of smaller or newer companies that often trade at lower prices. While the term "penny stocks" might seem outdated, these investments can offer potential value when they are supported by strong financial health and clear growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.31M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4125 | $239.8M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.48 | £365.3M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Mercia Asset Management (AIM:MERC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mercia Asset Management PLC is a private equity and venture capital firm that focuses on various stages of investment, including incubation and growth capital, with a market cap of £133.70 million.

Operations: The company generates revenue from its Proactive Specialist Asset Management segment, amounting to £33.30 million.

Market Cap: £133.7M

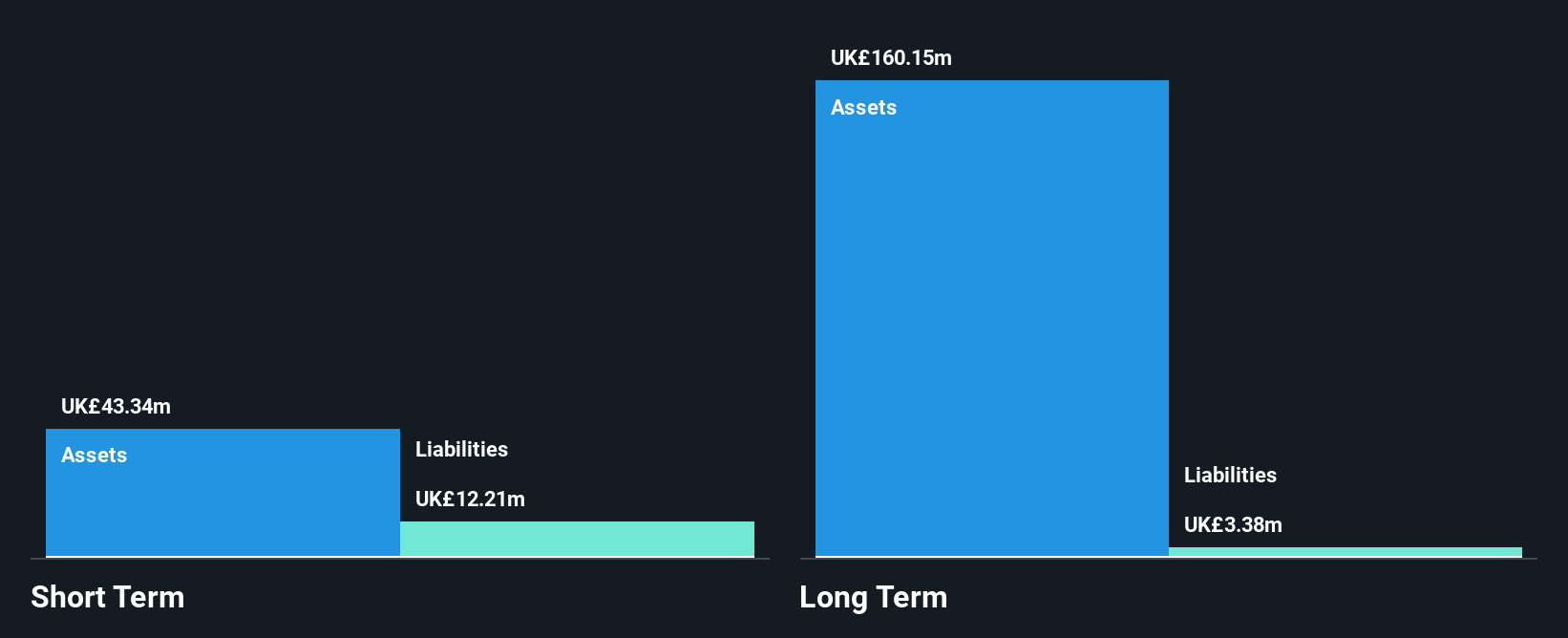

Mercia Asset Management PLC, with a market cap of £133.70 million, has shown revenue growth, reporting £17.91 million in sales for the first half of 2024 compared to £15.04 million the previous year. Despite being unprofitable and experiencing increased losses over five years, it remains debt-free and has strong short-term asset coverage over liabilities. The company completed a share buyback program and announced a slight dividend increase to 0.37 pence per share, reflecting management's confidence in its financial stability despite current profitability challenges. Analysts anticipate significant earnings growth moving forward, although past performance comparisons are limited due to its unprofitability.

- Unlock comprehensive insights into our analysis of Mercia Asset Management stock in this financial health report.

- Assess Mercia Asset Management's future earnings estimates with our detailed growth reports.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the United Kingdom, Ireland, the Netherlands, France, the rest of Europe, and internationally with a market cap of £205.24 million.

Operations: The company's revenue is primarily derived from its vaping segment (£77.29 million), followed by branded household consumer goods (£67.25 million), batteries (£42.00 million), sports nutrition and wellness products (£18.52 million), and lighting (£17.13 million).

Market Cap: £205.24M

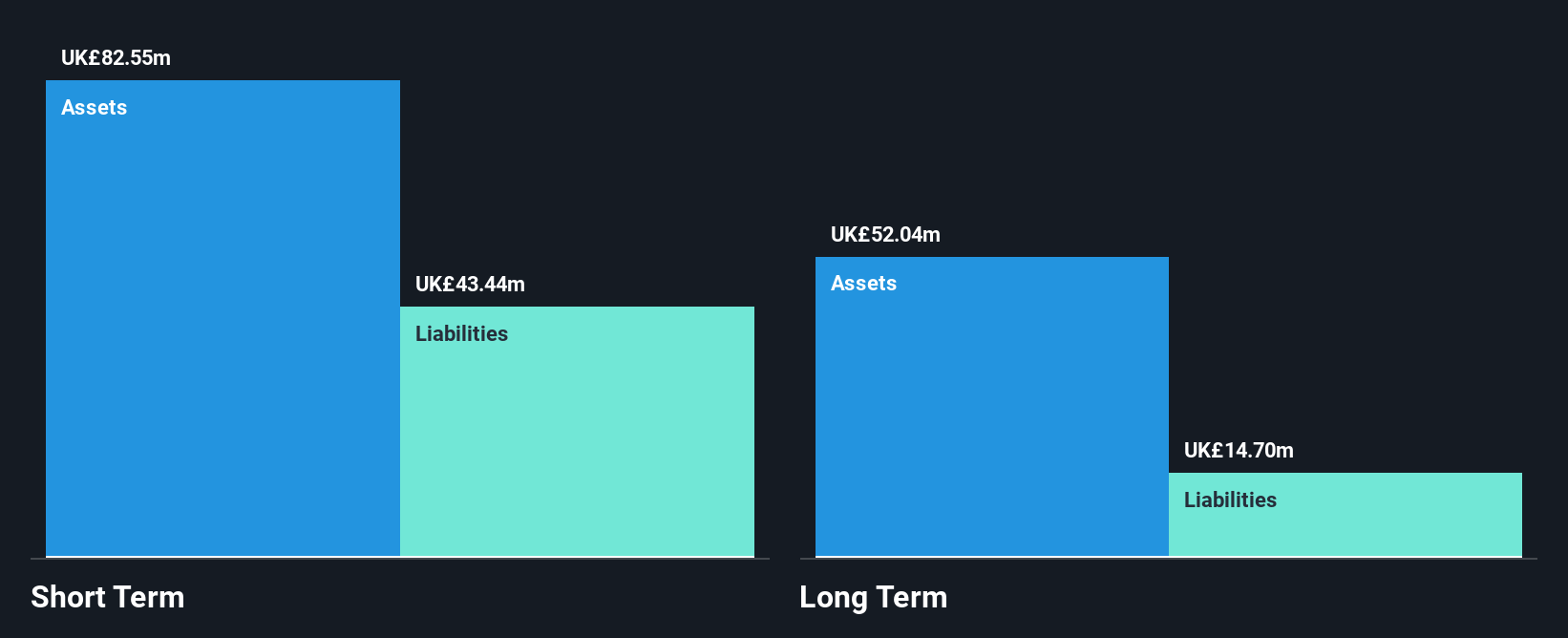

Supreme Plc, with a market cap of £205.24 million, has demonstrated strong financial health and growth potential. The company's earnings have grown significantly, with a 32.7% increase over the past year and a high return on equity of 36.5%. Supreme is debt-free, enhancing its financial stability, and its short-term assets comfortably cover both short- and long-term liabilities. Despite an unstable dividend track record, recent increases suggest improving confidence in profitability. The company is currently in advanced discussions to acquire Typhoo Tea Limited using existing bank facilities, indicating strategic expansion efforts despite potential risks associated with the acquisition process.

- Take a closer look at Supreme's potential here in our financial health report.

- Examine Supreme's earnings growth report to understand how analysts expect it to perform.

Tissue Regenix Group (AIM:TRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tissue Regenix Group plc is a medical technology company that develops and commercializes platform technologies for bone graft substitutes and soft tissue in the United States and internationally, with a market cap of £41.32 million.

Operations: The company's revenue is derived from three main segments: Dcell ($7.24 million), GBM-V ($3.28 million), and Biorinse ($21.28 million).

Market Cap: £41.32M

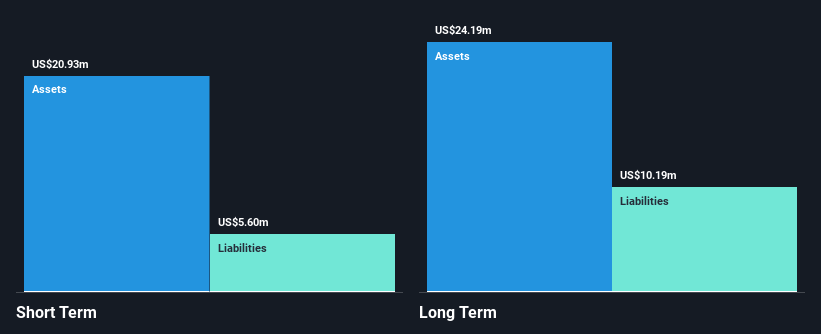

Tissue Regenix Group plc, with a market cap of £41.32 million, is navigating strategic uncertainties while showing some financial resilience. The company reported half-year sales of US$16.4 million, up from US$14.1 million the previous year, and reduced its net loss to US$0.281 million from US$0.893 million a year earlier. Despite being unprofitable with negative return on equity (-3.34%), it maintains a satisfactory net debt to equity ratio (23.1%) and has sufficient cash runway for more than three years based on current free cash flow levels. Strategic reviews are underway, potentially impacting future shareholder value propositions.

- Click to explore a detailed breakdown of our findings in Tissue Regenix Group's financial health report.

- Understand Tissue Regenix Group's earnings outlook by examining our growth report.

Make It Happen

- Click this link to deep-dive into the 465 companies within our UK Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUP

Supreme

Owns, manufactures, and distributes batteries, lighting, vaping, sports nutrition and wellness, and branded household consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives